Broker Dealer Index

Leadership may not just be shifting from large caps to small caps. Recently out of favor groups are also seeing renewed interest. The broker/dealer index has rallied off of support and is attempting to breakout of both an absolute and relative price consolidation that has been ongoing since February. Financials getting back in gear could help provide fuel for continued gains in the S&P 500 even as leadership rotates (and perhaps broadens).

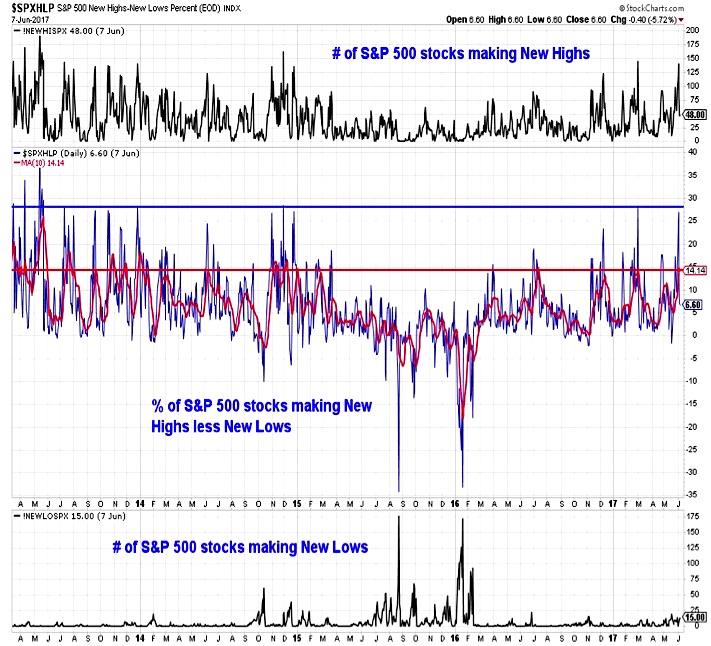

Market Breadth

On a daily basis, the new high lists has been somewhat unremarkable (although 25% of stocks on the S&P 500 making new highs in a single day is about as good as we have seen in recent years). Even more encouraging has been the steady rise in the 10-day trend, which indicates more consistent and persistent strength than a single-day spike. On either basis, it is hard to make the case that the market is only supported by a handful of stocks. If this becomes more broadly recognized, interest in that small basket could wane.

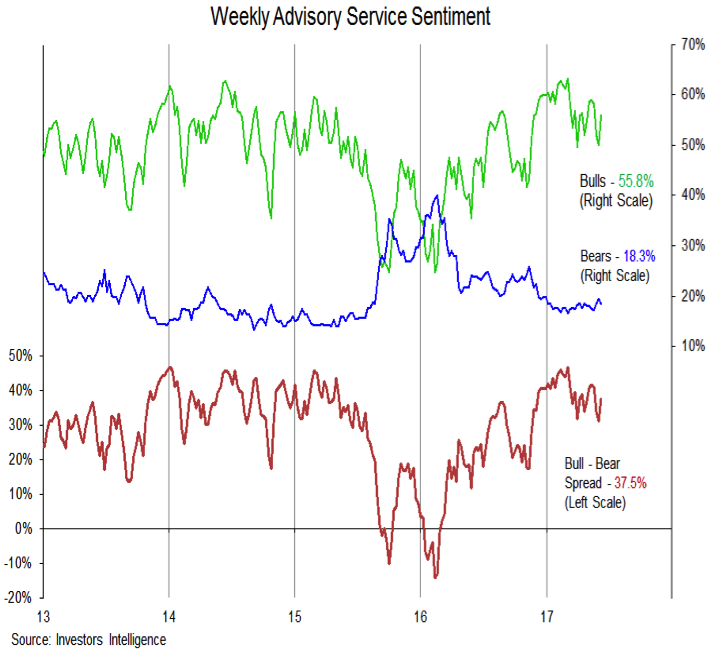

Investor Sentiment

Near-term complacency is on the rise, and after staying elevated last week, put/call ratios have collapsed this week. While this could be a near-term headwind, longer-term sentiment indicators, which showing optimism, are not at historically extreme levels. Bulls on the Investors Intelligence survey of advisory services rose from 50% last week to over 55% this week and this pushed the bull-bear spread back up to 37.5%. Both of these readings, however, are shy of the peaks seen in March.

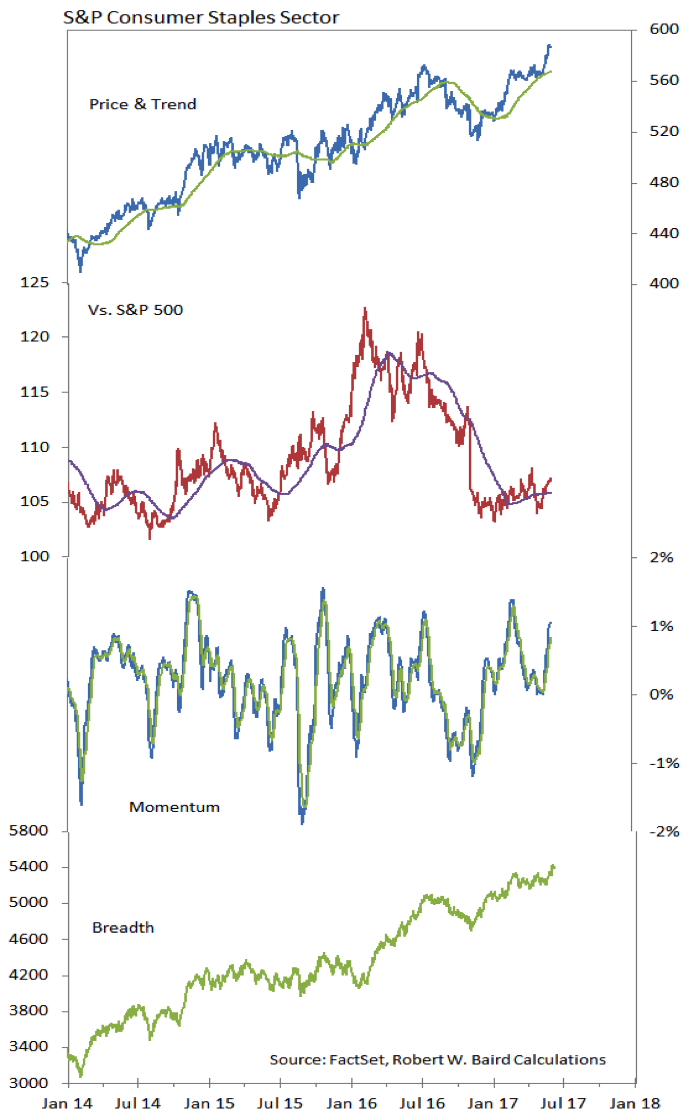

S&P Consumer Staples Sector

Leadership rotation is also being seen at the sector level. The Consumer Discretionary sector failed to make a new relative price high recently, and its price high was unconfirmed by breadth and momentum. Discretionary has also started to lose relative strength versus Consumer Staples. Staples have rallied to a new price high as momentum has surged and breadth has improved. Strength in the sector is supported at the sub-industry level as groups there are seeing improving trends. Rotation out of recent leaders and into less-loved areas of the market may be a theme this summer.

Thanks for reading.

Twitter: @WillieDelwiche

Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.