Recent stock market gains have been remarkably broad based, with new highs being seen in the United States & around the world at the index, sector, and individual stock level.

Over the past two weeks, the equity markets have pivoted sharply – from the most new lows since April to the most new highs since January. Market breadth and momentum are clearly a wind at the market’s back.

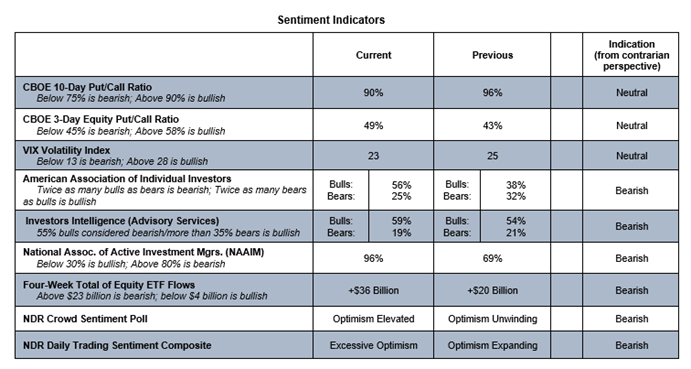

Our investor sentiment indicators suggest that most investors are looking in the same direction. Optimism is widespread in equities and even the AAII survey now shows twice as many bulls as bears. Fund flow data shows $26 billion flowing into Equity ETF’s last week and the 4-week total surged to $36 billion.

Over the past decade, stocks have struggled when the 4-week total surpassed $23 billion. In the 20% of the time that has happened since 2007, the S&P 500 has fallen at a 25% annual rate. Where there is increased optimism for one asset class, there tends to be decreased optimism for another. Commodity ETF’s last week experienced the largest single week of outflows in the past four years. When it comes to investor sentiment, it often pays to be wary of the crowd at extremes – and the equity crowd is signaling extreme optimism right now.

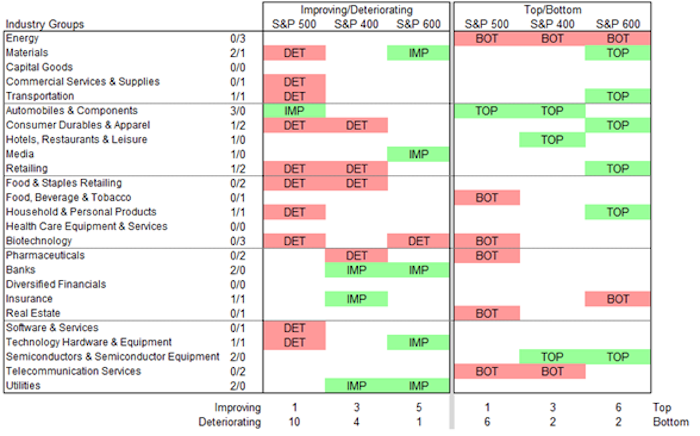

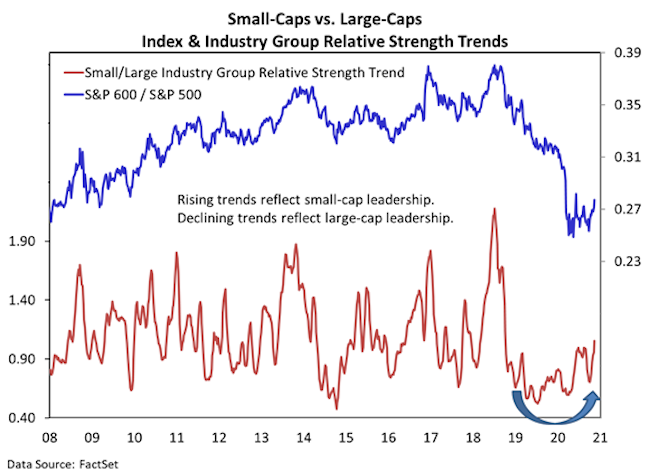

While sentiment suggests stocks are near-term overheated, there are important long-term trends to keep an eye. From a size perspective, the rotation from large-cap leadership to small-cap leadership has intensified in recent weeks. This is especially evident when viewed at the industry group level. Large-cap groups are seeing deteriorating relative strength and small-cap groups are seeing improving relative strength. Our overall small-cap/large-cap industry group relative trend indicator has moved to its highest level in over two years.

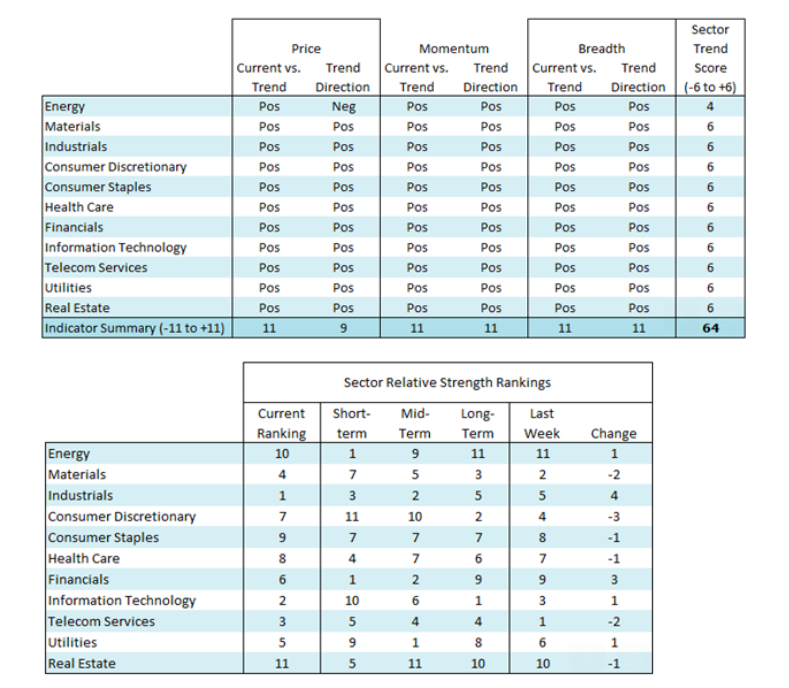

From a sector perspective, we are seeing near-term strength virtually across the board (even trends in the Energy sector have turned positive). From a relative strength perspective, Industrials moved to the top spot in the rankings this week. Financials and Energy have been market leaders on a short-term basis – Financials have begun to climb in the overall rankings but Energy less so. Consumer Discretionary and Technology have been near-term laggards. Consumer Discretionary is slipping in the rankings, while Technology has been more resilient (and still holds the second spot in the overall rankings)

The Bottom Line: Optimism is elevated and from a contrarian perspective that argues for near-term caution. Longer-term trends in terms of overall market breadth, as well as leadership shifting toward small-caps and more cyclical areas of the market, is encouraging.

Twitter: @WillieDelwiche

Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.