In this week’s investing research outlook, we analyze the current trend of the S&P 500 Index (INDEXSP:.INX), key stock market indicators, and discuss emerging themes and news that we are watching closely in our investing research.

Here’s a summary of our findings for the week ending June 9, 2017:

Shifts in Leadership? – The NASDAQ (INDEXNASDAQ:.IXIC) looks overextended with neither momentum nor breadth confirming recent highs. Small cap stocks and the Russell 2000 (INDEXRUSSELL:RUT), however, are gaining relative strength with momentum expanding. This could be an early signal that leadership is shifting away from the large-cap high flyers and toward small caps.

S&P 500 New High List Expands – The new high list has been unspectacular in terms of aggregate numbers but is showing signs of persistent strength. This supports the view that strength is emerging beyond just a small group of large-cap stocks.

More Evidence of Complacency – Options data has turned sharply toward complacency. The CBOE total put/call ratio has had two readings in the 70s this week, and the equity-only version has been in the 50s for three consecutive days. The AAII and Investors Intelligence surveys showed sharp upticks in optimism this week, while the NAAIM exposure index shows that active investment managers remain heavily exposed to equities.

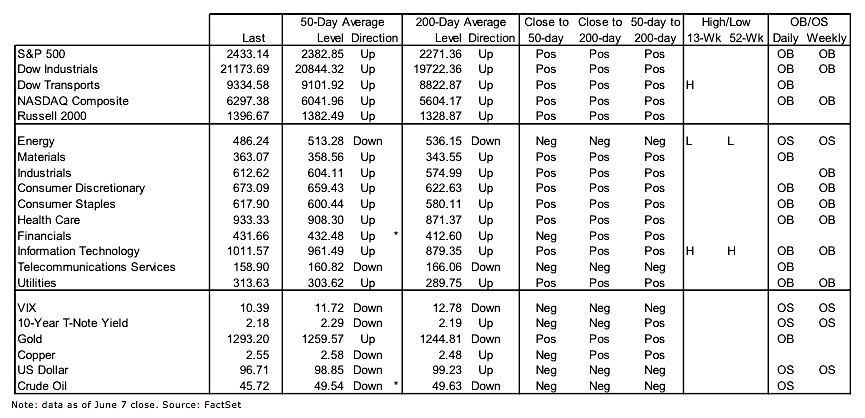

Stock Market Indicators

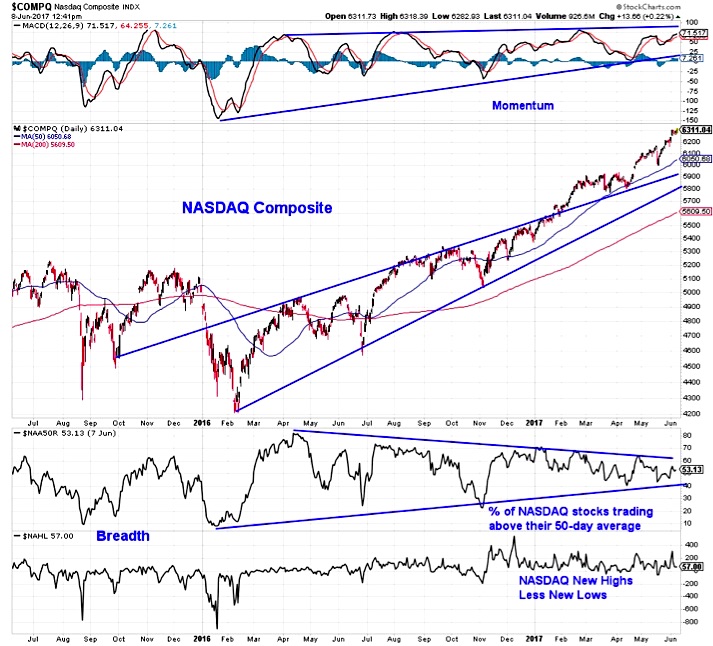

Nasdaq & Technology Sector

New price highs for the NASDAQ Composite have come without confirmation from momentum and with only about half the stocks (53%) trading above their 50-day averages. This lack of support could leave the index vulnerable to near-term consolidation as price appears to have gotten over-extended.

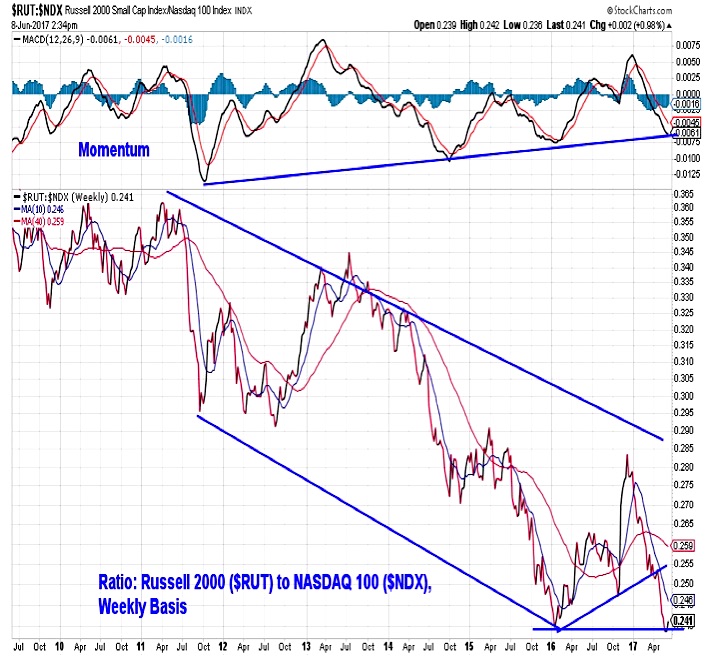

Small Cap Stocks

Small caps continue to build in recent strength. The Russell 2000 is on the cusp of a new high and the price trend is supported by expanding momentum. In fact, momentum is turning higher after a period of consolidation since late 2016. This coincides with improvement being seen on a relative price basis.

With the NASDAQ poised for potential consolidation and the Russell 2000 seeing renewed interest and improving momentum, a shift in leadership may be underway. We will watch the ratio between the Russell 2000 and the NASDAQ 100 for evidence that this is unfolded. The ratio had pulled back to the early 2016 low before turning higher in recent weeks, but momentum continues to make a series of higher lows. The early 2017 theme of leadership from just a handful of large-cap stocks may be tested this summer.

continue reading to the next page…