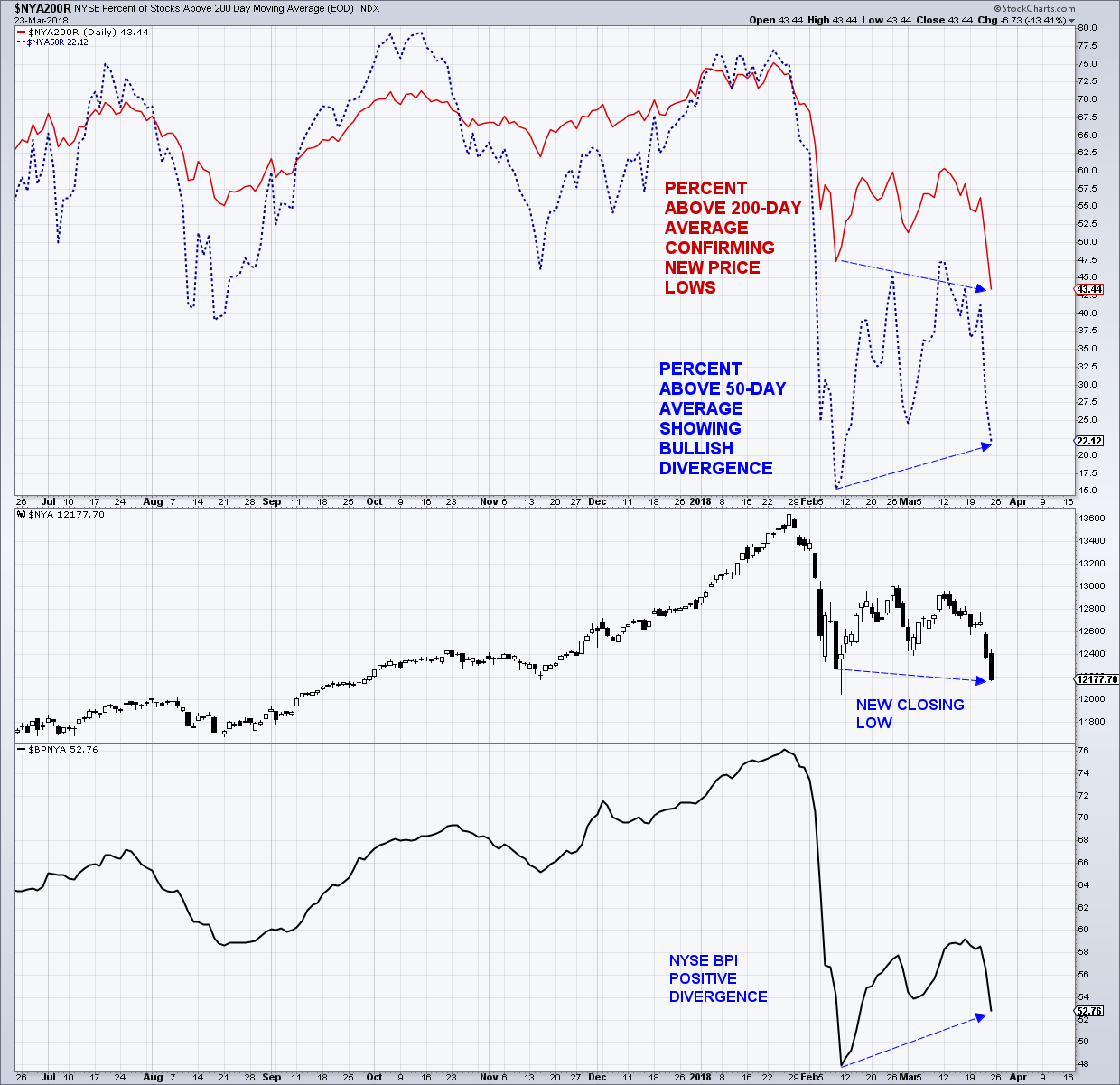

The percent of NYSE stocks above their 50-day average is showing a bullish divergence while the percent above their 200-day average is confirming the new price lows. NYSE BPI (Bullish Percent Index) is showing a positive divergence vs. price. Overall, a positive, but I would rather see a positive divergence with respect to the 200-day data, like we did in 2015 and 2016.

