Broad Stock Market Futures Trading Overview For March 13

Stocks are making another rally attempt for the second day in a row. They were rejected yesterday… will resistance hold again today? 2801-2805 is the first important resistance area. Let’s see what happens there.

The price levels below highlight key support and resistance levels and how to use them.

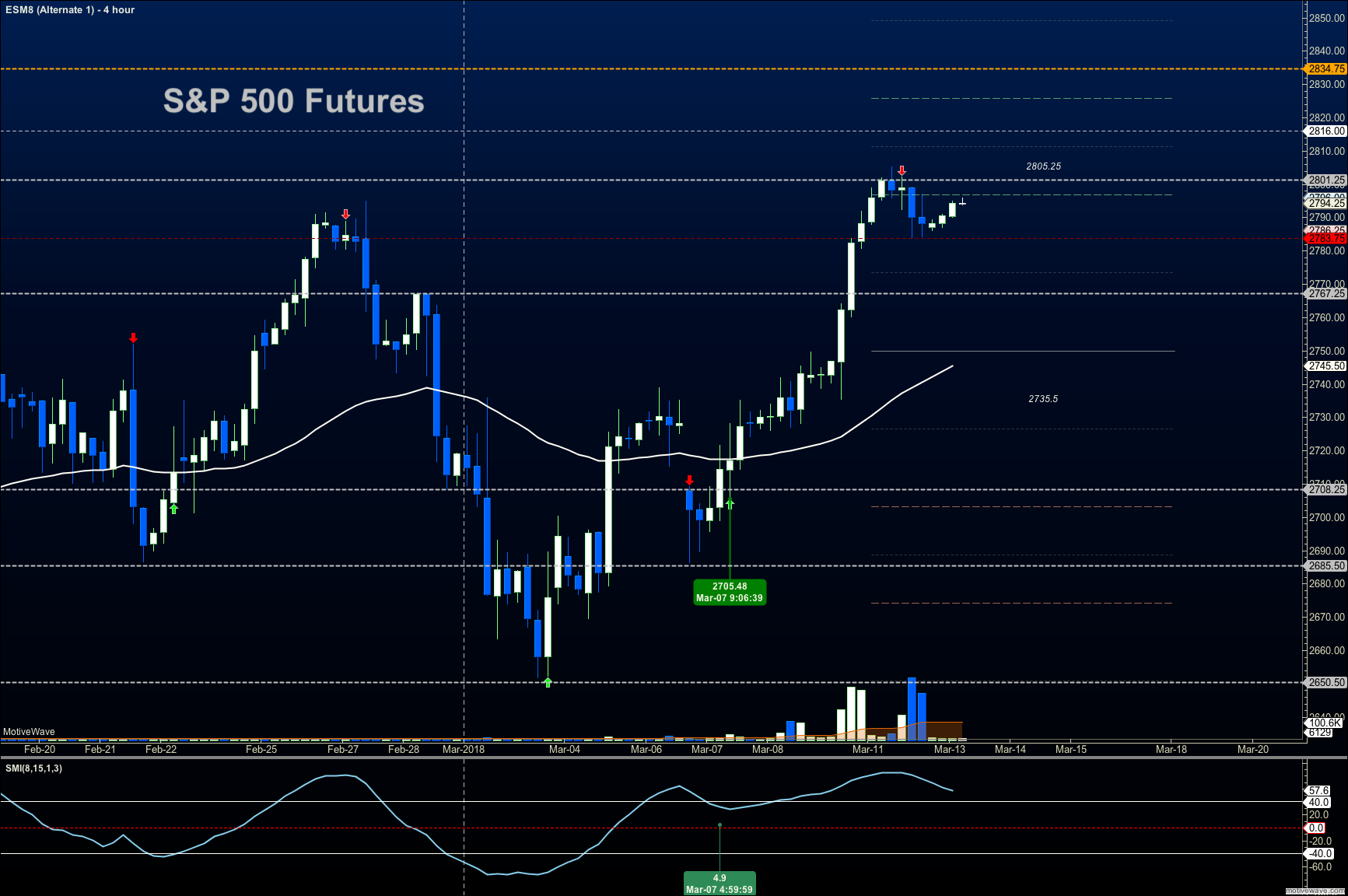

S&P 500 Futures

Resistance sits near 2805.5 for a second day- above that, we see 2814.5 and 2834 as targets. Failure to hold above 2784.75 gives sellers a chance to move into 2774, but this seems unlikely with all the buying pressure afoot (without a news catalyst of some sort, that is). Watch for a potential failed retest of 2801. The bullets below represent the likely shift of trading momentum at the positive or failed retests at the levels noted.

- Buying pressure intraday will likely strengthen with a bullish retest of 2802.75

- Selling pressure intraday will likely strengthen with a bearish retest of 2791.5

- Resistance sits near 2801.75 to 2812.5, with 2820.75 and 2834.75 above that.

- Support sits between 2795.5 and 2784.75, with 2774.25 and 2767.5.

