Stock market futures are feeling some additional pressure this morning. And the outlook for April 7, and perhaps beyond, may hinge on how prices react at key support.

Buyers still support regions of key support in and around 2046.75 on S&P 500 futures. As long as we hold this level, we will give buyers confidence to push prices north. Resistance is firm at 2061.75- 2065 at this writing.

Though stock market futures remain heavy today, and momentum remains damp, we are currently holding support. But that’s a lot of energy being exerted against downside pressure – it is apparent that more money is sitting on the long side for now.

Momentum on the four hour chart is still neutral; we are sitting at important support and congestion so buyers should come back into the game near support levels- just as they did yesterday, and the day before. In range bound environments, it is best to trade level to level intraday.

Shorter time frame momentum indicators are positive, but rolling over into congestion here at 2048. There is strong congestion between 2044 and 2052

See today’s economic calendar with a rundown of releases.

THE RANGE OF THURSDAY’S MOTION

Crude Oil Futures (CL_F)

With the OPEC meeting ahead, it appears that traders are anticipating positive outcomes for oil as we continue to bounce after the recent pullback. Support on Crude oil futures is near 37.5.

Today, the trading ranges are between 37.08 and 38.54.

Moving averages in oil are mixed on tighter time frames, but we are moving down from an importance resistance area near 38.3 back into a likely support zone near 37.7. Charts are muddy here so sideways action and level to level trading is on the horizon.

Intraday long trading setups on crude oil suggest a long off a 37.55 positive retest (check momentum here), or 36.75 positive retest on the pullback into targets of 37.24, 37.42, 37.7, 38.3, 38.68 and if buyers hold on, we’ll see 38.94.

Intraday short trading setups suggest a short below a 37.55 failed retest, or the failed retest of 38.14 (with negative momentum prevailing) sends us back through targets at 37.86, 37.59, 37.26, 36.85, 36.68, and 36.19 to 35.87, if sellers hang on.

E-mini S&P 500 Futures (ES_F)

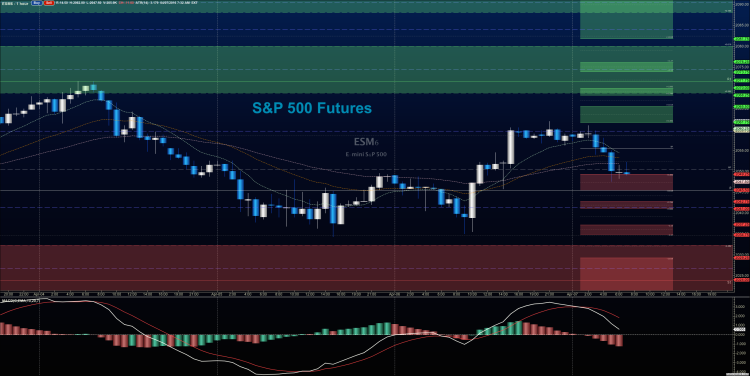

Below is a S&P 500 futures chart with price support and resistance trading levels for today. Click to enlarge.

The levels between 2061.5- 2064.75 on S&P 500 futures now serve as front line resistance. Meanwhile, support remains the 2033.5- 2036.5 region. Expansions outside these ranges should retest nearby before continuation.

Upside motion has the best setup on the positive retest of 2039.5 or a breach and retest of 2047.5 with positive momentum. I use the 30min to 1hr chart for the breach and retest mechanic. S&P 500 futures targets from 2039.5 are 2042.25, 2044.5, 2047.5, 2049.75, 2051.25, 2054.5, 2057.5, and if we can catch a bid there, we could expand into 2061.5, 2064.25, and 2067.5. Long action is still trending over the bigger picture for now, but momentum is now drifting.

Downside motion opens below a failed retest of 2047.75 or at the failed retest of 2054.5 with negative divergence (careful here- watch for the higher low to develop to tell you that an early exit might be necessary). Retracement into lower levels from 2054.5 gives us the targets 2052.25, 2049.5, 2047.75, 2044.75, 2040.50, 2037.75, 2035.75, 2032.75, 2029.5, and perhaps 2025.5 to 2022.5, if selling really takes hold.

If you’re interested in the live trading room, it is now primarily stock market futures content, though we do track heavily traded stocks and their likely daily trajectories as well – we begin at 9am with a morning report and likely chart movements along with trade setups for the day.

As long as traders remain aware of support and resistance levels, risk can be very adequately managed to play in either direction as bottom picking remains a behavior pattern that is developing with value buyers and speculative traders.

Thanks for reading.

Twitter: @AnneMarieTrades

The author trades stock market futures every day and may have a position in mentioned securities at the time of publication. Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.