Gold and Copper continued…

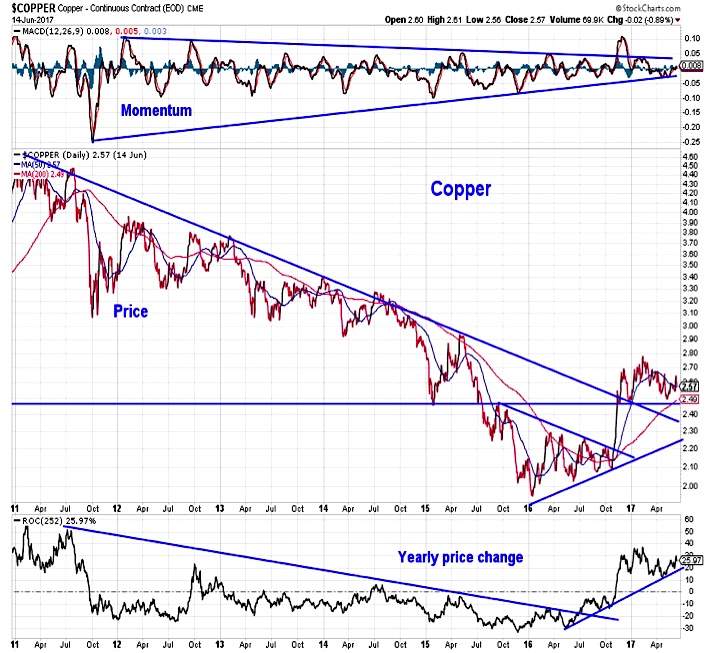

Copper prices

Copper has not built on the strength that emerged in late 2016, but neither has it given up much. Rather it continues to move within a sideways consolidation phase. Momentum is turning higher and the yearly price change is trending higher. This suggests that this consolidation is likely to resolve higher.

U.S. Dollar Index

The dollar may be showing skepticism in the U.S. economy, but this may also reflect increased optimism in the Euro and the European economic recovery. Either way, the price action on the dollar remains weak. The uptrend off of the 2014 lows has been broken following an unsustained breakout. This has been followed by a series of lower highs and lower lows (by definition, a downtrend). Momentum uptrends have also been broken.

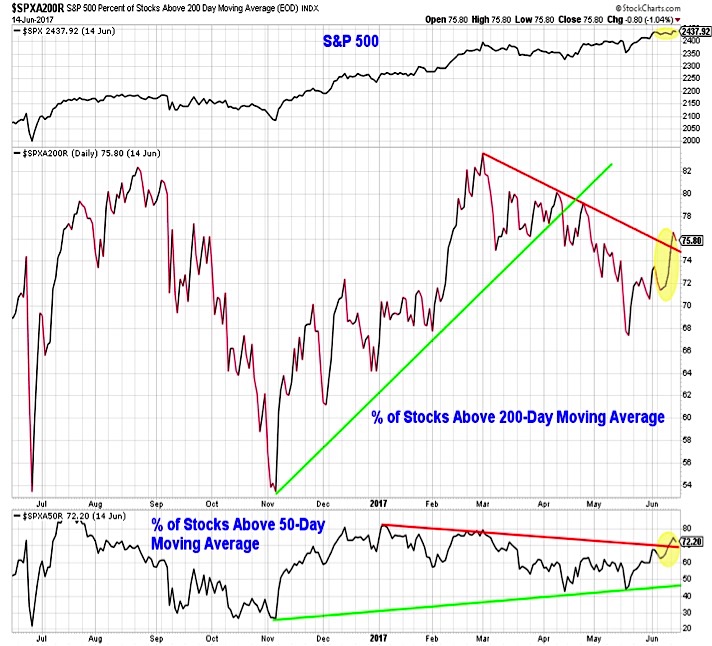

S&P 500 – Market Breadth

Beyond the noise of mega-caps stumbling and how that could de-rail the entire stock market, the news of an increasing percentage of stocks in uptrends has been encouraging and evidence that new leadership is poised to emerge. Over the past month, the percentage of stocks in the S&P 500 trading above their 200-day average has expanded from 68% to 76%, while the percentage of stocks above their 50-day averages has risen from 45% to 72%. In both cases downtrends off of early year highs have been broken. This is evidence that stock market breadth is increasingly robust even as the headlines focus on a handful of popular stocks.

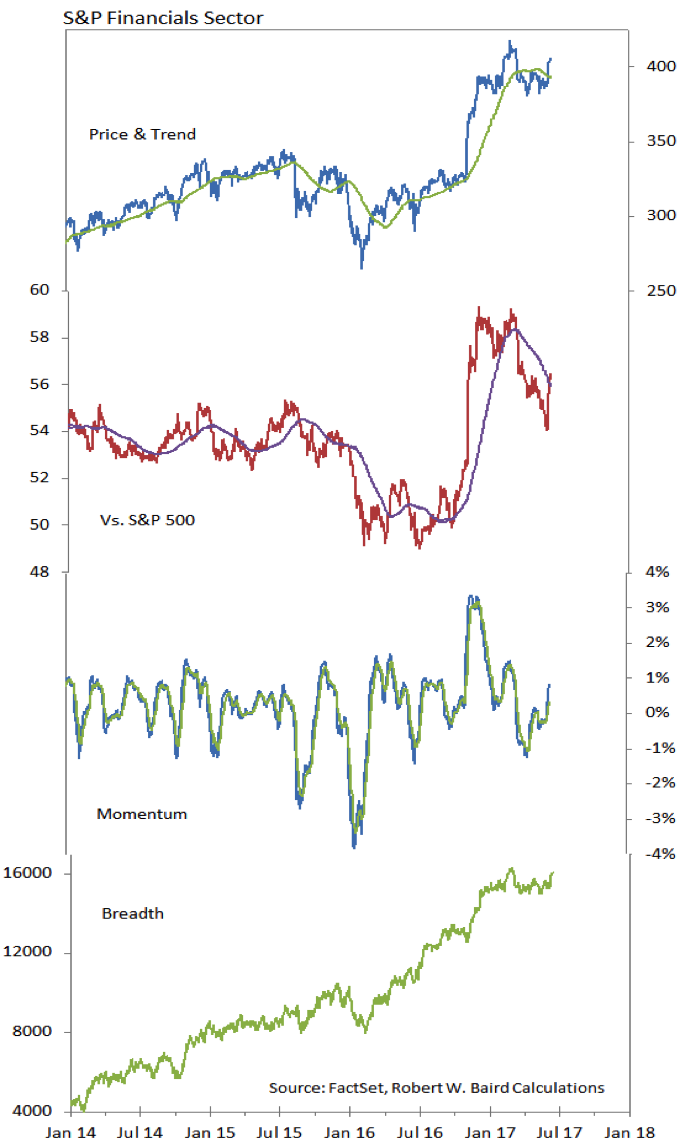

S&P Financials Sector

As recent leaders like Technology and Consumer Discretionary have stumbled, new strength is emerging. The Materials sector has quietly gained relative strength and moved to new highs. Encouragingly for the entire stock market, Financials have also seen improved relative strength. While the sector has not yet seen a new high, the uptrends that emerged last year remain intact on an absolute and relative price basis. Momentum has turned sharply higher, breaking a downtrend that had emerged last year.

Thanks for reading.

Twitter: @WillieDelwiche

Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.