Stock Market Futures Considerations For May 4, 2017

We are creeping higher on generally positive news floating around the media today, but with NFP (Non-Farm Payrolls) out tomorrow, the S&P 500 (INDEXSP:.INX) is likely to see muted action or action that reverses itself into congestion. Traders did see some knee-jerk reactions in gold, however, and since the swings, this chart seems to be headed to deeper support.

Check out today’s economic calendar with a full rundown of releases. And note that the charts below are from our premium service at The Trading Book and are shared exclusively with See It Market readers.

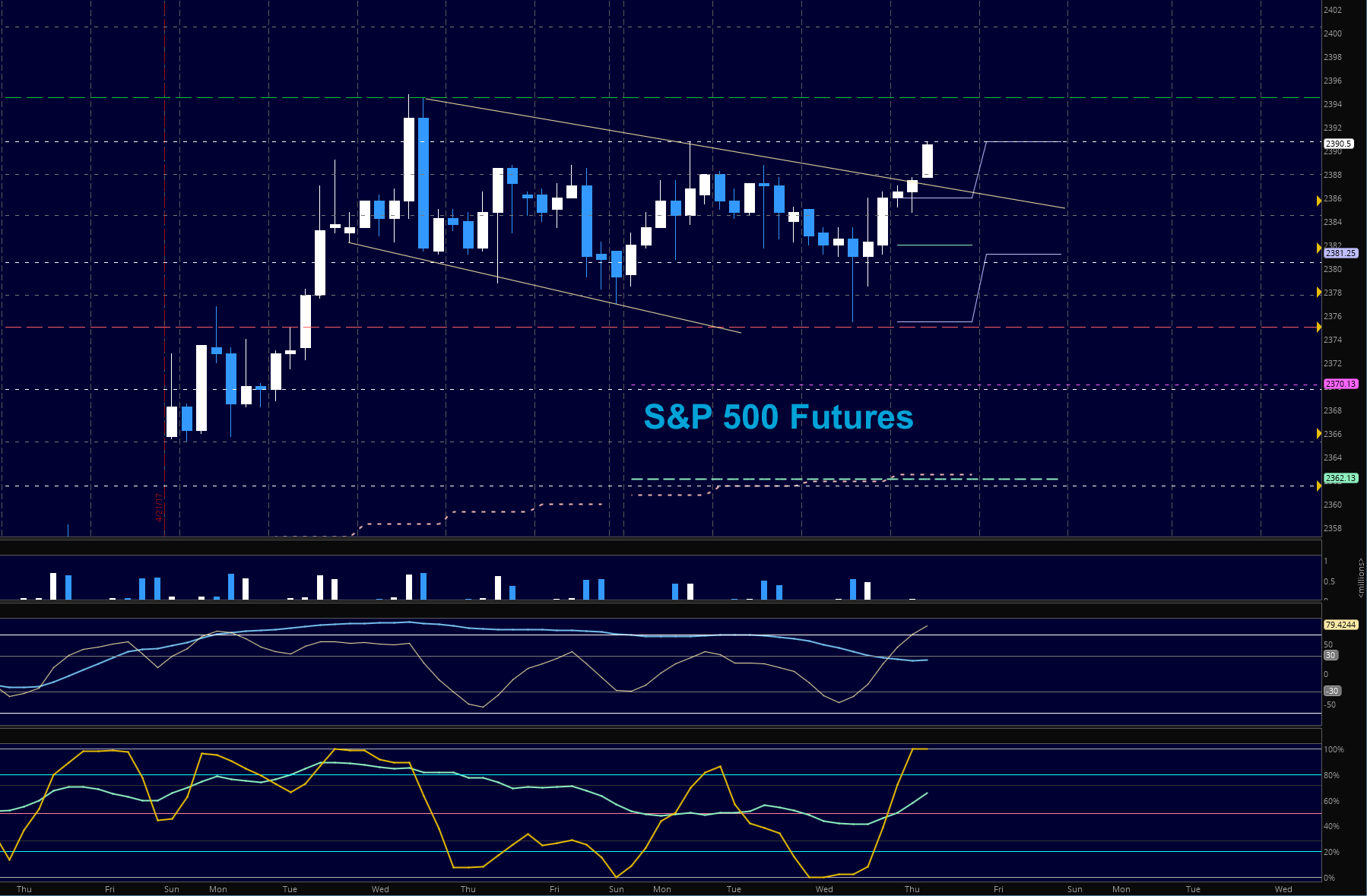

S&P 500 Futures (ES)

Sellers are camped between 2390.5 and 2392.5 with support levels near 2381 to 2375. Momentum is mixed but is bullish overall. Price action is still very congested. The bullets below represent the likely shift of trading momentum at the positive or failed tests at the levels noted.

- Buying pressure intraday will likely strengthen above a positive retest of 2390.5 (bull flag in progress)

- Selling pressure intraday will likely strengthen with a failed retest of 2384.25

- Resistance sits near 2390.5 to 2392.5, with 2394.5 and 2411 above that

- Support holds between 2380.5 and 2377.75, with 2375.5 and 2365.5 below that

NASDAQ Futures (NQ)

A retest of highs seem to be on the horizon with enough underlying momentum to breach again to new highs. The ability for these new levels to hold are in question. Momentum is mixed, but still, favors buyers at value areas of support. The bullets below represent the likely shift of trading momentum at the positive or failed tests at the levels noted.

