Broad Stock Market Futures Outlook for June 8, 2018

A potential fade is in progress and today’s behavior will shed light on its continuation in the ES_F. Buyers have failed to breach a significant resistance level and hold.

If we break yesterday’s low, we’ll drift into levels of support below. The NQ_F is doing this now. Long trades in the current intraday space will be against the trend until we breach yesterday’s highs.

S&P 500 Futures

Resistance levels fail to hold as support as negative divergence finally weighs in on price action. As mentioned yesterday, the longer the divergence holds through the range expansion, the stronger the fades are likely to be. Stand aside if you are looking for the bounces as we are in the process of a likely fade to deeper supports UNLESS we breach 2777. The bullets below represent the likely shift of trading momentum at the successful or failed retests at the levels noted.

- Buying pressure intraday will likely strengthen with a bullish retest of 2777.50

- Selling pressure intraday will likely strengthen with a bearish retest of 2759.5

- Resistance sits near 2774.5 to 2778.75, with 2784.75 and 2792.75 above that

- Support sits between 2761.25 and 2755.75, with 2751.25 and 2742.5

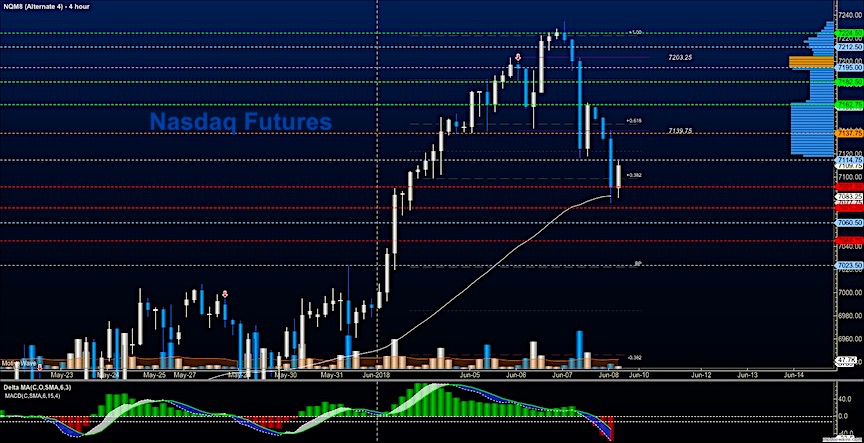

NASDAQ Futures

After new highs yesterday, the buyers could not hold the tide against sellers waiting. The loss of 7192 sent sellers into the front of power and we are back at support for early in the week at 7101. Formations remain generally bullish on larger time frames so deep dips will be buying opportunities. The failure to breach 7147 will keep sellers in power for now. The bullets below represent the likely shift of trading momentum at the successful or failed retests at the levels noted.

- Buying pressure intraday will likely strengthen with a bullish retest of 7147.5

- Selling pressure intraday will likely strengthen with a bearish retest of 7127.5

- Resistance sits near 7137.75 to 7159.25 with 7176.25 and 7184.5 above that.

- Support sits between 7131.5 and 7102.5, with 7087.75 and 7065.75 below that.

WTI Crude Oil

Traders are continuing a bottoming formation and holding support near 65. we broke out of the range yesterday breaching 65.59 but failed to reach our target at 66.29 verifying yesterday’s comment that bounces were resistance and selling zones into the region. We should hold the fades into the 65.1 region if we are to have another press forward. The bullets below represent the likely shift of trading momentum at the successful or failed retests at the levels noted.

- Buying pressure intraday will likely strengthen with a bullish retest of 65.97

- Selling pressure intraday will strengthen with a bearish retest of 65.1

- Resistance sits near 65.96 to 66.23, with 66.47 and 66.87 above that.

- Support holds near 65.17 to 64.94, with 64.47 and 64.15 below that.

You can learn more about trading and our memberships HERE.

Twitter: @AnneMarieTrades

The author trades stock market futures every day and may have a position in mentioned securities at the time of publication. Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.