The following data, analysis, and charts highlight long and short interest as of October 31, 2017 across several S&P 500 Sector ETFs. Note that these stock market charts and excerpts also appeared on my blog in the full article.

Below I highlight 3 of 9 important stock market sector ETFs. We look at the SPDR S&P Financial Sector ETF (NYSEARCA:XLF), the SPDR S&P Technology Sector ETF (NYSEARCA:XLK), and the SPDR S&P Consumer Discretionary ETF (NYSEARCA:XLY).

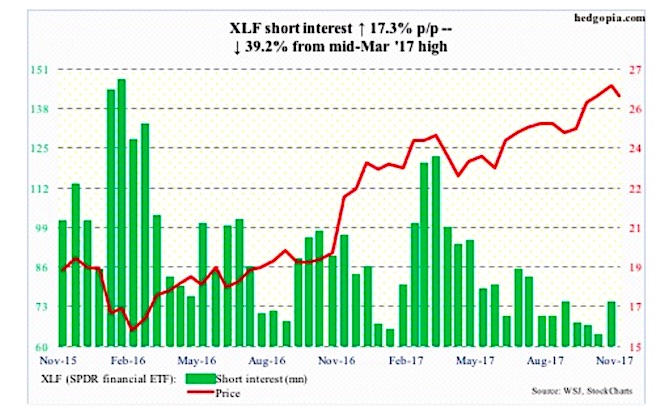

SPDR Financial ETF (XLF)

XLF has been slightly under pressure since peaking six sessions ago at 26.93, and has room to continue to head lower. Short-term price resistance lies at 26.40.

That said, it is comfortably above 25, where resistance-turned-support goes back more than a decade and which it broke out of in September after several tries.

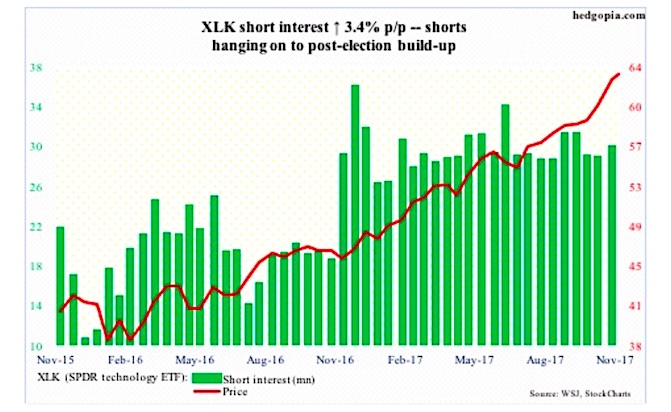

SPDR Technology ETF (XLK)

Since defending the 20-day on the 25th through Wednesday’s all-time high, XLK jumped six-plus percent. In 11 sessions!

Some cracks are beginning to appear in the prevailing momentum.

Shorts continue to hang on to post-election buildup in short interest.

Nearest support lies at just north of 61.

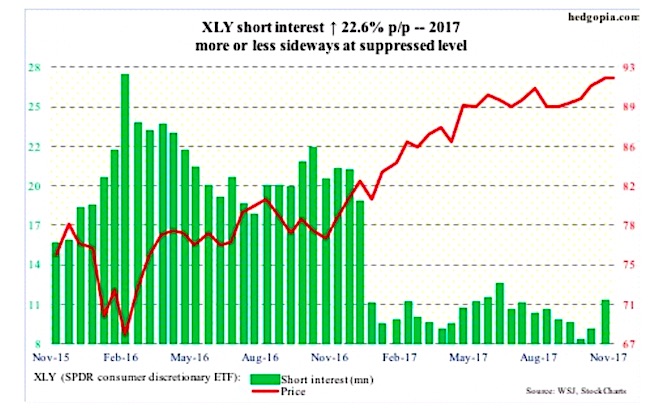

SPDR Consumer Discretionary ETF (XLY)

XLY keeps getting repelled at $92, which has resisted rally attempts since June this year, but the bulls are not giving up.

Short interest has pretty much gone sideways at a subdued level throughout this year – not leaving much room for squeeze.

A convincing breakout hence will be significant. Down below, there is support from a rising trend line from February last year around 90.50.

Twitter: @hedgopia

Author may hold a position in mentioned securities at the time of publication. Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.