News of the omicron variant has hit the stock market like an arctic breeze. And the already struggling airlines industry has taken another turn lower in November.

Will December be better to airlines stocks?

Stock Market bulls hope sure hope so. Cause if it doesn’t, it will likely mean more restrictions, slower business / travel, and perhaps another turn lower in the economy.

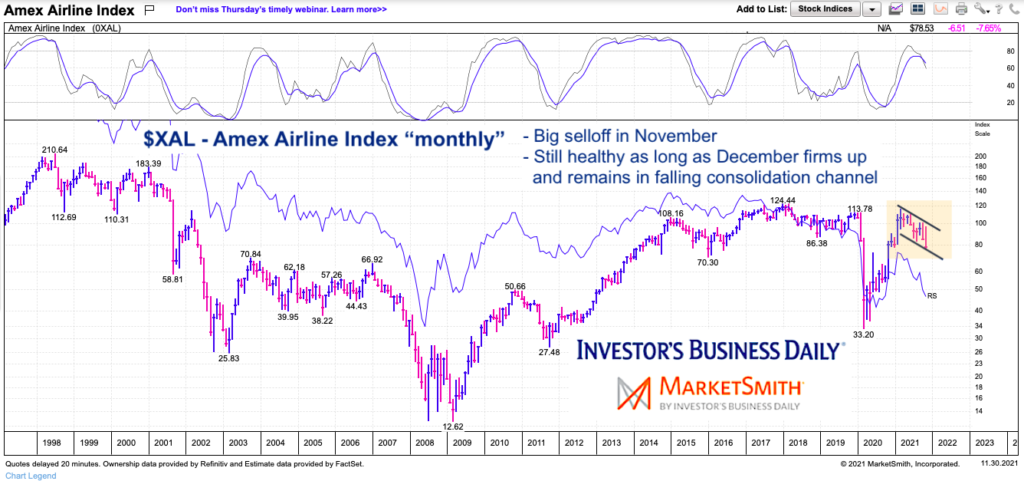

As you will see in the charts below, the Amex Airlines Index (XAL) is down 20% from its November high (yikes!) and down nearly 35% from its March high. Let’s review the charts.

Note that the following MarketSmith charts are built with Investors Business Daily’s product suite.

I am an Investors Business Daily (IBD) partner and promote the use of their products. The entire platform offers a good mix of analysts, education, and technical and fundamental data.

$XAL Airlines Index “daily” Chart

The daily chart of XAL highlights the months long selloff… as well as the short-term selloffs over the past couple of months. The selling begun prior to news of the omicron variant so perhaps lingering uncertainty helped to price some of this in.

In any event, bulls need to step up soon or else the poor price action will like turn a so-so holiday travel schedule into a worse-than-expected one (and have deeper effects on the economy).

$XAL Airlines Index “monthly” Chart

The monthly chart highlights the multi-month bear market. The price action has remained within a “relatively” controlled descending channel. That said, November’s price candle is LONG and RED. So bulls will need to step up and produce a better December or things could get ugly.

Twitter: @andrewnyquist

The author may have a position in mentioned securities at the time of publication. Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.