NASDAQ Futures

Resistance sits near 7185 this morning as the strength of the NQ_F holds. Semiconductor interests are driving this one higher. Momentum is still quite bullish and pullbacks will be buy zones for the traders, even as we remain extended. A failure to breacher higher will tell us that we have stalled. Deep support looks like 7045 but traders are holding 7140 as the level to watch this morning. The bullets below represent the likely shift of intraday trading momentum at the positive or failed tests at the levels noted.

- Buying pressure intraday will likely strengthen with a bullish retest of 7185.5

- Selling pressure intraday will likely strengthen with a bearish retest of 7140.25

- Resistance sits near 7174.75 to 7185.5 with 7235.5 and 7256.5 above that.

- Support sits between 7141.5 and 7124.75, with 7104.5 and 7060.75 below that.

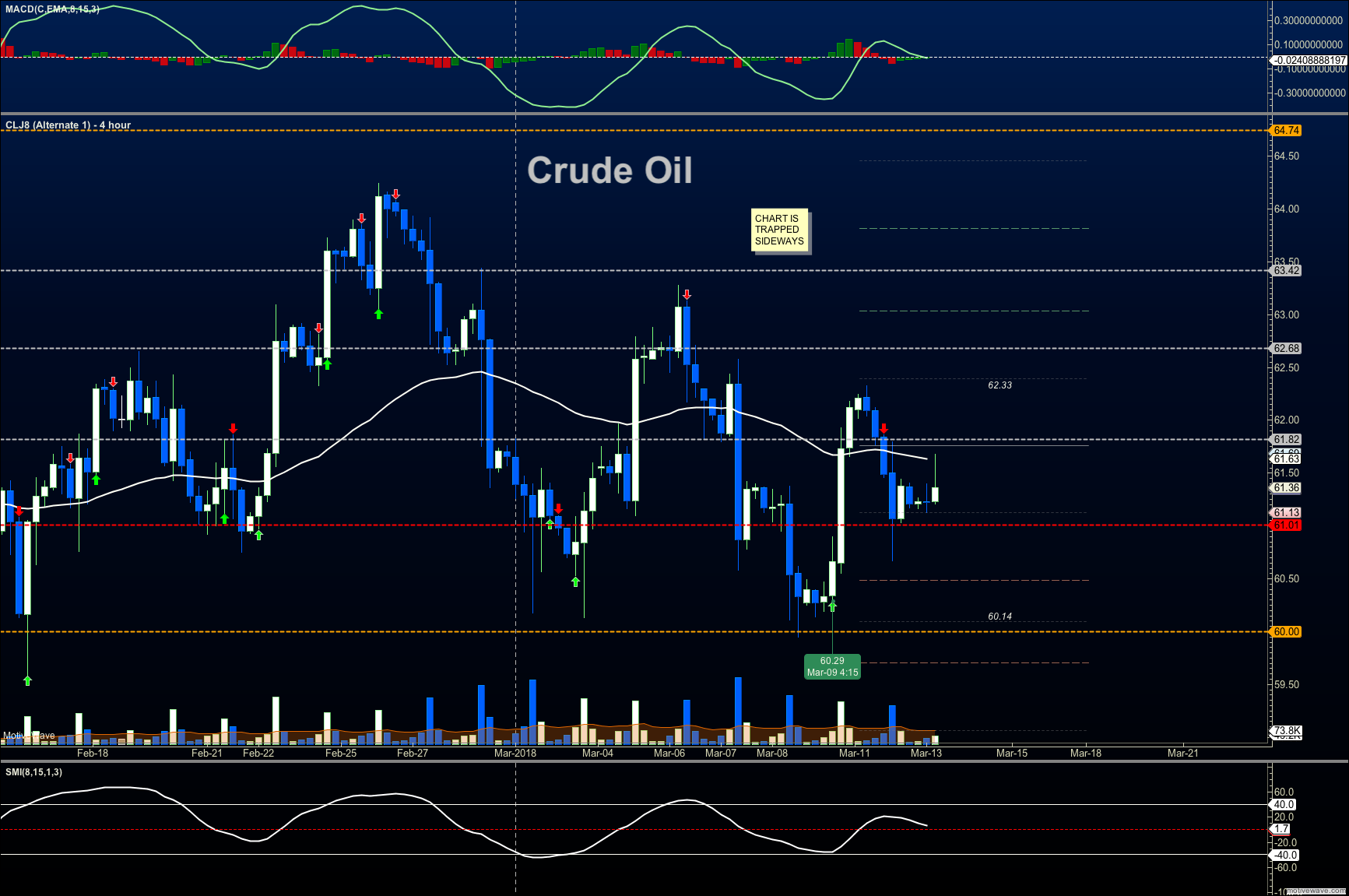

WTI Crude Oil

Traders remain rangebound in a rebalance of weight – big traders are trimming their bullish stance a bit as we continue this drift into support. The bullets below represent the likely shift of intraday trading momentum at the positive or failed tests at the levels noted.

- Buying pressure intraday will likely strengthen with a bullish retest of 62.2

- Selling pressure intraday will strengthen with a bearish retest of 61.1

- Resistance sits near 61.87 to 62.14, with 62.86 and 63.35 above that.

- Support holds near 61.01 to 60.65, with 60.21 and 59.58 below that.

Twitter: @AnneMarieTrades

The author trades stock market futures every day and may have a position in mentioned securities at the time of publication. Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.