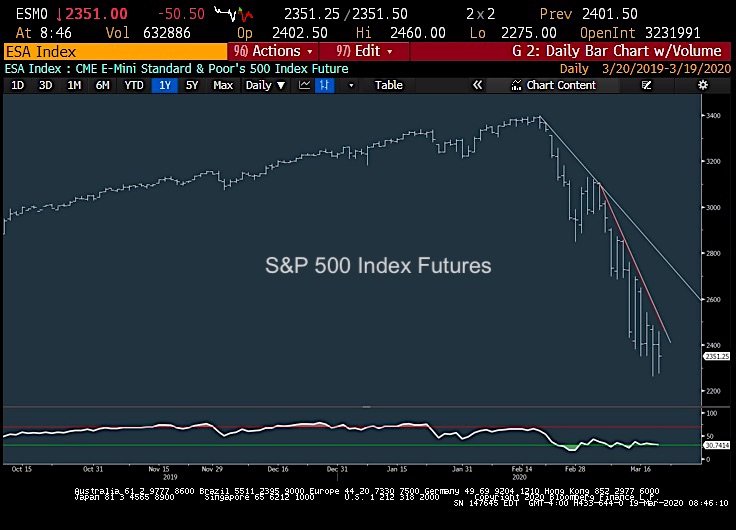

S&P 500 Index Trading Outlook (3-5 Days): Bearish, but lows should be right around the corner and could initially materialize between Friday and Monday of next week.

For now, there hasn’t been sufficient strength to turn bullish. The pattern has been choppy and more indicative of a 4th wave triangle.

Given that counter-trend exhaustion remains 3-5 days away, and near-term patterns resemble triangle consolidations, one should continue to hedge longs and not accumulate too many longs until evidence of this March downtrend being broken is in place.

Downside should contain pullbacks at 2260 and below near 2207-10, or 2163-5, while movement over 2454-6 would allow for a likely push to the 2700 area.

Price trends have stabilized only briefly, but remain trending sharply downwards, and cannot be bullish without further proof.

Overall, I’m on the lookout for lows in stocks starting Friday-next Monday as a trade.

It’s right to start to add oversold stock longs, while keeping hedges on until some structural improvement occurs.

Technicals have advocated being defensive, but lows should finally be around the corner based on cycles, structure, to add to our current oversold conditions and bearish sentiment. I am inclined to start off “small” with stocks I like until at least some evidence of a reversal day.

If markets can make a larger than average bounce starting in the days ahead, it’s necessary to watch carefully for what participates, along with breadth and volume. Wave structure should allow for a bounce but then one can’t rule out a stalling out and movement back to new lows to complete the 5-wave decline from February. For now, we look to be getting closer… finally.

If you have an interest in seeing timely intra-day market updates on my private twitter feed, please follow @NewtonAdvisors. Also, feel free to send me an email at info@newtonadvisor.com regarding how my Technical work can add alpha to your portfolio management process.

Twitter: @MarkNewtonCMT

Author has positions in mentioned securities at the time of publication. Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.