S&P 500 Trading Outlook (2-3 Days): MILDLY BULLISH

The S&P 500, along with NASDAQ 100 and NASDAQ Composite all look to require another 2-3 days per DeMark Exhaustion counts before they reach termination.

Thus, while the indices may be close to a stock market top, there looks to be one more minor push higher into early next week. Upside should prove limited, however, and used to trim exposure to stocks.

Tactical Trading Thoughts

Semiconductors can be favored in the very short run; Overweight Healthcare (outside of device makers); select Consumer Staples stocks look to be bottoming and could be setting up for a long. Gold stocks are nearing first real area of resistance… but considering construct, pullbacks should be buyable.

Yield sensitive stocks should be avoided and/or used as trading shorts given the minor breakout in Ten-year yields over 2.59%. The REITS, Utilities, and Telecom stocks still look vulnerable into early next week, and TBT can be played as a long for 2-3 days given TNX rally which should get to 2.63%.

The Bottom line on the Stock Market: Yesterday’s minor pullback did little to offset the largely bullish day from Wednesday, and exhaustion counts still look to be 2-3 days away (11 TD Count) on SPX, NDX, CCMP, TNX, XLI, XLK.

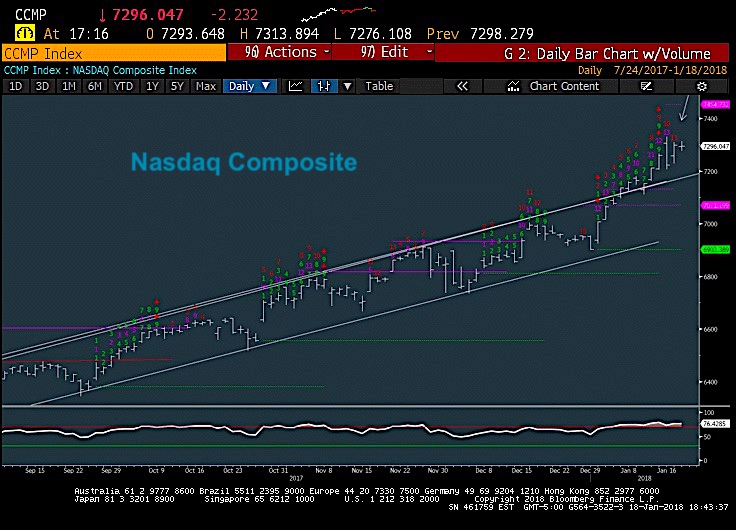

NASDAQ Chart Spotlight

The NASDAQ Composite has failed to reverse despite hovering over the upper trend channel for the last few weeks. Its sideways move recently has coincided with its first counter-trend TD Combo sell, while Sequential remains about 2 days away, requiring one final push into next week. But time is running out.

Overall, further gains look likely as prices likely exceed 7330 with a final rise to 7370 to 7440 which should mark the highs for this lift from early January. Any pullback before this occurs that violates 7163 means that this move likely has already begun and would postpone the last push higher.

If you have an interest in seeing timely intra-day market updates on my private twitter feed, please follow @NewtonAdvisors. Also, feel free to send me an email at info@newtonadvisor.com regarding how my Technical work can add alpha to your portfolio management process.

Twitter: @MarkNewtonCMT

Author has positions in mentioned securities at the time of publication. Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.