S&P 500 Trading Considerations For December 19, 2017

The S&P 500 (INDEXSP:.INX) is making new highs seemingly every day, but the broad market index is approaching a measured move price target. In the commentary below I share my outlook and analysis on key stock index futures, along with crude oil.

You can access today’s economic calendar with a full rundown of releases.

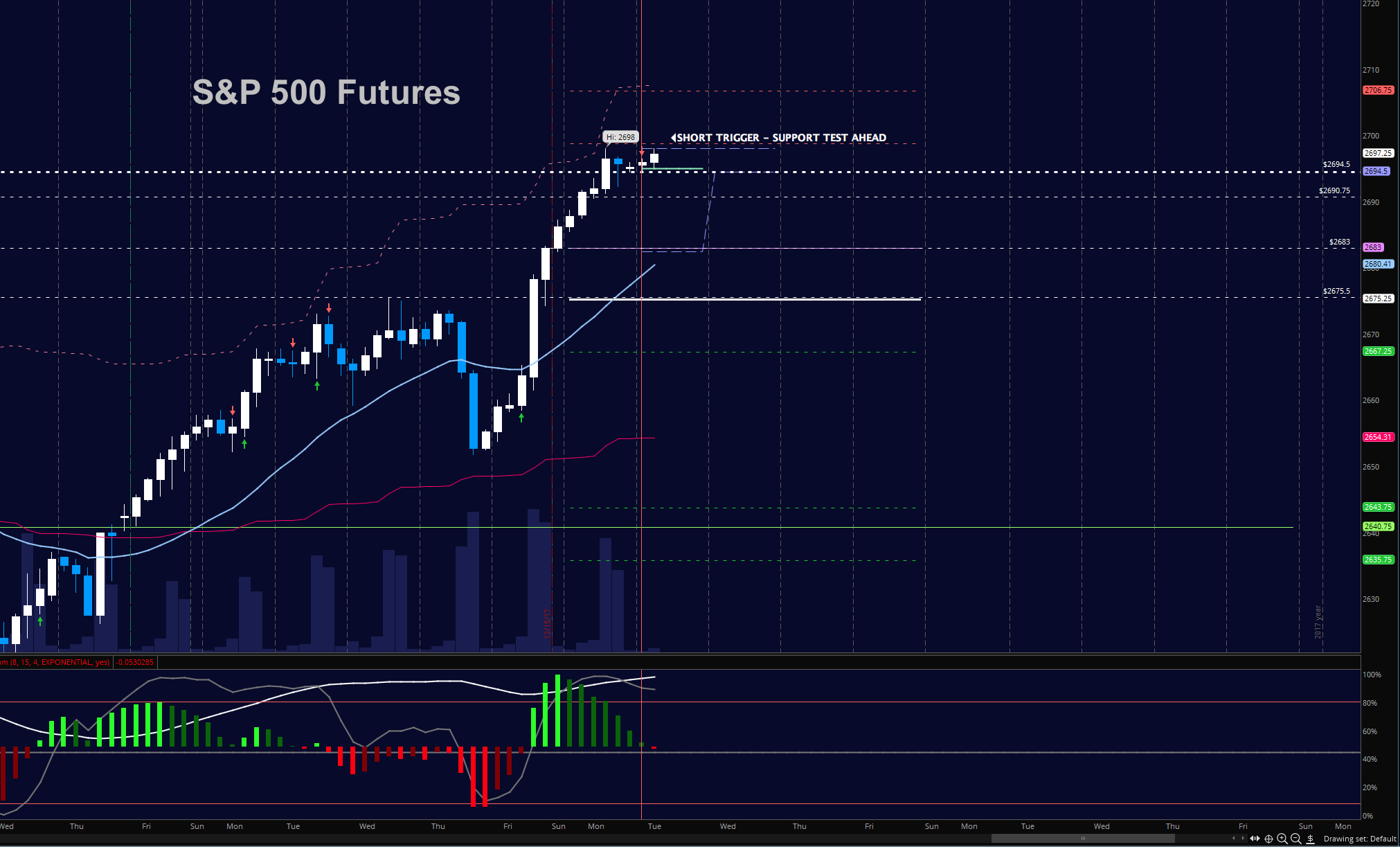

S&P 500 Futures

Charts expand and hold steady as the ES_F formations stretch to test the round number at 2700. Measured moves suggest 2706.75 as the target. This is likely to be a breathing point for this chart with a bit of profit taking, so even as we hold higher highs and higher lows, we are in a space that does not suggest holding the positions long without taking some gains. I suspect value buyers will return at the retest of congestion below near 2675.5 to exercise any pressure they have. Retracements have been shallow and should continue to be shallow unless profit taking catches hold. The bullets below represent the likely shift of trading momentum at the positive or failed retests at the levels noted.

