The stock market rose last week, with the S&P 500 (SPX) up 75 points to 2671, an increase of nearly 3%.

Traders were excited by trade negotiation news leaks, which showed that the US and China are continuing to talk.

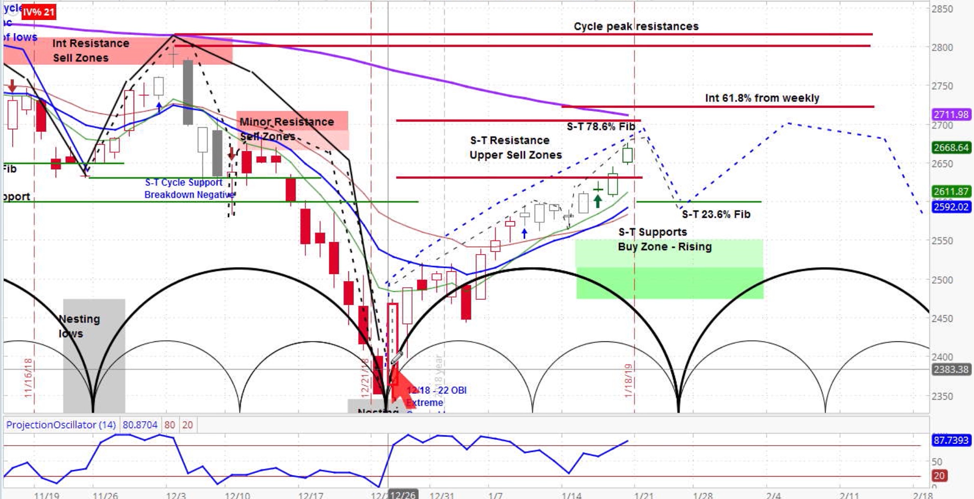

Our projection this week is for stocks to decline to 2598 and then return to the upside after the rising phase of the next market cycle begins.

S&P 500 Index (SPX) Daily Chart Analysis

Our approach to technical analysis uses market cycles to project price action. Our analysis is for the S&P 500 to tick lower to 2598 for the remainder of the declining phase of this current market cycle.

We then expect the market to move higher once the rising phase of the next market cycle begins.

S&P 500 Market Cycle Outlook Video (week of January 20, 2019)

The stock market continued to rebound, with the SPX higher by 6% year to date and 13% off its its December low, as I pointed out in the latest Market Week show. Volatility continued to tick lower, with the CBOE Volatility Index (VIX) finishing the week at 17.80.

We discuss our outlook here:

The US-China negotiations continued mostly behind closed doors, but the Wall Street Journal reported that Treasury Secretary Mnuchin was pushing to continue the negotiations after dropping the tariffs. The leak was later denied by a Treasury spokesperson.

Another rumor circulated that China was considering raising its US imports by $1 trillion over the coming 6 years. However, reportedly, the US side countered by asking them to close the trade gap within 2 years, which of course would better coincide with the election cycle.

Beyond this, the UK Parliament took a vote on Prime Minister Theresa May’s Brexit plan, which failed by a margin of 432 to 202. She pointed out that while the vote showed that her plan does not have sufficient support, it did not indicate what the Parliament does support.

In any case, May survived the subsequent no confidence vote and will continue to work to resolve the question of specifically how the UK will separate from the European Union. The British Pound Volatility Index (BPVIX) rose into the big vote, and later dropped by 18%.

The earnings season kicked off with bank earnings, most of which came in above expectations. Beyond banks, Netflix reported in-line earnings but missed on revenue, however the stock was only off by a few percentage points.

The good news with respect to earnings is that 76% of S&P 500 companies have reported an earnings surprise and 56% a revenue surprise. However, according to FactSet, none of them have guided Q1 earnings higher and 6 companies have guided earnings lower.

For more from Slim, or to learn about cycle analysis, check out the askSlim Market Week show every Friday on our YouTube channel.

Twitter: @askslim

Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.