The S&P 500 (SPX) has taken a bit of a beating recently and (so far at least) Santa Claus has not come to town. One trading opportunity for those traders with a bearish bias over the next week or so is a Bear Call Spread using the 2000 strike as the short call and the 2025 strike as the long call.

As of Tuesday’s close, this trade offered a roughly 39% return on risk over the next 10 calendar days when using the December 26th expiry.

Keep in mind, markets close early on Christmas Eve and are closed on Christmas day, so that is one and a half less days you will be in the trade.

The maximum profit on the trade would be $700 per contract with a maximum risk of $1,800. The spread would achieve the maximum 39% profit if SPX closes below 2000 on December 26th in which case the entire spread would expire worthless allowing the premium seller to keep the $700 option premium.

The maximum loss would occur if SPX closes above 2025 on December 26th which would see the premium seller lose $1,800 on the trade. The breakeven point for the Bear Call Spread is $2007 which is calculated as $2000 plus the $7.00 option premium per contract. Be aware that due to the bid-ask spread, you may not be able to get filled at these exact prices.

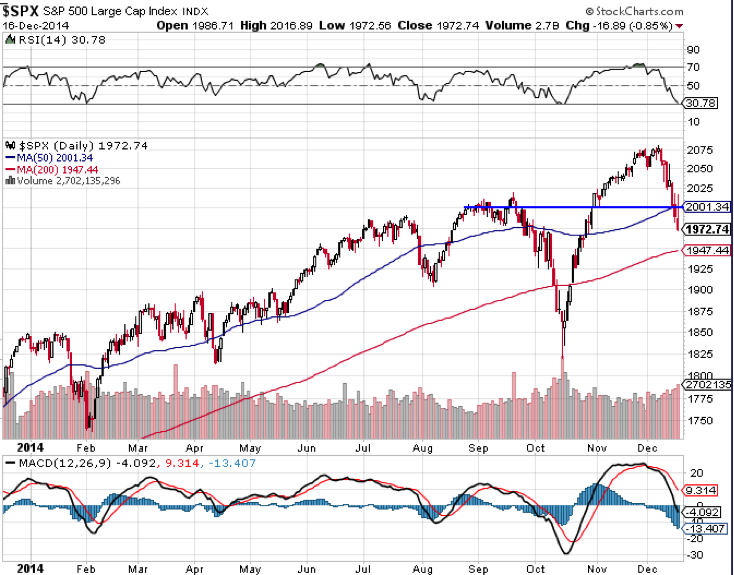

Looking at the SPX chart, 2000 is a crucial resistance level both technically and psychologically. It is also the location of the 50 day moving average which could provide additional resistance.

The RSI indicator is at 30.78 which is one of the lowest levels seen in the last 12 months and is approaching oversold levels. This level has seen rallies occur in the past so traders should proceed with caution.

The MACD which is in a clear bearish position and indicated lower prices could be coming. SPX price is also below the 50 day moving average which is bearish, but above the 200 day moving average which is considered bullish.

If Santa Claus doesn’t come to town this year, this Bear Call Spread is a nice way for traders to book a tasty profit over the Christmas period.

Follow Gavin on Twitter: @OptiontradinIQ

No position in any of the mentioned securities at the time of publication. Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.