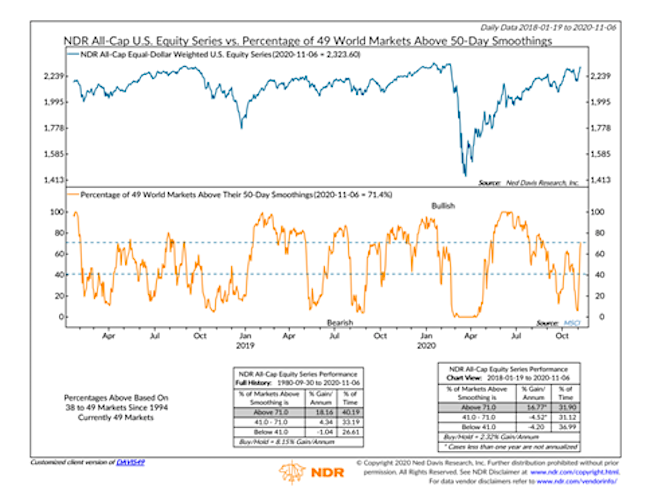

As impressive as the gains in the broader stock market indices are, it is what is happening beneath the surface that is even more encouraging.

The 7 percent rally in the S&P 500 Index last week was the best weekly gain since April and it helped both the 10-week and 40-week moving averages turn higher. The S&P 500 Index also posted its highest weekly close on record… and note that Monday morning news of an effective COVID-19 vaccine has the index obliterating those previous peaks and trading in record territory.

While the news of an effective vaccine suggest an encouraging path forward, this is not a time to be complacent from a health, investment, or economic perspective.

Those are the headlines, but the real market news of the past week seems to be in the resiliency and rebound in stock market breadth indicators.

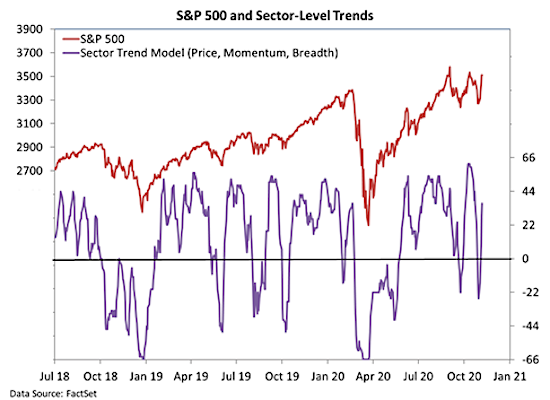

Index-level gains were accompanied by strength at the sector and industry group level. Our industry-group trend indicator has turned higher and sector-levels have bounced back into positive territory.

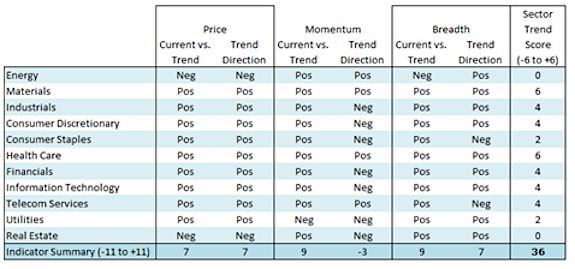

In terms of global market participation, last week saw the percentage of world markets trading above their 50-day moving averages rise from 6% to more than 70% (this peaked in October at 63%). It is hard to overestimate the importance of this improvement. All of the net gains in stocks over the past 3 years (and the bulk of the net gains over the past 40 years) have come when more than 70% of world markets are trading above their 50-day moving averages. Emerging markets are leading the way, with more than three-quarters trading above their 50-day moving averages.

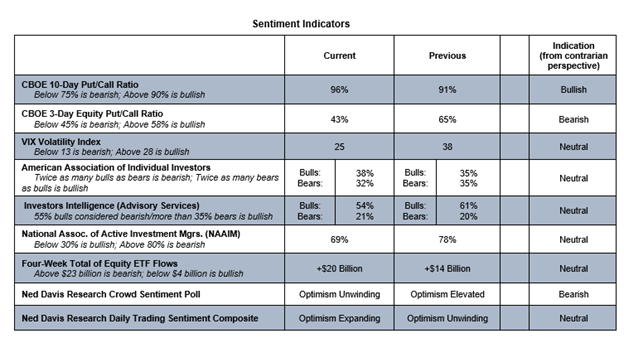

Sentiment indicators have shown little pessimism in the wake of excessive optimism in September and October. Last week’s price gains coupled with vaccine-related news could prompt a swift return to widespread complacency and optimism. Equity ETF flows have already started to heat up and options data shows a quick dissipation of any fear that emerged prior to the election.

Twitter: @WillieDelwiche

Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.