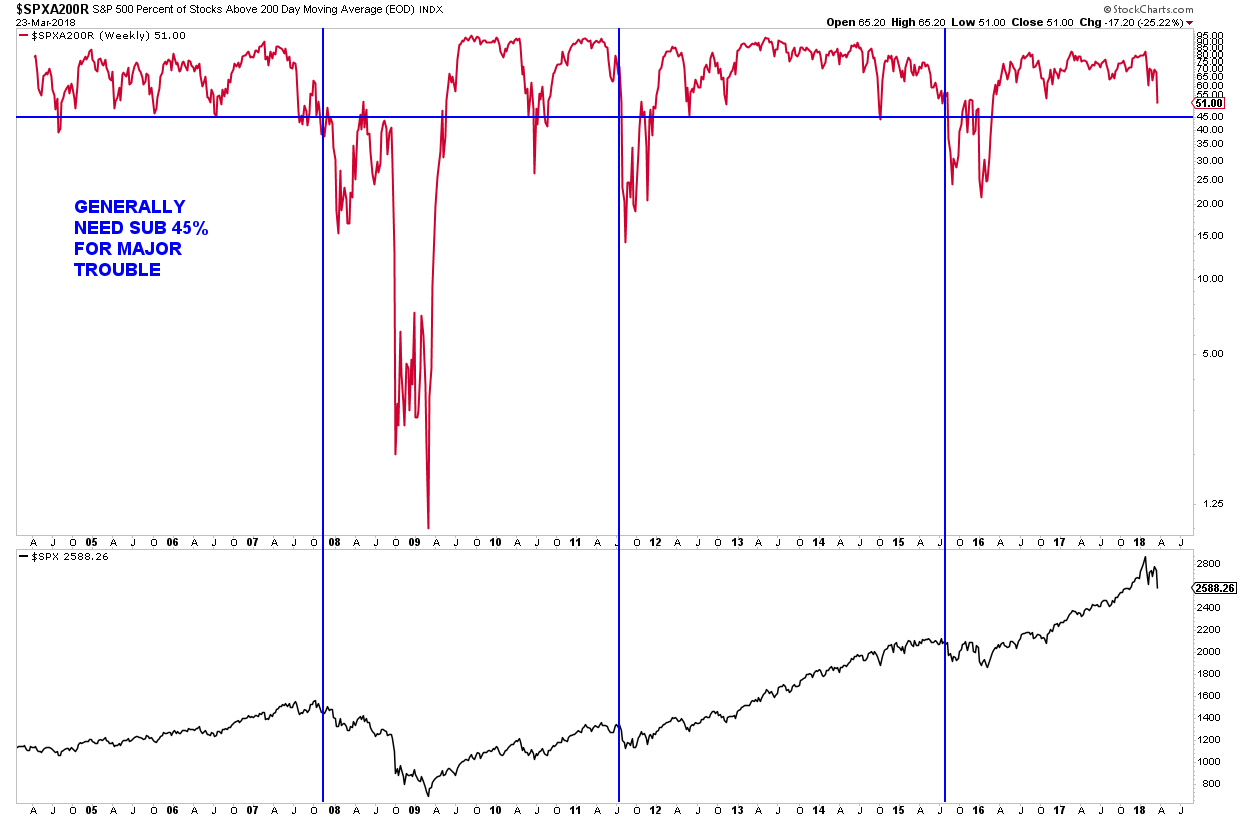

The percent of stocks above their 200-day average on a weekly chart is declining toward the 45% area. In the recent past, deterioration below the 45 level is generally when we see real trouble for the overall stock market. Certainly a concern, so we better right the ship soon based on this indicators past signals.

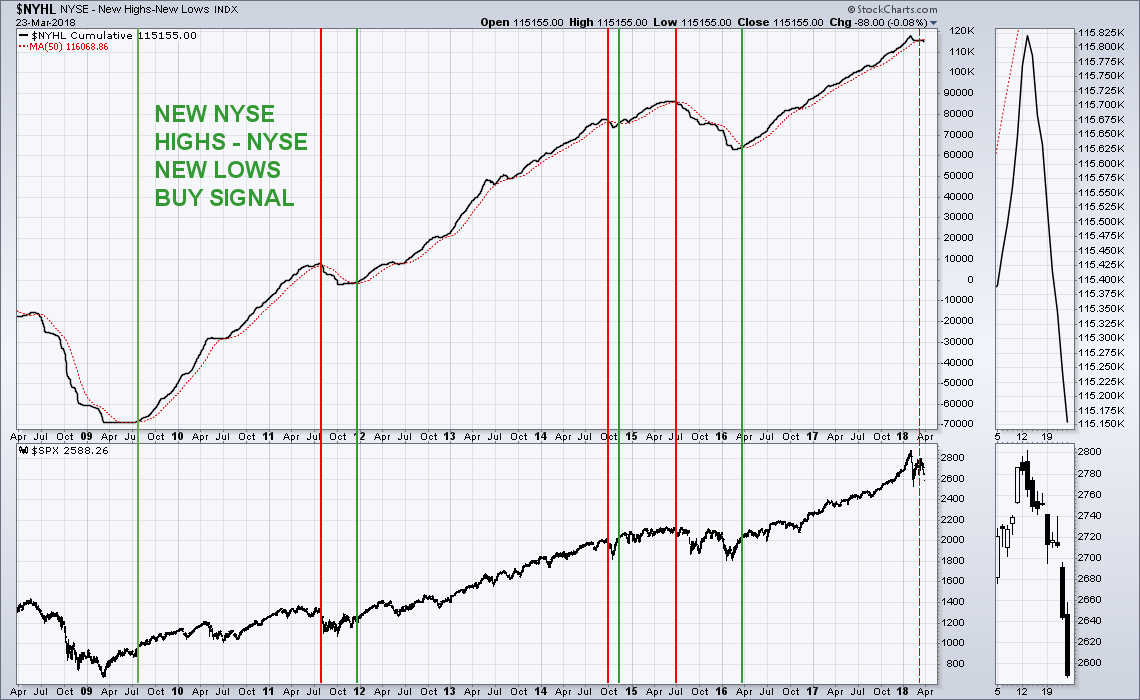

NYSE new highs minus new lows with a 50-day average. We saw a bearish crossover in early March which was the first sell signal since June 2015. This negates the last buy signal in March 2016. During extended bull runs, this indicator at times will give false signals that are erased very quickly. This is concerning if it does not turn back higher in the coming weeks.

