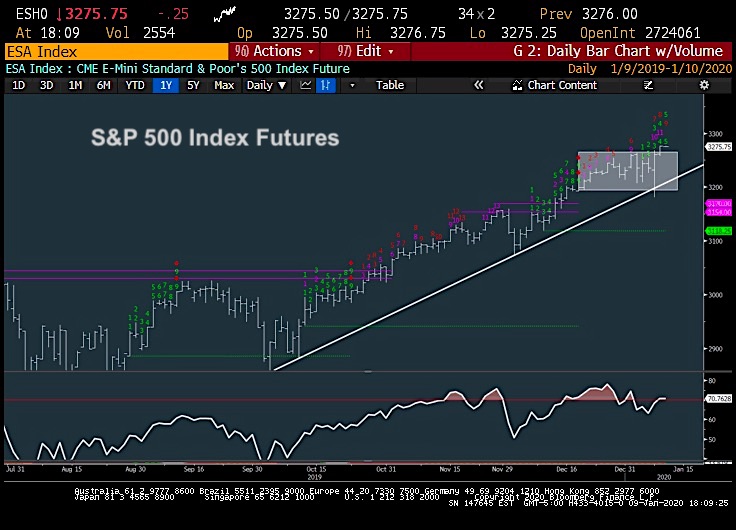

S&P 500 Index Trading Outlook (3-5 Days): Limited upside to 3283, possibly 3293

Expecting a reversal to occur Friday or perhaps early next week.

Trends remain bullish but stretched and momentum is not following suit.

The S&P 500 is up nearly 100 points over a couple of days and warrants selling/hedging this move into the key cycle date of 1/10-1/13 in my opinion.

Let’s discuss the chart of S&P 500 futures in more detail.

S&P 500 Index Futures Chart Analysis

The S&P 500 Index is bullish, yet extended. Price has managed to push back up above the January 2 highs and is well positioned to test 3283-5 if not 3292-3 before stalling out and turning back down.

The next reversal could product the first major selloff since October lows.

Prices have grown overbought, yet momentum is not following suit. Counter-trend exhaustion looks to be 2-3 days away before this comes together to give some evidence of exhaustion on this push higher. Overall, trends remain bullish and have grown more so with the move back over the highs from early January. Yet, challenges remain and should result in this stalling out into early next week before turning back down.

The extent of this rally has clearly reached blow-off proportions where nothing really matters anymore. When one takes a second to look around at the very real issues (which I rarely comment on) it’s important just to see the extent that this stock rally has continued without paying much attention.

We recently learned that Trump said “Phase 2” of the Trade Deal might not occur until after the Election. So while having Chinese delegates here next week to sign Phase 1 is truly important and a positive sign of initial confirmation, it’s discomforting that many of the key issues, yet again, are being postponed and pushed to the wayside. Additionally, reports of the Boeing plane being potentially shot down were also treated with not much concern vs this being a mechanical failure.

If you have an interest in seeing timely intra-day market updates on my private twitter feed, please follow @NewtonAdvisors. Also, feel free to send me an email at info@newtonadvisor.com regarding how my Technical work can add alpha to your portfolio management process.

Twitter: @MarkNewtonCMT

Author has positions in mentioned securities at the time of publication. Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.