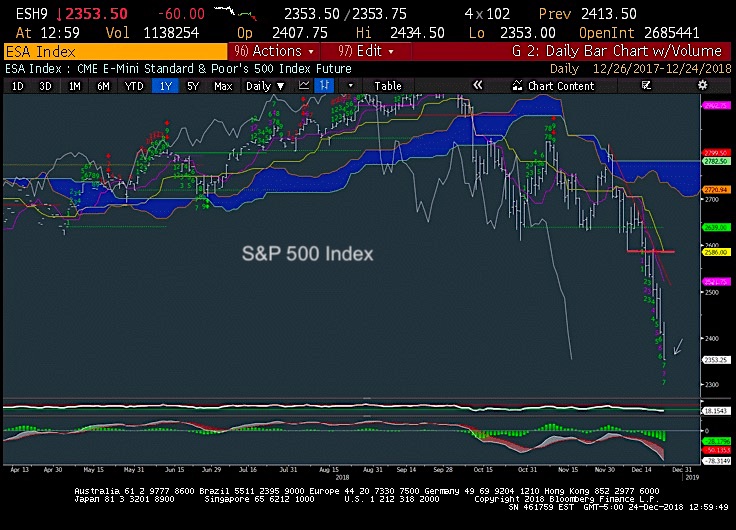

S&P 500 Trading Outlook: The pullback is getting stretched, but there are still no signs of any letup in the selling.

Looking forward to Wednesday, I suspect the 2330-2350 price area could be important on Wednesday.

The S&P 500 is still falling precipitously, and not much signs of support with prices closing down near the lows of the day Monday.

The S&P 500 is now within a stone’s throw” of being down 20% since the September 20 peak, which many would say makes this an official bear market.

Near-term, the following are at a least minor positives that can be relayed: 1) RSI has now reached a 17 reading on daily charts, so true oversold territory 2) Demark exhaustion now two days away potentially 3) Fear has escalated further with Put/call at 1.2 4) TRIN readings for Monday showed >2 reading (ARMS INDEX) so we’re seeing an excessive amount of volume now on the downside which typically suggests an upcoming low is near.

Overall, it’s very difficult to stand in the way of this decline, but the heavier volume Monday looked to potentially be a tell-tale sign that this pullback is getting close to exhaustion. I think it’s time to watch for evidence of price reversals between Wednesday and Friday of this week.

S&P 500 Trading Chart

If you have an interest in seeing timely intra-day market updates on my private twitter feed, please follow @NewtonAdvisors. Also, feel free to send me an email at info@newtonadvisor.com regarding how my Technical work can add alpha to your portfolio management process.

Twitter: @MarkNewtonCMT

Author has positions in mentioned securities at the time of publication. Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.