Stock Market Futures Considerations For April 26, 2017

Bullish but tired would be my estimation of the price action here as the S&P 500 (INDEXSP:.INX) continues to press forward on shallow pullbacks. This should also be the order of the day.

Check out today’s economic calendar with a full rundown of releases. And note that the charts below are from our premium service at The Trading Book and are shared exclusively with See It Market readers.

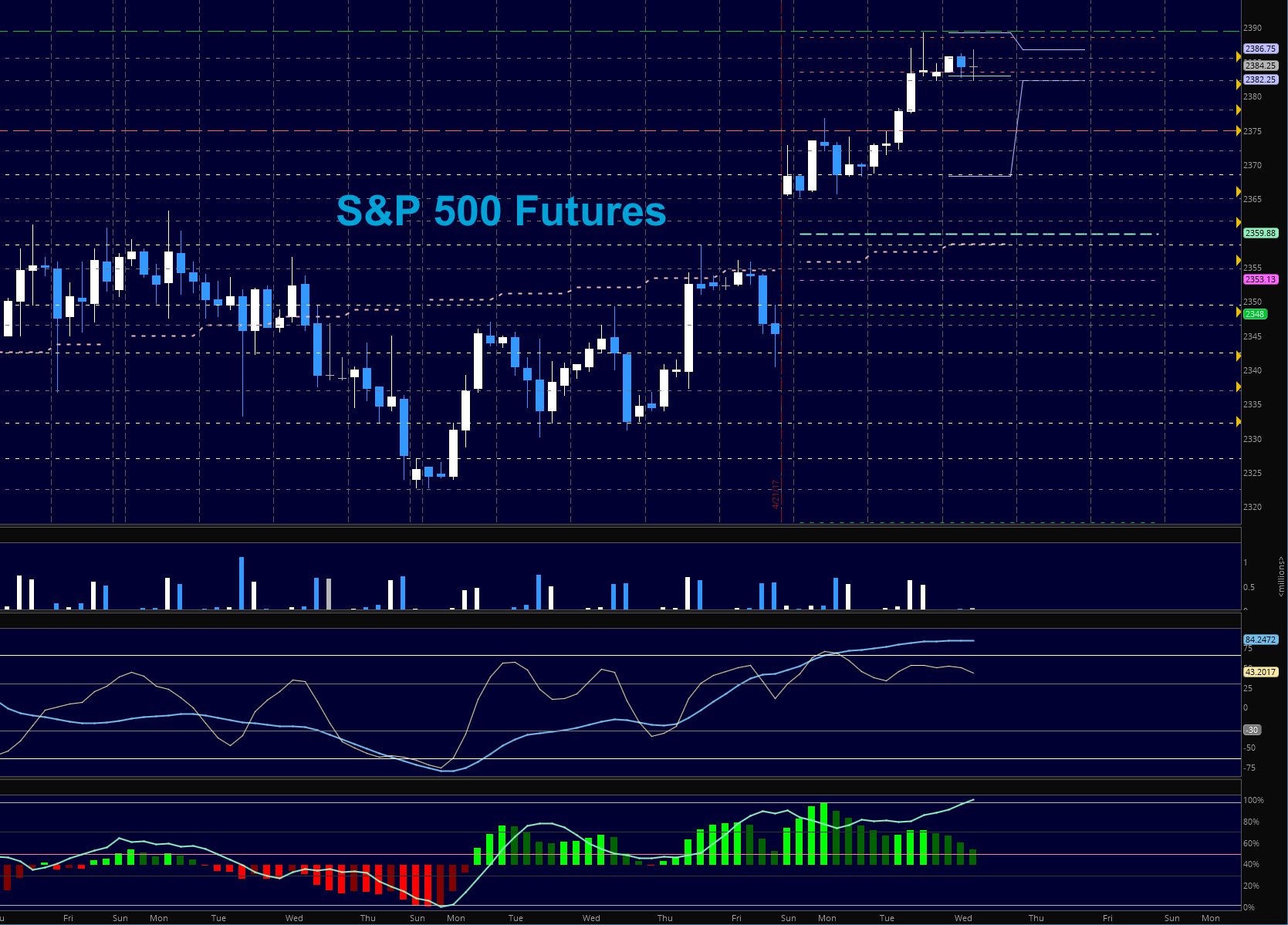

S&P 500 Futures (ES)

Buyers will be waiting at value areas to participate, but we should see some price chasing up here potentially into 2390 and 2394. Watch for failed retests with negative divergence to consider shorts into support levels (which continue to hold higher). We are currently range bound (speaking from an intraday perspective) – 2381 support and 2387 resistance.

