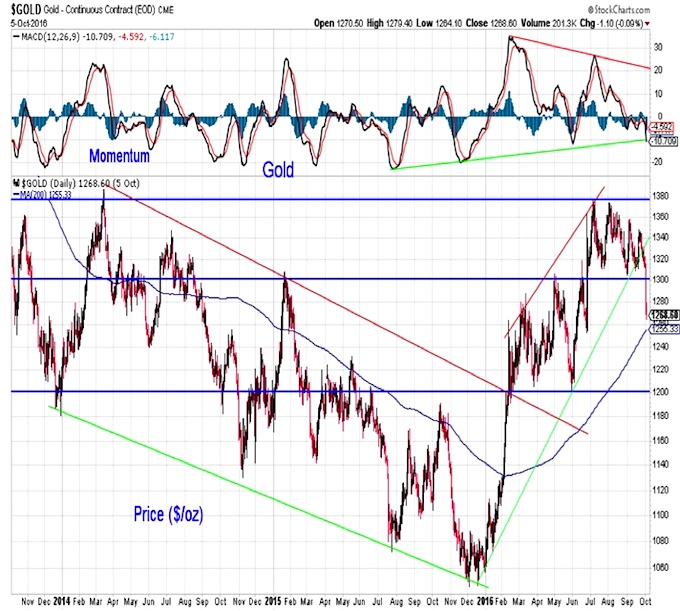

Gold

The rise in bond yields could also be weighing on gold. Now, gold has to contend with a significant technical breakdown as momentum failed to confirm summertime price strength and is pushing below the trend-line that marked a positive divergence late last year. The failure to hold support near $1300/oz could set up a test of support near $1200/oz. Accompanying this breakdown in price has been in surge in pessimism. While historically excessive pessimism has been bullish for gold, the experience of the past four years has been that the worst price performance for gold comes in periods of pessimism.

U.S. Dollar

While discussing bond yields and gold, a look at the chart of the dollar seems to make sense. From both a price and momentum perspective, trends lines are quickly converging. This suggests that we could get a breakout or breakdown sometime soon. However, the more dominant pattern seems to be the two-year period of broadly sideways action out of the greenback. There is little evidence that this pattern is poised to change any time soon. If the dollar does not move to test the upper portion of this range, then the yearly change in the dollar could soon move more convincingly into negative territory.

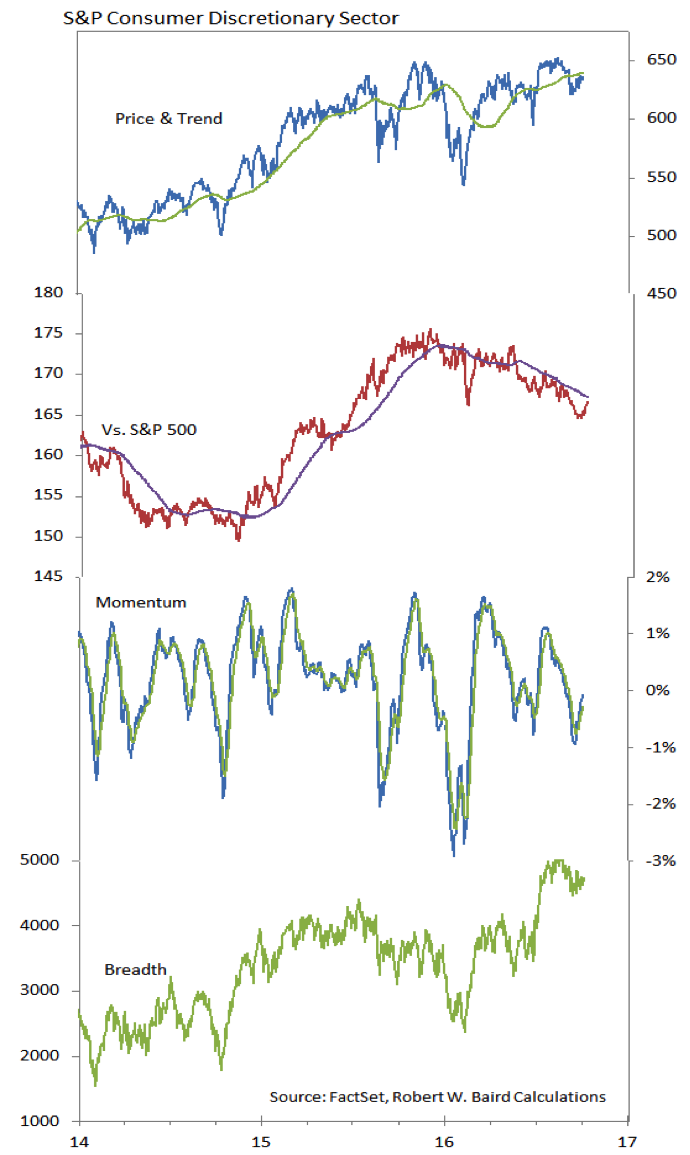

S&P Consumer Discretionary Sector

As mentioned above, we have seen a shift toward more cyclical leadership in our relative strength rankings. Consumer Staples, Telecom, and Utilities have fallen while Technology, Industrials, and Energy have risen to the top. Missing from this tilt toward cyclical strength has been a rebound in the Consumer Discretionary sector. The absolute price trend has a modest bias higher and breadth has been strong. Momentum is again swinging higher, but within the context of a downtrend while the relaitve price line has moved steadily lower for the past year.

Thanks for reading.

Twitter: @WillieDelwiche

Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.