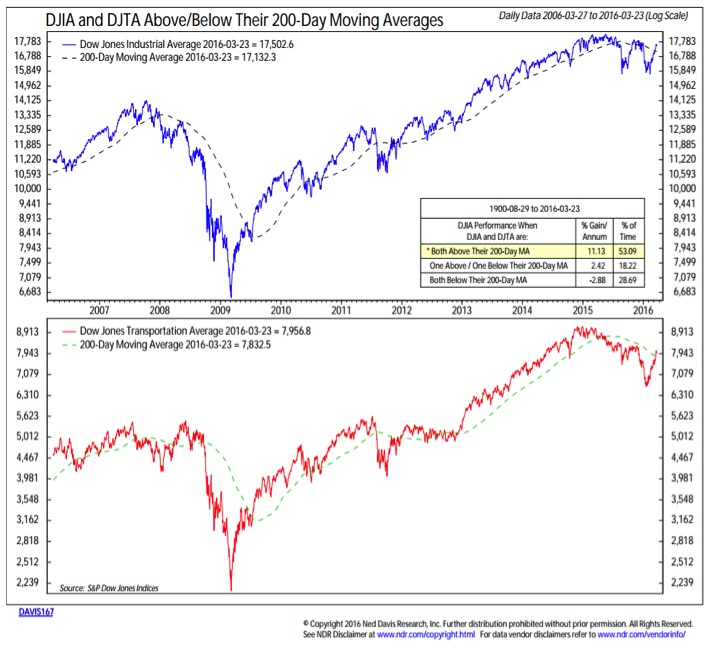

Dow Jones Transportation Average

The Dow Transports got a lot of attention in early 2015 as their cross below their 200-day moving average was heralded as an early warning for the rest of the stock market. A year later, the Dow Transports have now crossed back above their 200-day average. If weakness in the Transports was used as a signal for broader weakness, it seems fitting to hold up strength in the Transports as an argument for broader strength. Right now both the Dow Transports and Dow Industrials are above their 200-day average, and when that has been the case in the past, the Industrials have been able to rally.

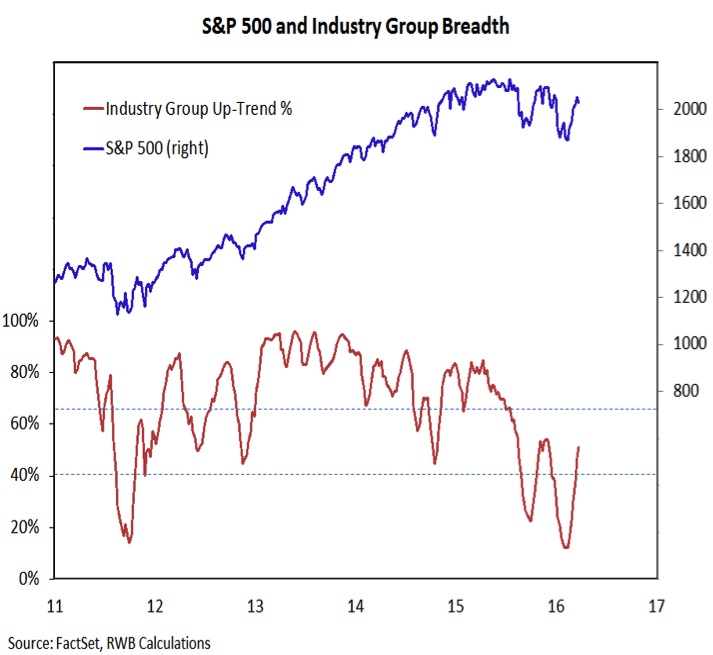

S&P 500 Industry Group Market Breadth

As the rally off of the February lows has progressed, we have seen evidence of broad market strength that was not present during the rally off of the 2015 lows. That is encouraging and we have upgraded our view on the broad market to neutral. Still lacking (but heading in the right direction) has been confirmation from our longer-term breadth indicators. The percentage of industry groups in up-trends is expanding, but we would need to see further strength to gain conviction that breadth has turned bullish. Alternatively, weakness in the S&P 500 that results in an only limited down-turn in the industry group indicator would also be a sign of broad market healing.

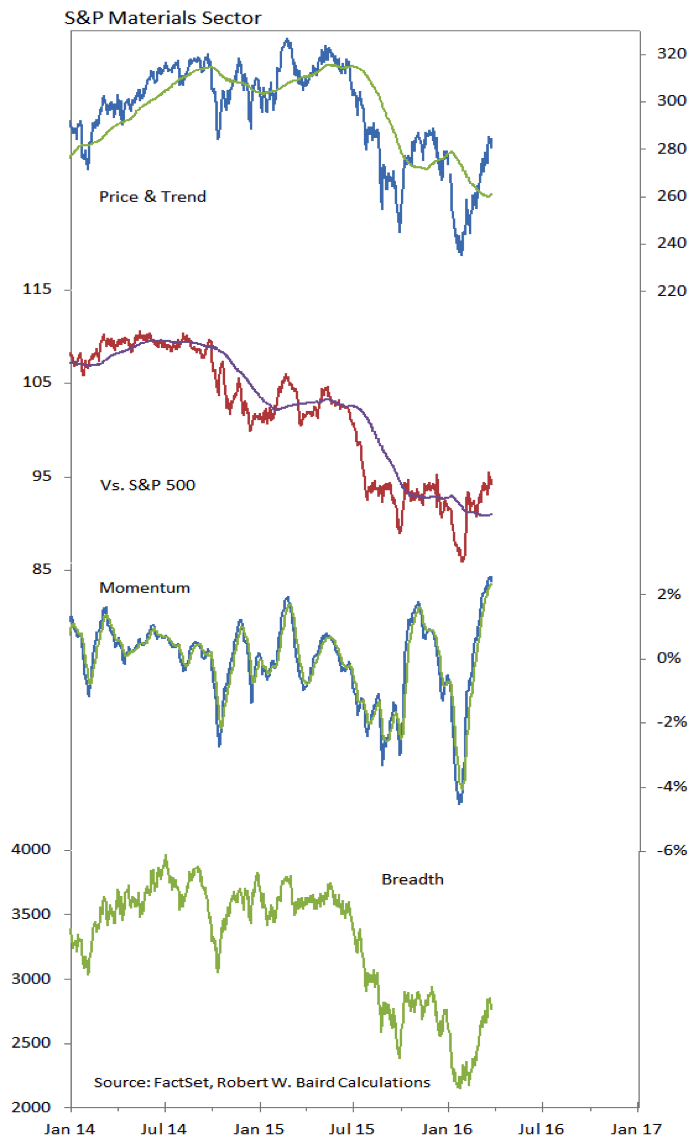

The Materials Sector

The materials sector has gone from laggard in 2015 to leader in 2016. It has moved into the sector leadership group since two brief appearances in February and June of last year. The price and breadth down-trends that emerged in the second half of 2015 have been broken. While a longer-term relative price down-trend remains intact, strong momentum from the sector suggests this too could be challenged.

Thanks for reading and have a good weekend.

Twitter: @WillieDelwiche

Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.