- Buying pressure intraday will likely strengthen with a positive retest of 2698.75

- Selling pressure intraday will likely strengthen with a failed retest of 2691.5 (countertrend)

- Resistance sits near 2697.75 to 2702.75, with 2706.75 and 2717.5 above that.

- Support holds between 2687.5 and 2683.5, with 2675.5 and 2671.25 below that.

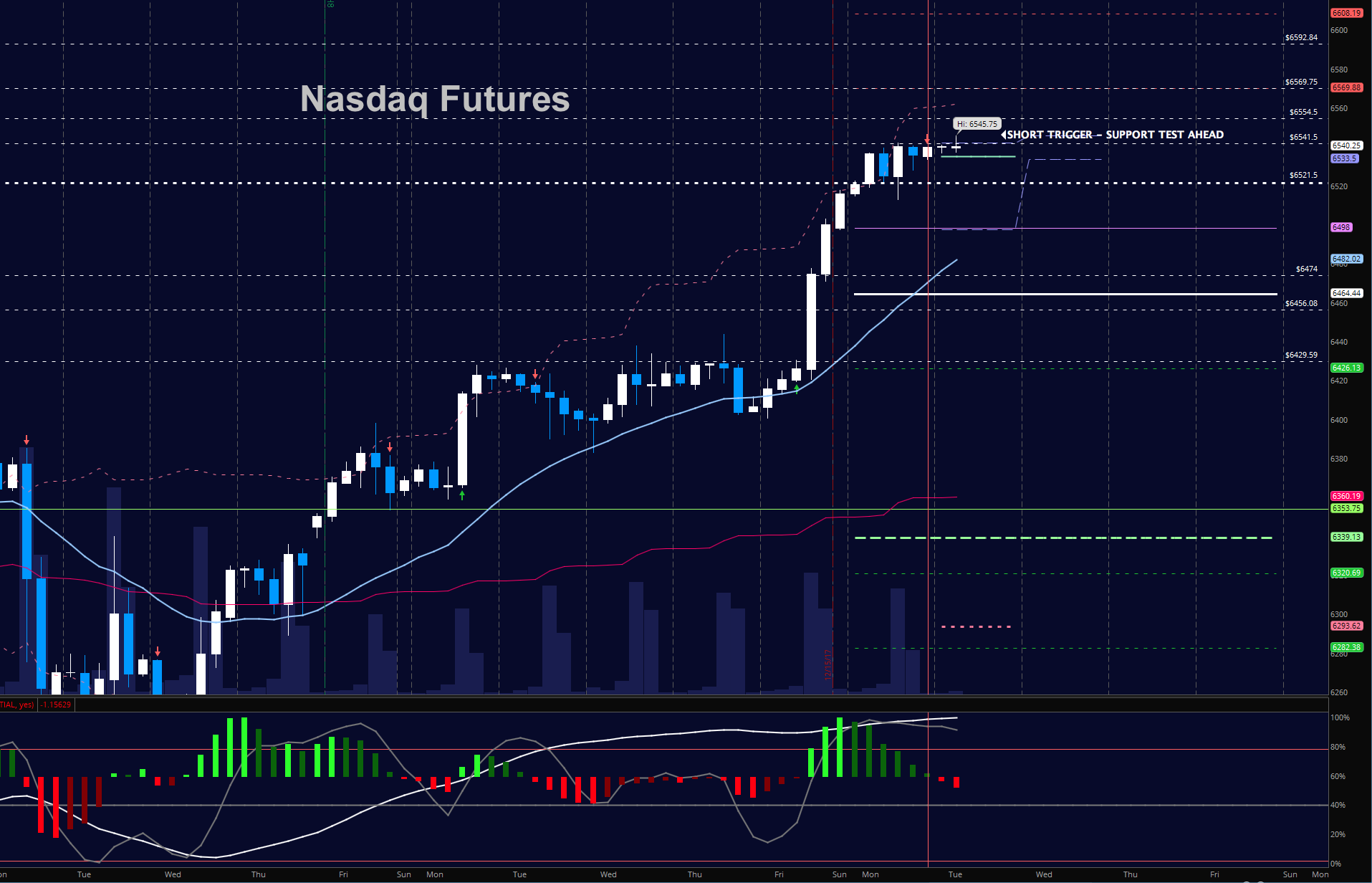

NASDAQ Futures

Traders stopped right at the Fibonacci extension yesterday. The chart is now in a support test formation that should bring higher lows. New highs today are good places to take profit today. Buyers have control of this chart but we are likely to see a bit of profit taking today. If higher support holds, however, charts will stretch higher once more. Pullbacks may be shallow and trading shorts are quite countertrend. The bullets below represent the likely shift of intraday trading momentum at the positive or failed tests at the levels noted.

- Buying pressure intraday will likely strengthen with a positive retest of 6542.5

- Selling pressure intraday will likely strengthen with a failed retest of 6514.5

- Resistance sits near 6545.75 to 6554.5 with 6569.75 and 6592.75 above that.