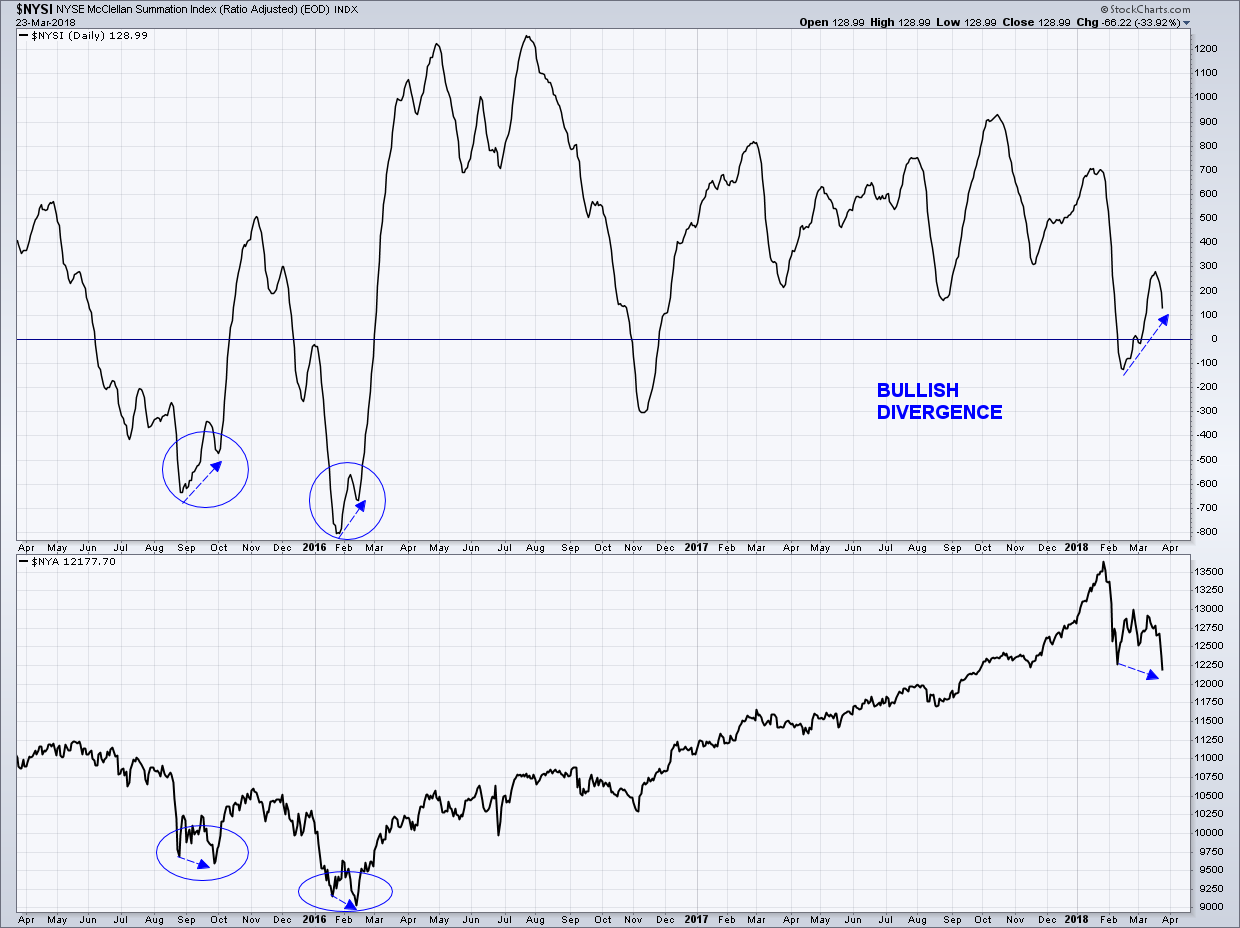

Bullish divergence on the NYSE McClellan Summation Index (breadth indicator) as well.

Based on historical price action and the many bullish divergences with respect to market breadth, as well as overall breadth, the weight of the evidence suggests this is just nasty corrective action within an ongoing bull market. There are a couple areas I would use to increase equity exposure and they are the intraday low at 2,533, as well as the measured move target of the ABC decline at 2,460 region.

IF we get into the 2400’s and do not see a quick recovery back above 2,533 (false breakdown) then I would be concerned. I have been recommending some downside hedging in my weekly letters and I would unwind most of it if we see weakness early next week.

Feel free to reach out to me at arbetermark@gmail.com for inquiries about my newsletter “On The Mark”. Thanks for reading.

Twitter: @MarkArbeter

The author does not have a position in mentioned securities at the time of publication. Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.