Stock Market Outlook for November 7, 2016 –

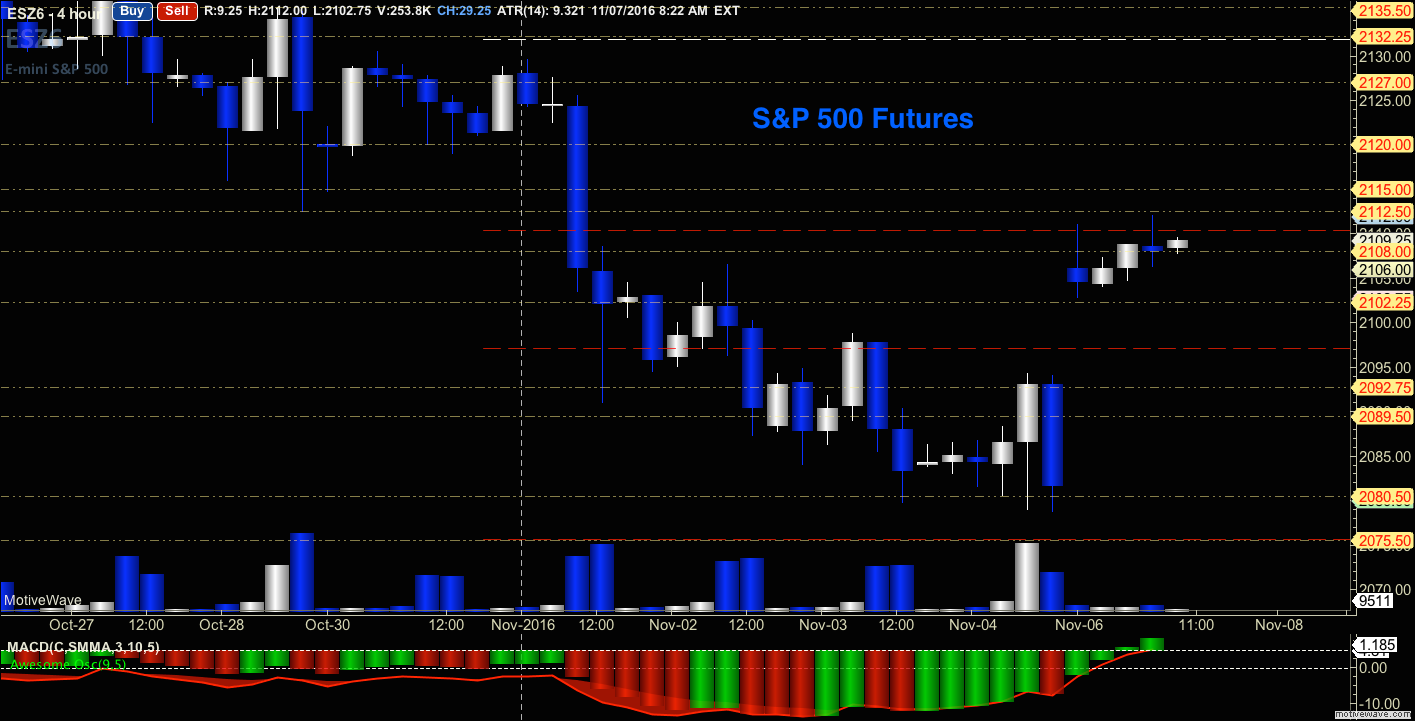

Support levels near 2084 gave us the battleground for much of Friday. The gap last night that currently holds, gives us an unusual shift in movement under damp momentum. The bounces will likely be sold at the first test as there are many trapped buyers, as they did at 2112. Looking for a higher low will give us the clue to a shift in price. We are currently above 2106, and as long as we keep above this line, we are likely to find buying opportunities. Tight congestion patterns still hold between 2122 and 2137 and will serve as upper resistance for now. Support holds in the regions near 2094.25 to 2106. A break below there forces us to consider 2087-2077 as the targets below.

See today’s economic calendar with a rundown of releases.

TODAY’S RANGE OF MOTION

S&P 500 Futures Trading Chart – November 7

Upside trades in S&P 500 futures trading – Two options –

Positive retest of continuation level -2108.50

Positive retest of support level– 2102.25

Targets ranges -2105, 25, 2108.5, 2111.75, 2115.25, 2119.25, and 2121.50.

Downside trades in S&P 500 futures trading – Two options –

Failed retest of resistance level -2111.50

Failed retest of support level– 2102

Targets ranges -2108.50, 2104.75, 2100.50, 2097.25, 2094.74, 2087.50, and 2084.50

NASDAQ FUTURES

The NQ_F has gapped up along with other charts we look into – but resistance still holds near 4740 after failing to reach this level on an early morning try. A breach there opens the retrace that should move cleanly north. Resistance levels are congested between 4754 and 4778. It seems that today’s trading will likely hold 4709 to 4695 as support. Failure to hold 4709 puts the gap fill into play.

Upside trades in Nasdaq futures trading – Two options

Positive retest of continuation level -4728.5

Positive retest of support level– 4709.5

Targets ranges – 4714.50, 4725.25, 4734.25, 4739.75, 4748.50, 4754.50, and 4762.25

Downside trades in Nasdaq futures trading – Two options

Failed retest of resistance level – 4726.75

Failed retest of support level – 4708.50

Targets ranges – 4720.25, 4715.5, 4709.25, 4704.25, 4700.25, 4695.75, 4680.50, 4674.50, and 4662.50

CRUDE OIL –WTI

WTI crude charts are also bouncing, but momentum remains quite negative. This bounce is being attributed to an OK earthquake. To change direction, we will need to see a retest of 45.2, and a hold of higher lows for us to consider. So far, we are unable to breach 45.11, but this should be where we focus today

Upside trades on Crude Oil – Two options

Positive retest of continuation level -44.94

Positive retest of support level– 44.30

Targets ranges -44.48, 44.87, 45.06, 45.32, 45.57, and 45.78

Downside trades on Crude Oil – Two options

Failed retest of resistance level -44.75

Failed retest of support level– 44.25

Targets ranges – 44.48, 44.28, 43.89, 43.45, 43.05, and 42.77.

If you’re interested in watching these trades go live, join us in the live trading room from 9am to 11:30am each trading day.

Visit TheTradingBook for more information.

If you’re interested in the live trading room, it is now primarily stock market futures content, though we do track heavily traded stocks and their likely daily trajectories as well – we begin at 9am with a morning report and likely chart movements along with trade setups for the day.

As long as the trader keeps himself aware of support and resistance levels, risk can be very adequately managed to play in either direction as bottom picking remains a behavior pattern that is developing with value buyers and speculative traders.

Twitter: @AnneMarieTrades

The author trades stock market futures every day and may have a position in mentioned securities at the time of publication. Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.