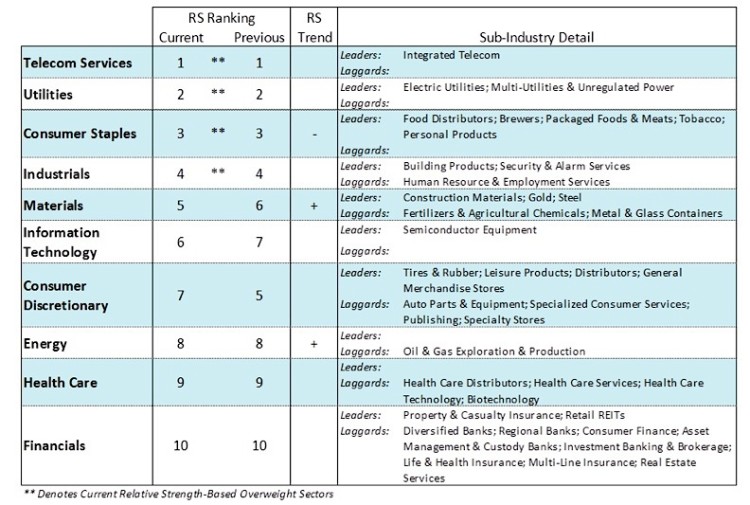

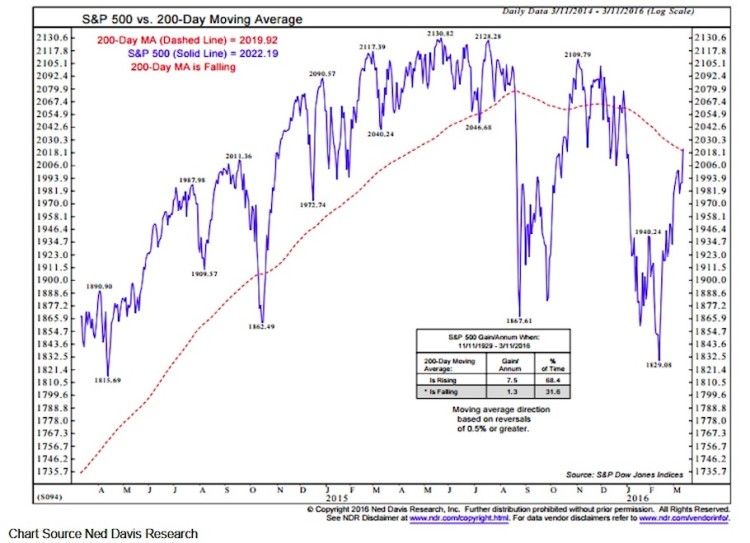

Stocks added to their gains last week, as the recent stock market rally put in its 4th week higher. Understanding that, some near-term divergences have begun to emerge. While the S&P 500 and the Dow Jones Industrials rallied through their 200-day moving averages on Friday, the NASDAQ Composite and Russell 2000 remain 3% and 6%, respectively, below their comparable levels.

Can the stock market rally surpass notable resistance?

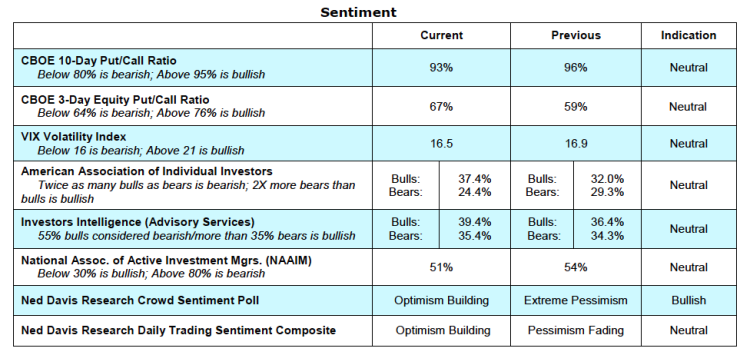

The S&P 500 is now down just over 1% for 2016, but the small-cap Russell 2000 remains down over 4%. While the spread between the best performing and worst performing stock market sectors has narrowed considerably with this stock market rally, sector-level leadership remains tilted toward defensive areas of the market.

The number of issues making new 52-week highs remains relatively low and while 90% of the stocks in the S&P 500 are trading above their 50-day averages, only 55% are above their 200-day averages. In other words, while the strength (and breadth) of the recent stock market rally is encouraging, it seems to be more a function of the weakness that proceeded it than confirmation that a new bullish trend has emerged.

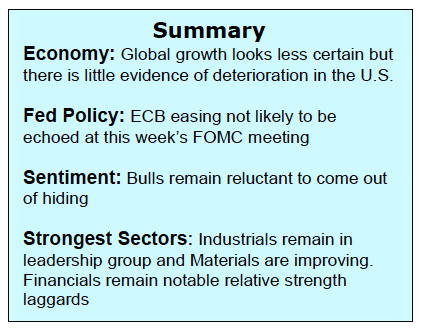

Pessimism has waned and complacency increased, but optimism has been and remains fairly muted. The absence of excessive optimism could allow the rally a chance to extend higher in the near term and perhaps fuel improvement in longer-term price and breadth trends. The emergence of more cyclical sector leadership, continued improvement in breadth trends and/or signs of small-caps getting back in gear would be an indication that the cyclical bear market that emerged in the second half of 2015 has already run its course. We will wait for more evidence for jumping to that conclusion.

Adding to our cautious view is that that continued or increased central bank support and accommodation have fueled the stock market rebound. Last week was a good example of that, with the gains for the week coming in the wake of news of additional accommodation by the European Central Bank. The FOMC meets this week and while a surprise rate hike does not seem likely, recent strength in the labor market, upside surprises in inflation and a better tone in the global financial markets seem to provide little rationale for meaningfully trimming its rate hike guidance for this year. If the longer-term price trends for equities are improving, the stock market should be able to absorb talk of continued policy normalization. Obscured by the price volatility of the past three months is that the valuation picture has not improved. Stocks remain expensive by most measures and as has been the case in recent years, earnings expectations continue to be ratcheted lower. With stocks already expensive, it could be difficult to sustain price rallies in the absence of better earnings growth.

Thanks for reading.

Twitter: @WillieDelwiche

Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.