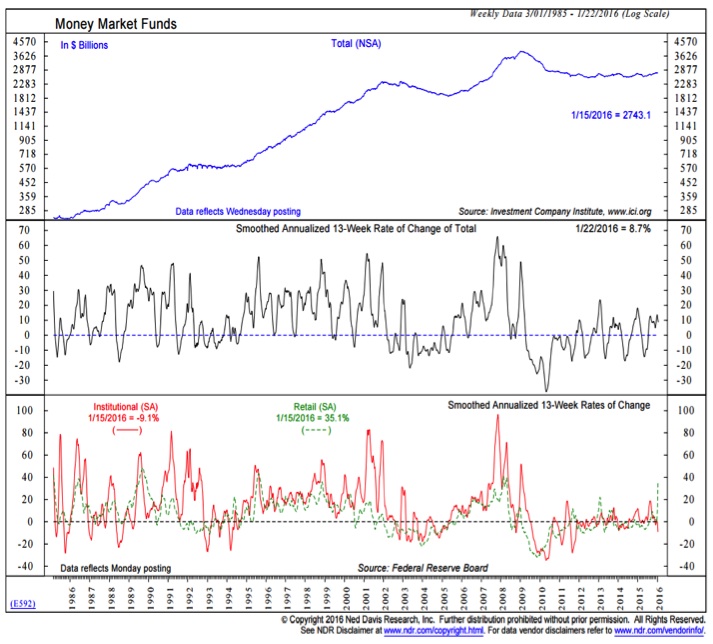

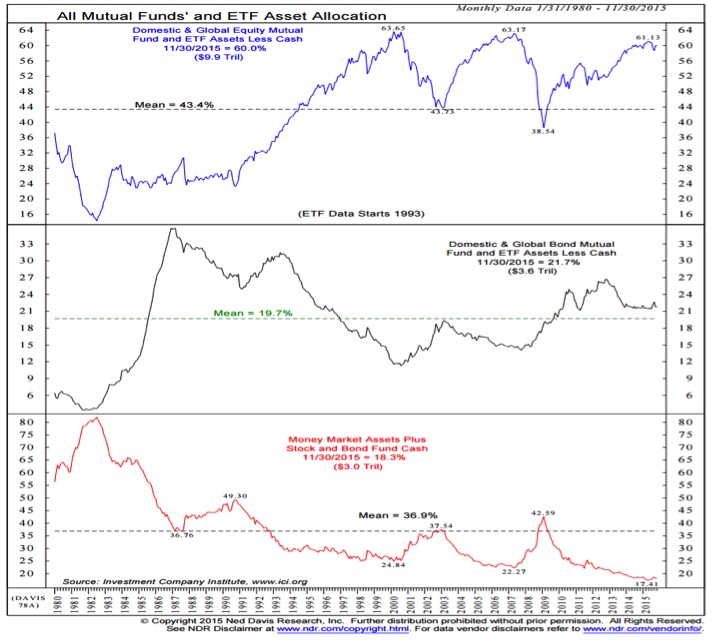

Not only are investors pulling funds out of equity funds, but they are starting to amass cash on the sidelines (i.e., not just spending what they pull out). Retail money market funds are growing at their fastest pace since 2008, although this is in part offset by a continued decline in institutional money market funds. What remains to be seen is whether this is evidence of short-term pessimism or a longer-term asset allocation shift due to preferences.

One of the limiting factors for stocks over the past year has been a fully invested public that simply does not have a lot of cash on the sidelines that can be put to work when stocks pull back. The large outflows from equity funds and increase in retail money market funds could be the beginning of a much-needed re-balancing and asset allocation shift in household investment portfolios (from equity exposure to cash). While this would be bullish from a longer-term perspective, it might also mean that cash that is now leaving stocks may be slow to return (thus limiting the bullish implications of the sentiment data).

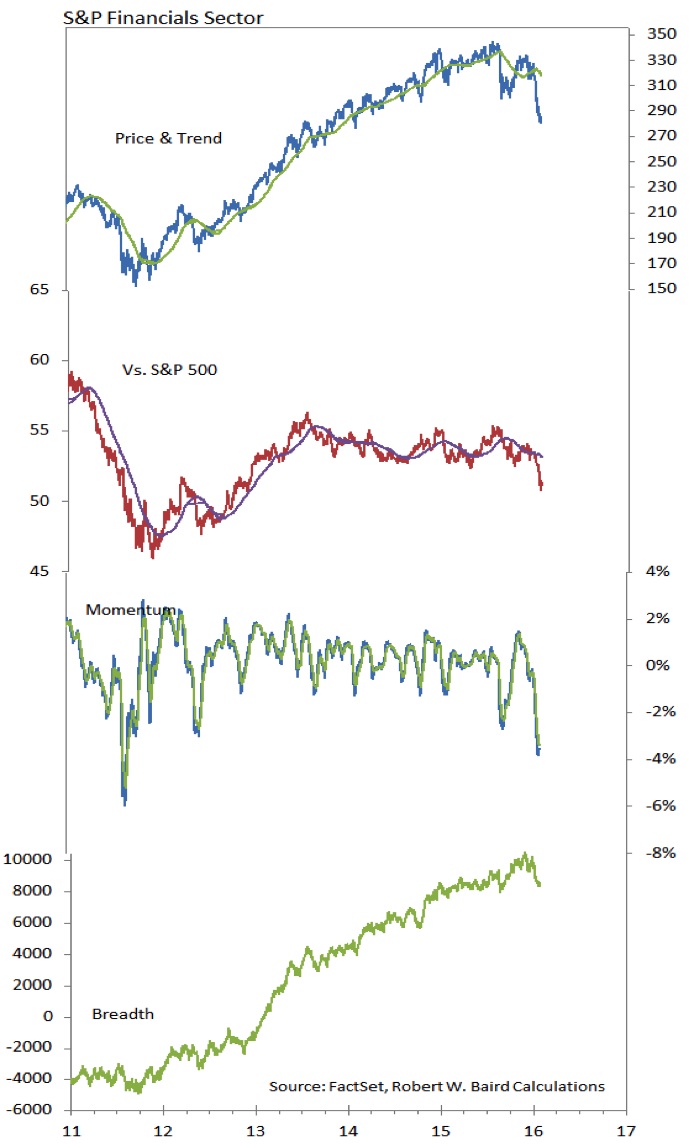

S&P Financials Sector

One of the limiting factors for stocks over the past year has been a fully invested public that simply does not have a lot of cash on the sidelines that can be put to work when stocks pull back. The large outflows from equity funds and increase in retail money market funds could be the beginning of a much-needed re-balancing in the household investment portfolio (from equity exposure to cash). While this would be bullish from a longer-term perspective, it might also mean that cash that is now leaving stocks may be slow to return (thus limiting the bullish implications of the sentiment data).

Thanks for reading.

Twitter: @WillieDelwiche

Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.