Broad Stock Market Futures Outlook for May 22, 2018

Traders faded into the gaps as expected yesterday before bouncing and are now testing resistance regions ahead. Sellers have been holding the line from advancing.

Though the charts are bullish, it is better to look for a hold of support to enter rather than breach of resistance as this expands the size of your stop.

S&P 500 Futures

Sitting at resistance, a likely drift back to higher support is ahead- If we test 2740, it would seem that buyers moved sellers out of the way and traders would be able to now test the targets above near 2754 and higher. This remains suspect right now with weak pushes upward showing. Watch those edges. The bullets below represent the likely shift of trading momentum at the successful or failed retests at the levels noted.

- Buying pressure intraday will likely strengthen with a bullish retest of 2739.75

- Selling pressure intraday will likely strengthen with a bearish retest of 2730.5

- Resistance sits near 2739. to 2743.75, with 2749.75 and 2754.5 above that.

- Support sits between 2727.5 and 2724.5, with 2719.5 and 2713.75

NASDAQ Futures

Ranges are steady as traders battle at familiar resistance – With the majority of the gap fill behind us, traders are holding higher lows this morning. As with days prior, pullbacks will be buying opportunities for the patient and cautious trader. The bullets below represent the likely shift of trading momentum at the successful or failed retests at the levels noted.

- Buying pressure intraday will likely strengthen with a bullish retest of 6946.75

- Selling pressure intraday will likely strengthen with a bearish retest of 6935.5

- Resistance sits near 6952.25 to 6962.5 with 6976.5 and 6989.25 above that.

- Support sits between 6928.75 and 6920.5, with 6906.75 and 6884.5 below that.

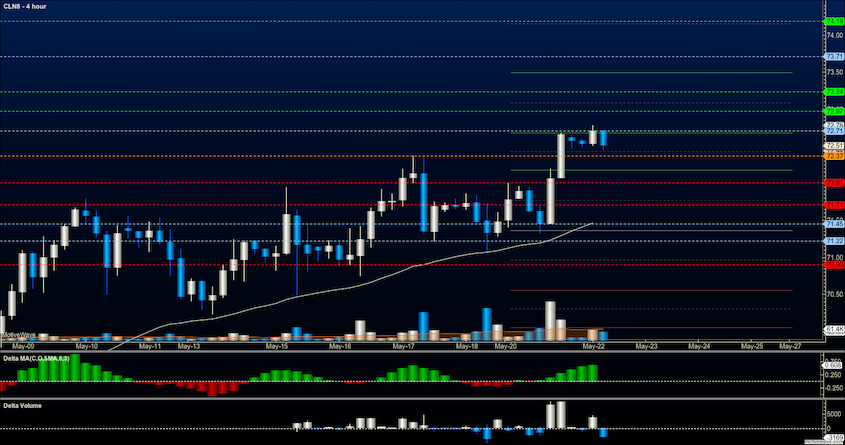

WTI Crude Oil

We hit our target of 72.77 overnight and have held sideways since then. Bullish behavior is expected as the undercurrent of motion presses forward still. Measured moves show a potential target above 80. Fuel prices are accelerating sharply as hedge funds pile into distillates. Pullbacks will remain buying opportunities for now. The bullets below represent the likely shift of trading momentum at the successful or failed retests at the levels noted.

- Buying pressure intraday will likely strengthen with a bullish retest of 72.71

- Selling pressure intraday will strengthen with a bearish retest of 72.35

- Resistance sits near 72.97 to 73.24, with 73.71 and 74.2 above that.

- Support holds near 72.2 to 72.01, with 71.78 and 71.22 below that.

Twitter: @AnneMarieTrades

The author trades stock market futures every day and may have a position in mentioned securities at the time of publication. Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.