Broad Stock Market Futures Outlook for June 7, 2018

Breaches continue as we move above strong resistance in the indices that will need retesting for strength to hold.

Buyers are clearly in charge but pullbacks could be quite deep under these divergences so even as we press higher buying the breakouts will increase risk thresholds. Continue to be patient when choosing your trading directions- particularly if you are an intraday trader.

S&P 500 Futures

Resistance levels breached again as bullish price action holds under negative divergence that holds steady. Fades will be buying opportunities as in days pass but the longer the divergence holds through the range expansion, the stronger the fades are likely to be. Be cautious in your approach with these crosscurrents. The bullets below represent the likely shift of trading momentum at the successful or failed retests at the levels noted.

- Buying pressure intraday will likely strengthen with a bullish retest of 2777.50

- Selling pressure intraday will likely strengthen with a bearish retest of 2770.5

- Resistance sits near 2776.5 to 2779.75, with 2784.75 and 2792.75 above that.

- Support sits between 2767.25 and 2762.75, with 2758.25 and 2742.5

NASDAQ Futures

New highs in tech in the early morning show up. Holding higher support, price acceptance sits at 7192 this morning. Formations remain generally bullish but divergent, making pullbacks excellent opportunities for entry- this has been the backdrop of trading for the entire week. Divergent action still tells us not to buy highs that present themselves, but instead wait for the pullback to minimize risk. As we rise, our dips could be deep and swift if they occur as auction profiles are shallow on the way up. The bullets below represent the likely shift of trading momentum at the successful or failed retests at the levels noted.

- Buying pressure intraday will likely strengthen with a bullish retest of 7224.25

- Selling pressure intraday will likely strengthen with a bearish retest of 7192.5

- Resistance sits near 7223.75 to 7234.25 with 7251.25 and 7271.5 above that,

- Support sits between 7195.5 and 7184.5, with 7174.75 and 7142.75 below that.

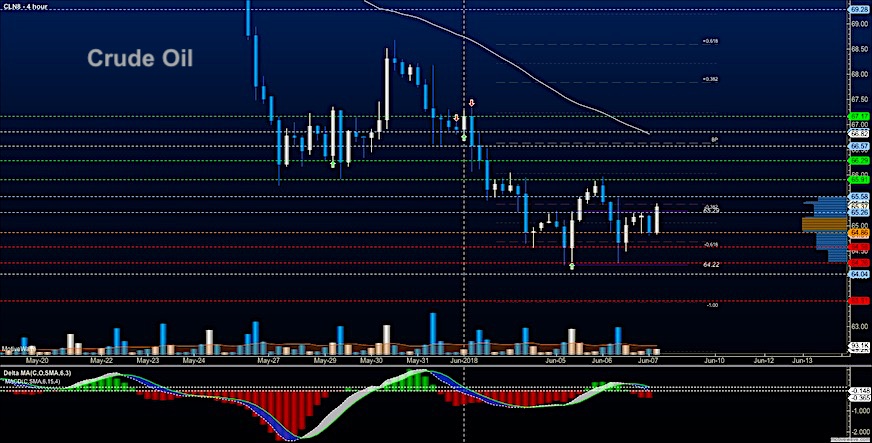

WTI Crude Oil

Oil traders remain range bound as buyers hold a floor at support near 65. The EIA reported a build and OPEC is still considering more output as sanctions in Iran loom. Our levels have been essentially fixed all week so watch for the breakouts or breakdowns to cascade. Bounces to resistance seem likely to me at this time. The bullets below represent the likely shift of trading momentum at the successful or failed retests at the levels noted.

- Buying pressure intraday will likely strengthen with a bullish retest of 65.59

- Selling pressure intraday will strengthen with a bearish retest of 64.83

- Resistance sits near 65.48 to 65.64, with 65.96 and 66.29 above that.

- Support holds near 65.04 to 64.72, with 64.26 and 64.07 below that.

Twitter: @AnneMarieTrades

The author trades stock market futures every day and may have a position in mentioned securities at the time of publication. Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.