- Buying pressure intraday will likely strengthen above a positive retest of 2387 (careful here as sellers will try to push them down)

- Selling pressure intraday will likely strengthen with a failed retest of 2380.5

- Resistance sits near 2387 to 2390.25, with 2392.25 and 2394.75 above that

- Support holds between 2380.5 and 2377.5, with 2374.75 and 2365.5 below that

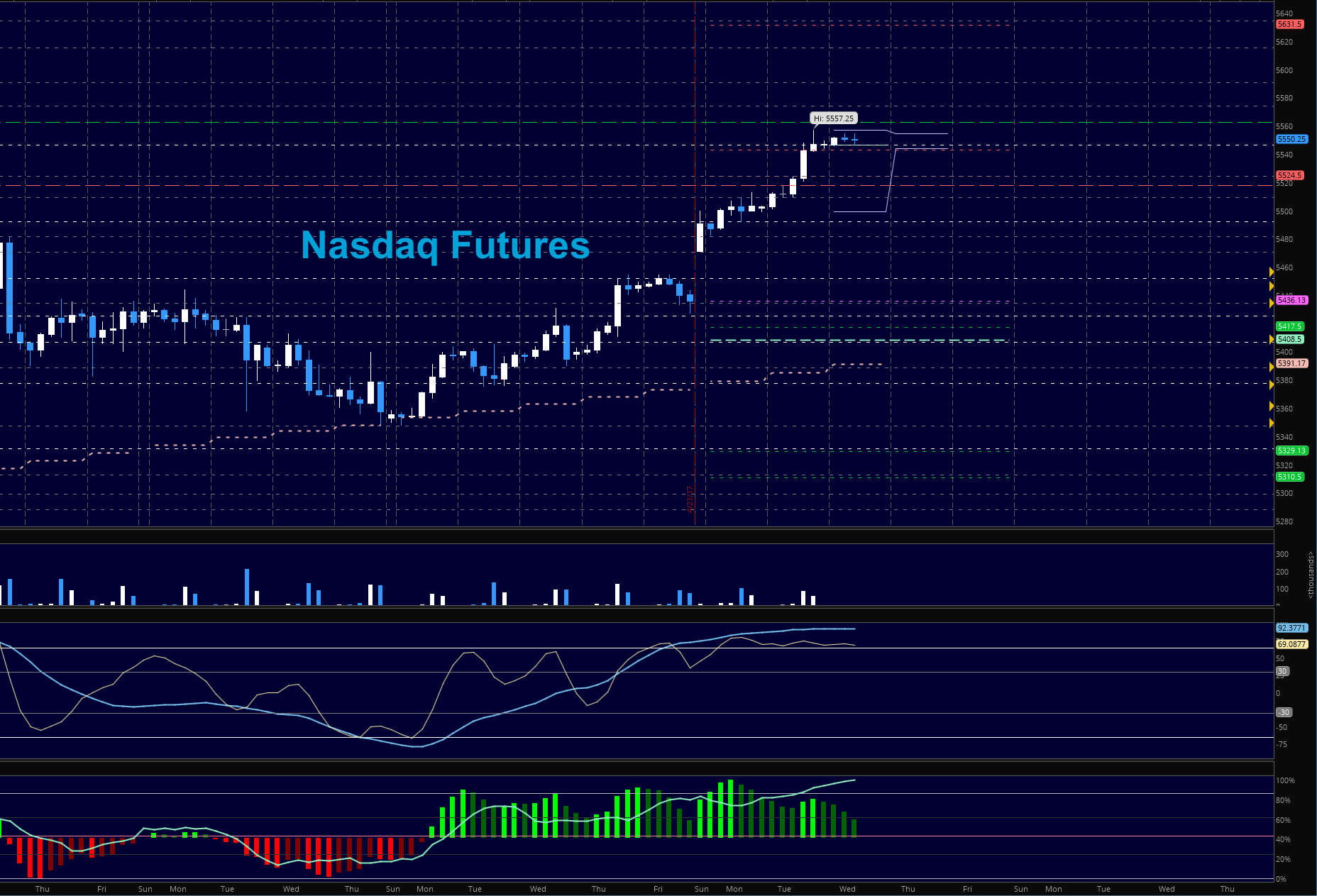

NASDAQ Futures (NQ)

Upward momentum and continuing to break to new highs continue in the NQ_F, and though momentum continues to drift a bit lower, buyers are holding new support as demand continues to press us forward. Pullbacks will continue to find buying support as long as we hold 5524. Below that, we are likely to retest 5492 as support. We went well past projection levels yesterday, so as buying power continues, we’ll continue with the northern press as long as support levels remain higher intraday. Intraday momentum continues bullish.

