Broker Dealer Index

Beyond the deterioration in breadth as measured by individual stock or industry group trends, the market has also suffered from a lack of leadership.

Neither the Broker/Dealer Index nor the Dow Transports confirmed the news highs in the broader indexes and both are now in negative territory on a year-to-date basis. On an absolute basis, the Broker/Dealer index is now approaching significant support levels. Holding these and gaining strength relative to the S&P 500 would be a step in the right direction.

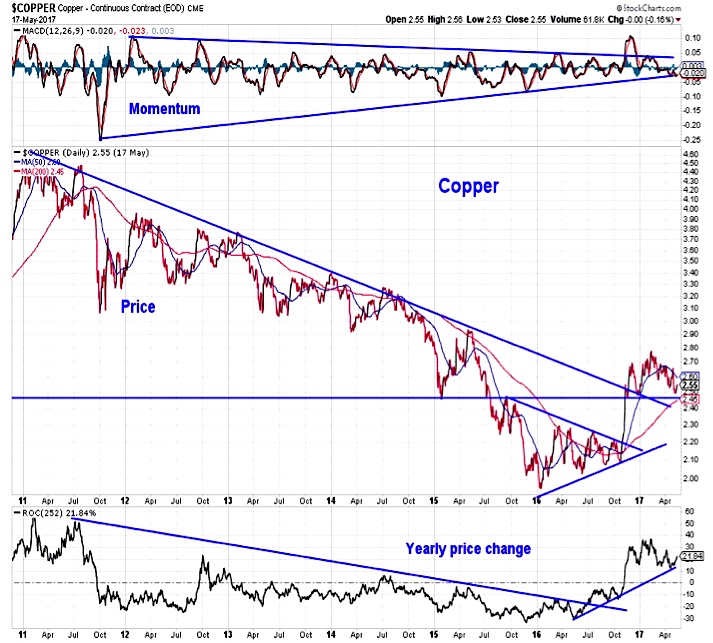

Copper

Beyond gut-level reactions to political headlines, there is some concern that stocks rallied on the hope of improving economic conditions that are now proving to be fleeting. Copper and bonds seem to be taking opposite sides of this argument.

While copper has not built on its late-2016 surge in price, it has held support following the break-out above a long-term downtrend. The yearly price change is still trending higher. If the economy is indeed improving, the consolidation in copper could soon resolve higher.

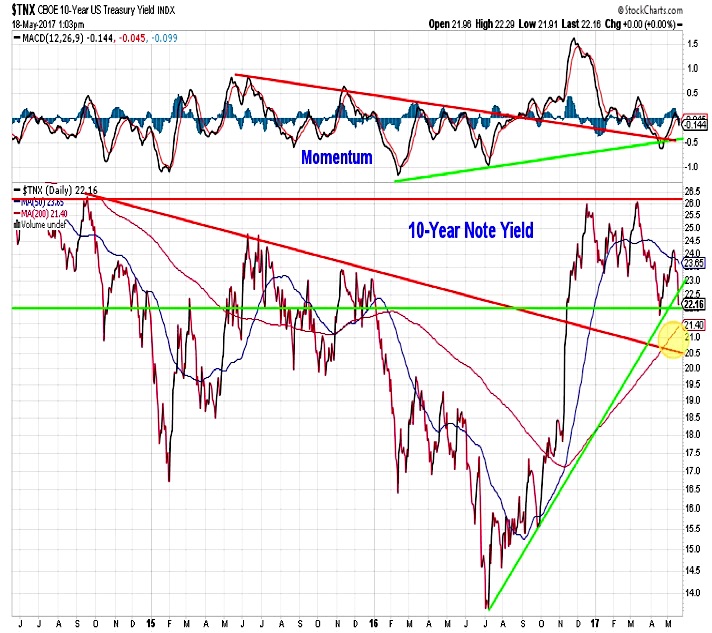

10 Year Treasury Bond Yields

Bond yields have struggled to hold on to support, suggesting that bond investors do not have confidence that the economy has turned a corner. While the 2.2% level on the 10-year T-Note yield remains important, heightened political uncertainties could push yields lower, perhaps toward 2.0%. If economic data improves as we move toward mid-year, this could leave yields vulnerable to a quick upside reversal, pressuring bond investors.

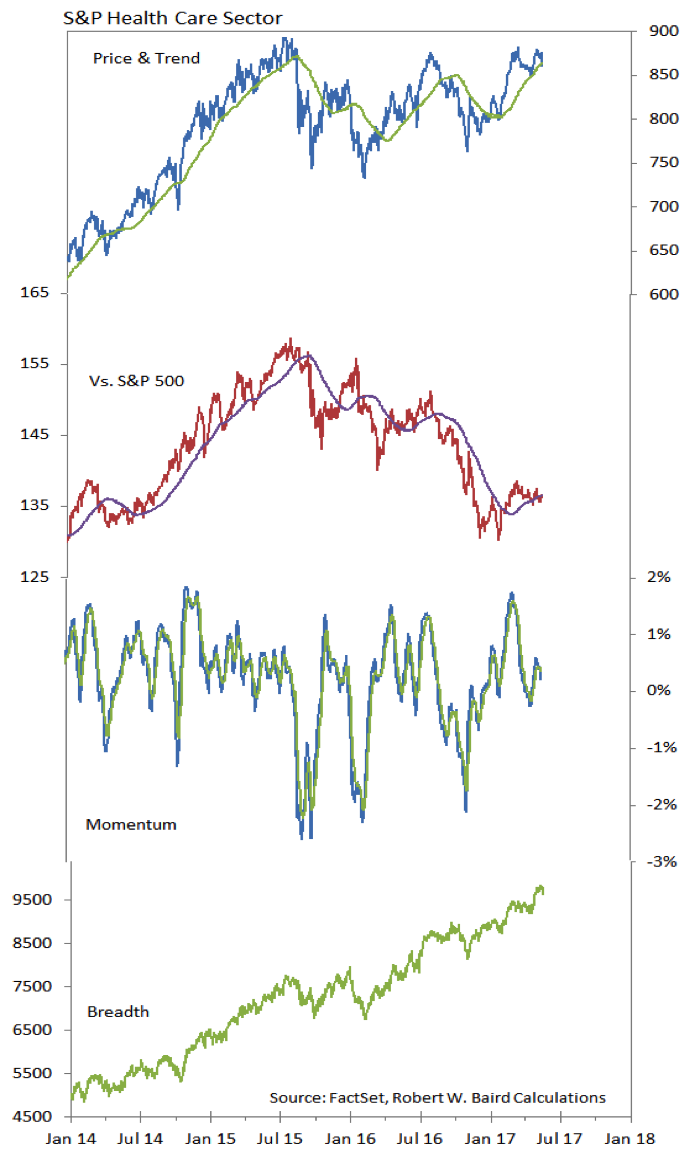

S&P Health Care Sector

The Health Care sector continues to hold up well on an absolute price basis, challenging it highs. Breadth remains robust. The relative price trend, however, has been slower to improve. To some extent, the sector has benefitted from a market that has been improving overall. The sector does appear to have made a relative price low earlier this year and momentum surged as the sector enjoyed a brief period of leadership. The longer-term relative price trend remains lower.

Thanks for reading.

Twitter: @WillieDelwiche

Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.