2022 has been one highlighted by fear, volatility, and more fear.

Despite much of the rhetoric, the companies that make up the market continue to perform fundamentally well in aggregate. As of today, sales expectations for 2022 are expected to reach +10%.

Some would suggest this is inflation induced, however one should also account for the revenue percent loss stemming from currency. Nearly 50% of S&P 500 revenue comes from international means, therefore a meaningful impact on headline revenue figures. I comment more on that later in this article.

When looking at sector by sector, all sectors are expected to see positive growth in 2022.

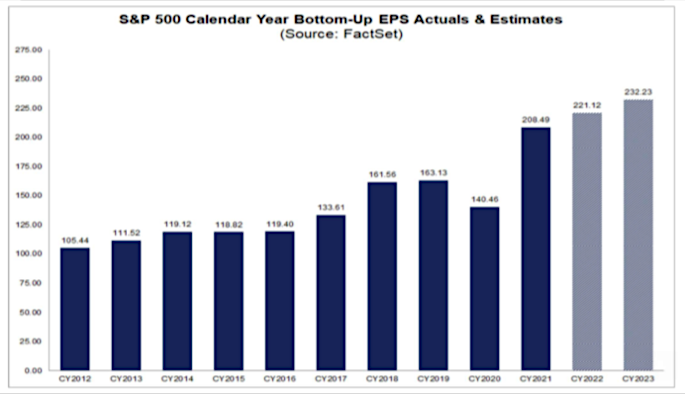

Current expectations are for another increase in sales in 2023 and mid-single-digit earnings growth. Will that come true? Only time will tell, but all the figures presented so far suggest 2022 was more around fear than reality.

Potential Implications On Asset Classes

One thing that long-term investors can do is focus on the progress (or lack of) your portfolio companies are making. Ultimately, I invest in companies, not stocks, and as history has proven, a stock eventually reflects the fundamental value of the underlying asset.

Now 2023 will be interesting from a standpoint of currency. All that currency loss throughout 2022 will possibly come back to revenues. In many cases, currency was a negative 3 to 7 percent of revenue headwind. If deflationary forces continue and the currency becomes a tailwind, we could see a continuation of a healthy consumer and some 2023 surprises.

Twitter: @_SeanDavid

The author or his firm may have positions in mentioned securities at the time of publication. Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.