The S&P 500 reversed course and rallied sharply this past week.

The price action was tricky and volatility persists. From Tariffs to White House exits, investors have a lot to navigate.

Our stock market cycles analysis sees the rally stalling out and beginning a pullback by week’s end. Let’s review and discuss more in-depth.

S&P 500 Analysis and Market Cycle Outlook:

- The S&P 500 moved higher last week, rising by 3.5%.

- Volatility continued last week, as talk of tariffs brought unease until investors saw that Trump’s policy had so much pushback and so many exemptions that it had no teeth.

- Late in the week, stocks surged as job growth strengthened while wage inflation eased.

- Our projection this week is for the current short-term rally to stall, bringing a downside correction to the stock market over the next week and a half.

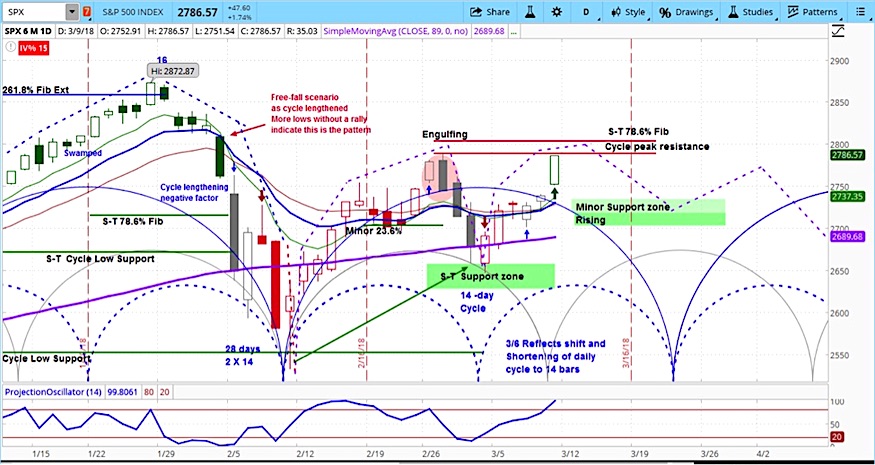

S&P 500 (SPX) Chart with Daily Bars

The stock market rose last week, with the S&P 500 (SPX) up 95 points to 2786.

Equities declined modestly in the overnight session leading into Monday, after the Italian national election in which voters largely shunned mainstream political parties, with over half casting ballots in favor of various populist parties.

On Monday, the talks between North and South Korea following the Winter Olympics proceeded, as Kim Jong-un hosted a Presidential delegation from the South for direct talks in Pyongyang.

Later that day, President Trump said he would stick to his bold plan for import tariffs until all parties could reach a “fair deal” on the North American Free Trade Agreement (NAFTA). The markets rallied, apparently taking this as a signal that he would rethink his approach to tariffs.

However, on Tuesday, Director of the National Economic Council Gary Cohn resigned from his post, citing disagreement with Trump over trade policy. The S&P 500 fell overnight by as much as 40 points but slowly came back.

In fact, market participants may have figured out by this time that Trump’s approach to tariffs was the “Art of the Deal” in action. His classic approach to negotiation is to open with a big proposal that shocks the other side and then extract concessions as they reel back. The bottom line is that the tough tariffs previously proposed would be implemented in some fashion but not in the original format.

On Wednesday, when Trump indicated that he still planned to authorize the tariffs before the end of the week, the markets tanked and rallied again. On Thursday, he signalled that he was open to exemptions for some countries, and later confirmed that Canada Mexico would be exempt from the tariffs. The markets responded positively.

Despite talk of a trade war, ECB President Mario Draghi showed his confidence in the European economy by removing standard language from his comments that indicated he was ready to increase quantitative easing if needed. This led to a rally in the European markets.

On Friday, the Department of Labor released non-farm payroll data showing an increase of 313,000 jobs in February, compared to expectations of 200,000. However, wage growth was only 2.6%, which was 0.2% below expectations.

Recalling that the big move lower in February was related to high wage inflation, Friday’s combination of high job creation and low wage inflation was what market participants were looking for. The S&P 500 rallied 47 points for the day.

Looking forward, our approach to technical analysis uses cycle analysis to project price action. The blue semicircles on the daily chart above represent the short-term market cycles. Our projection for the S&P 500 (SPX) is for the market to face a period of risk over the next week and half with a rising support zone starting at 2737.

For an introduction to cycle analysis, check out a clip of our Big Picture Analysis. To see the full version, visit askSlim.com and become a free Level 1 member.

For more on our analysis, check out the askSlim Market Week below – the latest episode is below.

Our latest askSlim Market Week Video:

Twitter: @askslim

Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.