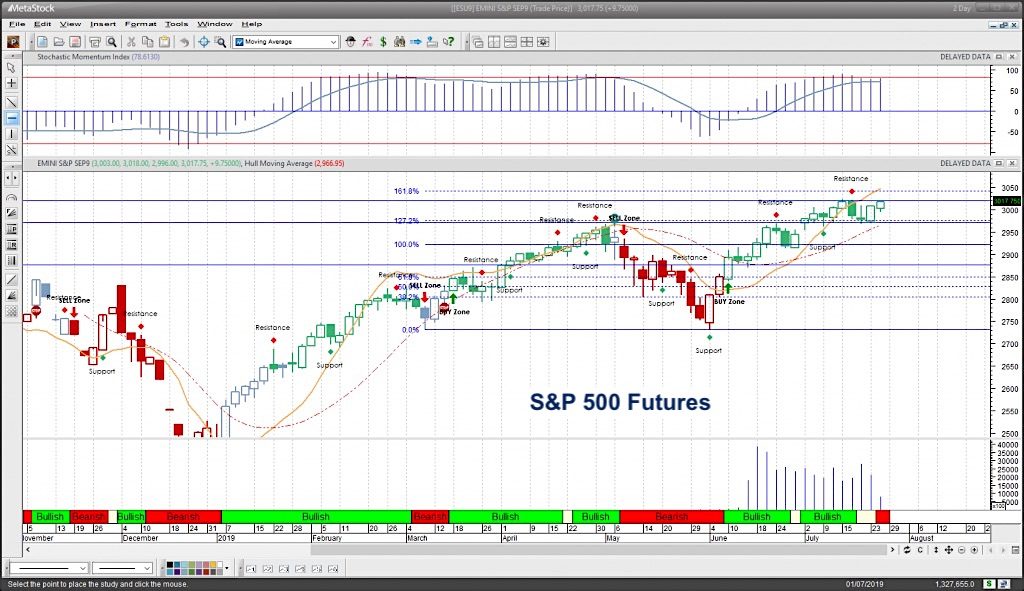

S&P 500 Futures Trading Chart – July 25 Analysis

Sideways motion on the S&P 500 Index (INDEXSP: .INX) broke one week before the Federal Reserve release, shifting the motion into positive gear but under very limited volume.

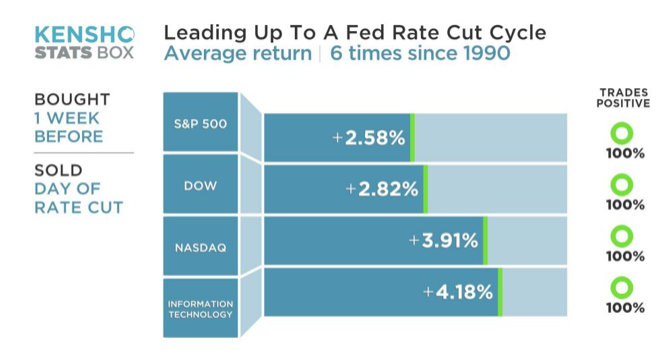

Here’s an interesting statistic I saw:

The lower highs I expected have been replaced by new highs everywhere except the Dow Industrials. The laggard may simply be a good space to get involved if we participate in the upward swing.

With several days over 3016 (S&P 500 Index), we may develop complacency into a fade but very interesting days ahead.

Divergence still exists – and new levels of note we are on watch – 3034, 3016, 2993, and 2974. The break below 2992 will signal that further dips if the bounce fails and then continuing to 2974 brings 2761 to view.

Gold holds higher lows and in ping pong fashion is again back above breakout territory of 1422- barely. Bitcoin and cryptos are under pressure – likely from general unrest in the space and all the big tech under pressure as well as a likelihood of a dollar bounce. The overnight session gives us a BIG dollar bounce but below the breakout zone of 98.55. Oil continues to hold 56 and bounce -but cannot seem to breach and hold 57 for now

THE BIG PICTURE – Daily momentum is mixed and neutral to positive and with some divergence. The breach and hold of support areas near 3026 will need to be hold if we are to move further out of the range. Bouncing off 3017-3018 will be bullish. Below 3014, we’ll see sellers try to pounce but there should be no foothold they garner.

INTRADAY RECAP – Neutral as traders hold support above and bounce off 3014 but fail to breach 3028. Watching the support levels near3014 and 3004 in the ES_F are on my radar today below, and 3034 to 3044 above.

Divergent action still sits below the movement of price on both sides of the trades – long and short – but traders are still looking at deep support edges to bounce.

METASTOCK UPDATE -SHORT STOPS OUT-which is why we enter at resistance. We are breaking out prior to the Fed release and this gives us a likely zone for short term upside to close shortly into the actual release and potentially a movedownward Here’s a link to the METASTOCK software

Twitter: @AnneMarieTrades

The author trades stock market futures every day and may have a position in mentioned securities at the time of publication. Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.