- Buying pressure intraday will likely strengthen with a positive retest of 5557.75 – watch your size

- Selling pressure intraday will likely strengthen with a failed retest of 5524.5

- Resistance sits near 5557.75 to 5562.5, with 5574 and 5590.5 above that

- Support holds between 5492.25 and 5483.25, with 5470.75 and 5462.25 below that

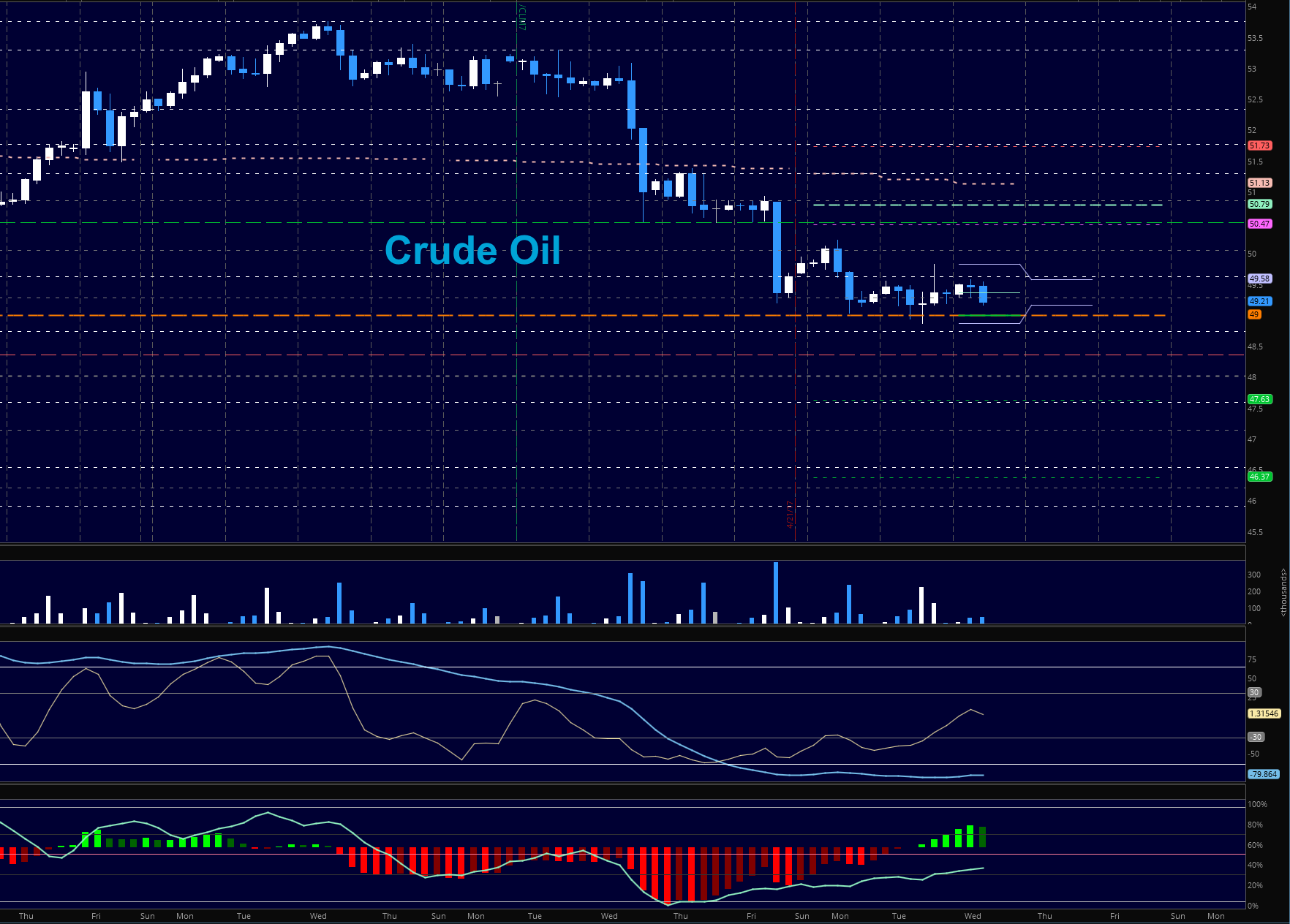

Crude Oil –WTI

Bearish behavior continues in the WTI into the EIA report today. Funds continue to trim longs from the latest Reuters reports. Failure to hold 49.12 will bring a new group of sellers ready to move price into deeper support. Lower lows and lower highs continue in general for now as traders try to find real support but the lack of buying support above 49.5 seems to be a warning call.

- Buying pressure intraday will likely strengthen with a positive retest of 49.6

- Selling pressure intraday will strengthen with a failed retest of 49.04

- Resistance sits near 49.9 to 50.6, with 51.3 and 51.77 above that.

- Support holds between 49.12 and 48.86, with 48.46 and 48.08 below that.

Our live trading room is now primarily stock market futures content, though we do track heavily traded stocks and their likely daily trajectories as well – we begin at 9am with a morning report and likely chart movements along with trade setups for the day.

As long as the trader keeps himself aware of support and resistance levels, risk can be very adequately managed to play in either direction as bottom picking remains a behavior pattern that is developing with value buyers and speculative traders.

Twitter: @AnneMarieTrades

The author trades stock market futures every day and may have a position in mentioned securities at the time of publication. Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.