The latest rally showed investors that even with the insecurity about the government stimulus package passing and rising tensions from job losses, the stock market is resilient (after closing the week strong).

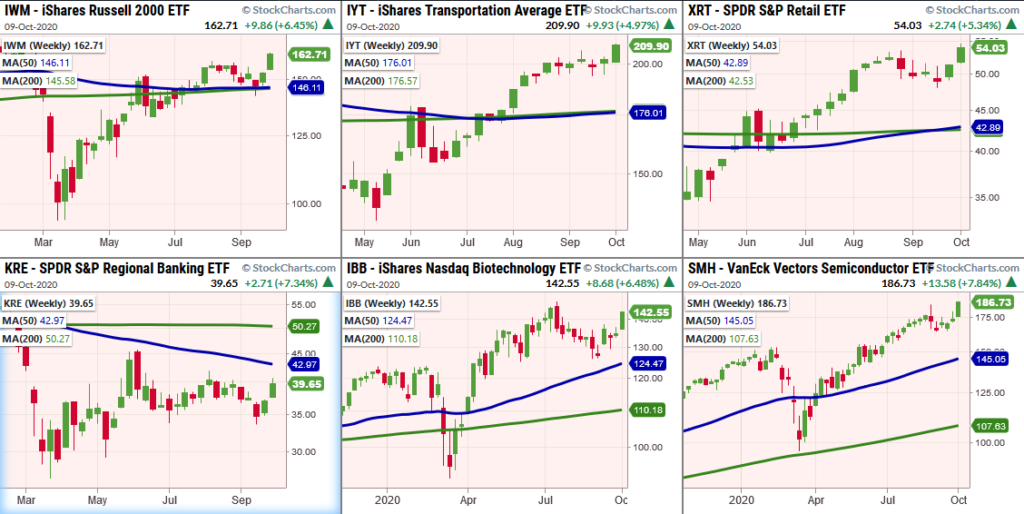

The Russell 2000 ETF NYSEARCA: IWM which has been in a consolidation period for the last 6 weeks has closed over resistance at 159.82, which was created on August 11th. In fact, IWM has gained about 12% since the start of October!

This breakout brings the Russell 2000 ETF (IWM) back into the price range before the crash in January.

The Transportation Sector ETF (IYT) broke all time highs this week trading up to 210.90!

What makes this more important is that it cleared resistance going back to 2018. Furthermore, the optimism for a real recovery is best reflected in Trans.

The Retail Sector (XRT) has been on a good run, but confirmed more strength this week when she held over her September high of 53.66 and close on a new all-time high.

The Regional Banks ETF (KRE), who many are worried about, have finally made a notable comeback, and hopefully with more strength this time can head up towards the 50-WMA. However, KRE could not close the week over 40.00. This sector, although improved, remains a sticking point for the MF.

Big Brother Biotech (IBB) had a recent surge with vaccines entering trial stages. This looks as though it could bring him back to all time highs.

Sister Semiconductors (SMH), like Granny Retail, has broken over her September high and held. Never one to miss the party, SMH has many wondering about rebalancing their portfolios away from tech. We say, lighten and tighten, but no need to exit this group yet.

With current underlying strength in Modern Family, it’s hard to take a negative stance, especially since this is the first time in years, we can report that the MF is showing leadership!

Even with the uncertainty of the presidential election looming ahead, the strength and optimism of the market (and the economy) isn’t something you want to trade against. You just have to be smart about asset allocation, watch volatility, now very cheap, and make sure you keep risk reasonable.

Below is a video wherein Mish runs through a brief overview of what is happening in the general markets. After that she dives into her top 13 picks from last week and reviews positions that were taken, ones that are still in process, and what to do with them now. Also as a bonus she adds 3 new stocks to the list.

Important ETFs to follow with key trading levels:

S&P 500 (SPY) Took out the September high. Now if holds 343, could see a test of July highs

Russell 2000 (IWM) 159-160 support area-now just 1.8% away from all-time highs

Dow (DIA) 280 Support. Resistance 292

Nasdaq (QQQ) 280 support. 289 resistance.

KRE (Regional Banks) Resistance at 40-42. 38 Support

SMH (Semiconductors) New all-time highs

IYT (Transportation) New all-time highs

IBB (Biotechnology) 137 Support Resistance 146

XRT (Retail) 53.50 needs to hold-as first one to show real strength, she could be first to drop if mkt weakens

Twitter: @marketminute

The author may have a position in the mentioned securities at the time of publication. Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.