- Buying pressure intraday will likely strengthen with a positive retest of 5634.5 (careful here as it is a pattern completion or could be a double top)

- Selling pressure intraday will likely strengthen with a failed retest of 5619.5 ( higher lows are showing)

- Resistance sits near 5638.5 to 5642, with 5650.5 and 5662.25 above that

- Support holds between 5619.5 and 5607.5, with 5597.75 and 5592.5 below that

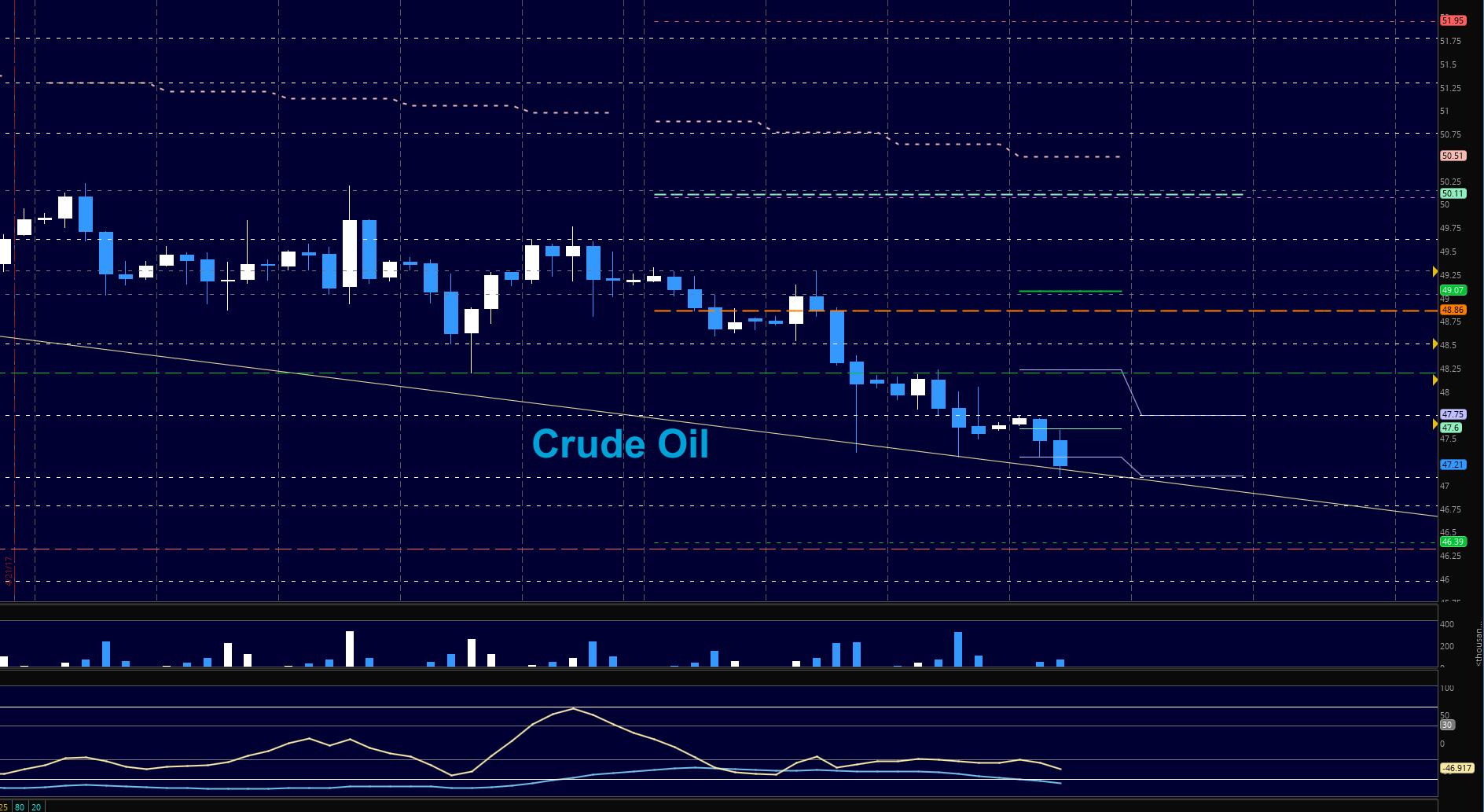

Crude Oil –WTI

The failed retest of 47.56 has sent us into the lower tests of support. Selling pressure does not seem to be alleviated, so bounces will sell as they have been. What we have to watch for is higher lows which are not visible at this time. The bullets below represent the likely shift of trading momentum at the positive or failed tests at the levels noted.

- Buying pressure intraday will likely strengthen with a positive retest of 47.78

- Selling pressure intraday will strengthen with a failed retest of 47.11

- Resistance sits near 47.78 to 48.2, with 48.51 and 49.29 above that.

- Support holds between 47.08 and 46.78, with 46.56 and 46.32 below that.

Our live trading room is now primarily stock market futures content, though we do track heavily traded stocks and their likely daily trajectories as well – we begin at 9am with a morning report and likely chart movements along with trade setups for the day.

As long as the trader keeps himself aware of support and resistance levels, risk can be very adequately managed to play in either direction as bottom picking remains a behavior pattern that is developing with value buyers and speculative traders.

Twitter: @AnneMarieTrades

The author trades stock market futures every day and may have a position in mentioned securities at the time of publication. Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.