- Support holds near 6521.5 and 6513.75, with 6497.75 and 6477.75 below that.

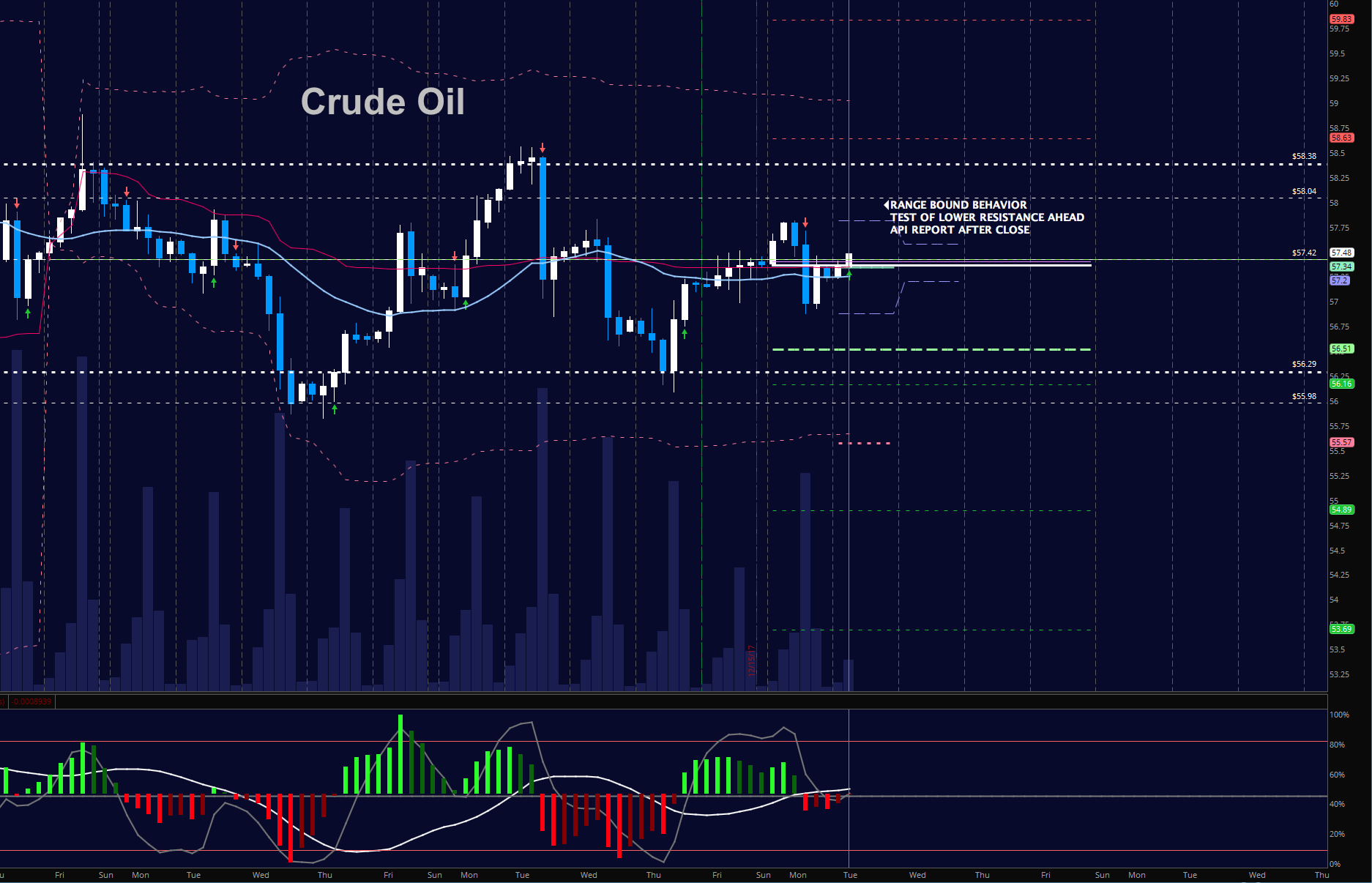

WTI Crude Oil

As yesterday, traders continue to chop this one around for yet another day – testing resistance this morning near 57.8 and rejecting. Ranges continue to tighten so pay attention to the edges of your formations. Failed tests of support and failure to breach and hold resistance will be important to mark the trail of intraday direction. The bullets below represent the likely shift of trading momentum at the positive or failed tests at the levels noted.

- Buying pressure intraday will likely strengthen with a positive retest of 57.85

- Selling pressure intraday will strengthen with a failed retest of 57.2

- Resistance sits near 57.85 to 58.1, with 58.57 and 58.85 above that.

- Support holds near 57.2 to 56.97, with 56.57. and 56.16 below that.

Twitter: @AnneMarieTrades

The author trades stock market futures every day and may have a position in mentioned securities at the time of publication. Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.