The stock market is under duress and internal breadth readings are deteriorating.

Earlier this week, the S&P 500 Index closed below the MFU-3 price level of 4211, signaling the MFU-4 price target of 4079 is in play.

Stock market indices don’t go down in a straight line, so I believe the index can get down to the next target of 4079 in the next few weeks with some near-term pops. But, given the weakness of market internals, the stage is set for further weakness.

One way to determine the correct identification of the bearish Money Flow Unit off a high is how the index or stock hits and gets a short-term reversal from the MFU-2 or 3 levels. We had a significant reversal off the MFU-3 at 4211 with a +4% rally. This adds credibility to the lower price targets, and we are in gear to head to the MFU-4 price target of 4079.

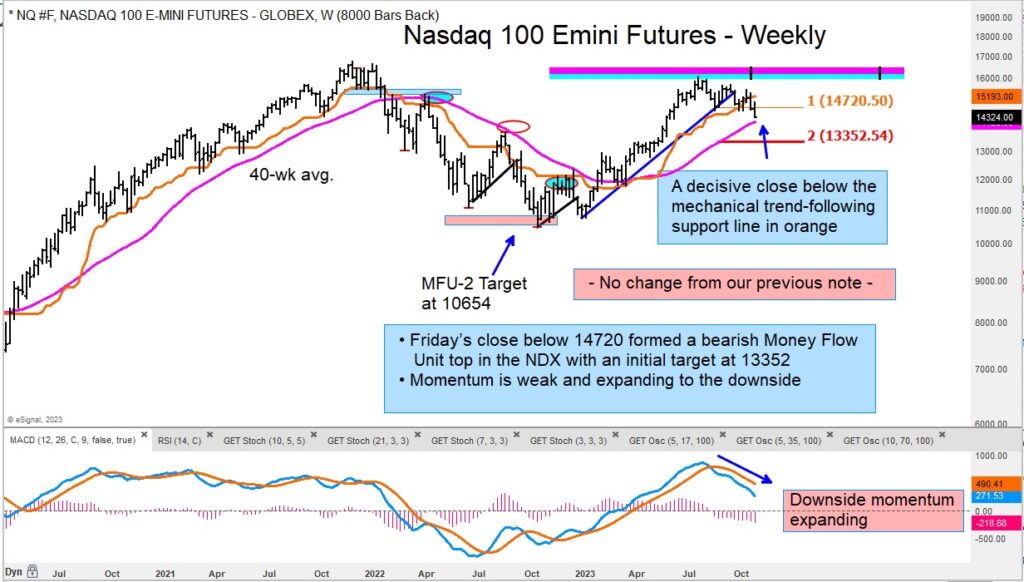

Looking at the Nasdaq 100 emini futures (NQ), we can see that downside momentum is expanding with a big break below our MFU top zone of 14720.50. This bearish close generates an “initial” price target at the MFU-2 level of 13352.54. Once we get a close below that level, we will highlight the MFU-3 level.

For now, I am remaining very cautious on long exposure given what we are seeing at the index level and confirmed at the stock level with both our Money Flow Unit work and the multi-factor model scoring of the S&P 1500.

In my opinion, it is not worth trying to pick a bottom at this point, as many indices are showing significant weakness ahead.

Twitter: @GuyCerundolo

The author or his firm have a position in mentioned securities at the time of publication. Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.