Stock Market Futures Trading Considerations For May 31, 2017

As May comes to a close, markets are muted with little change from yesterday’s close. Today may bring more action on the S&P 500 (INDEXSP:.INX) and traders will need to be aware of their buy/sell levels.

Check out today’s economic calendar with a full rundown of releases. And note that the charts below are from our premium service at The Trading Book and are shared exclusively with See It Market readers.

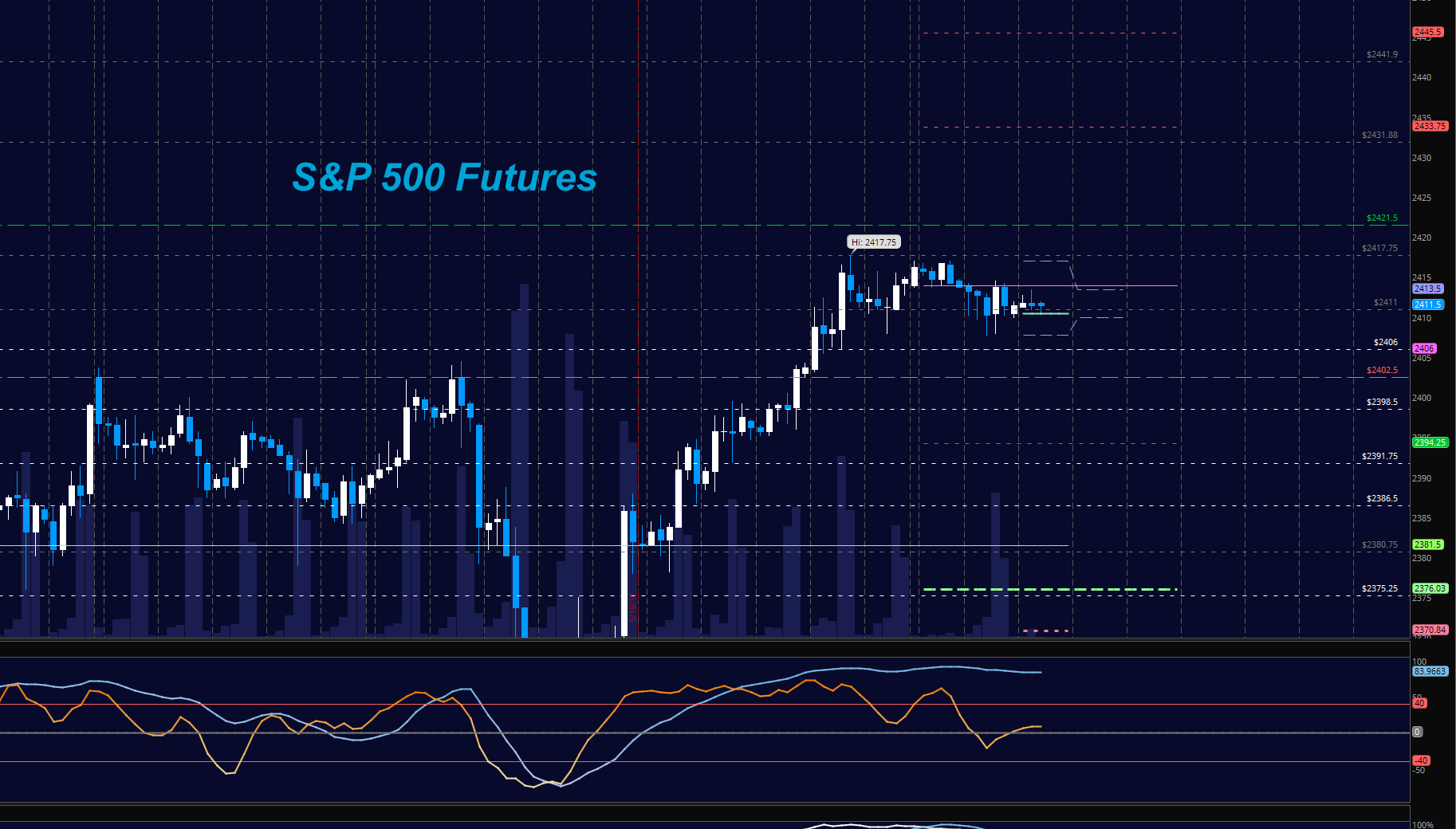

S&P 500 Futures (ES)

As suspected, buyers continued to support price at key levels, and in fact, did not drift anywhere into selling spaces. Short trades continue to be suspect – the level to watch today will be 2406 in the ES_F – a failed test there will bring us to the more important level of 2402. Above 2410 keeps buyers confident that long trades will hold. The key event will be lower highs and a breach below of key support to signal any continuing bearish action. The bullets below represent the likely shift of trading momentum at the positive or failed retests at the levels noted.

- Buying pressure intraday will likely strengthen above a positive retest of 2414.5 (though that is resistance for now)

- Selling pressure intraday will likely strengthen with a failed retest of 2402.25

- Resistance sits near 2414.5 to 2417, with 2421.5 and 2427.75 above that

- Support holds between 2402.5 and 2395.5, with 2391.5 and 2386.75 below that

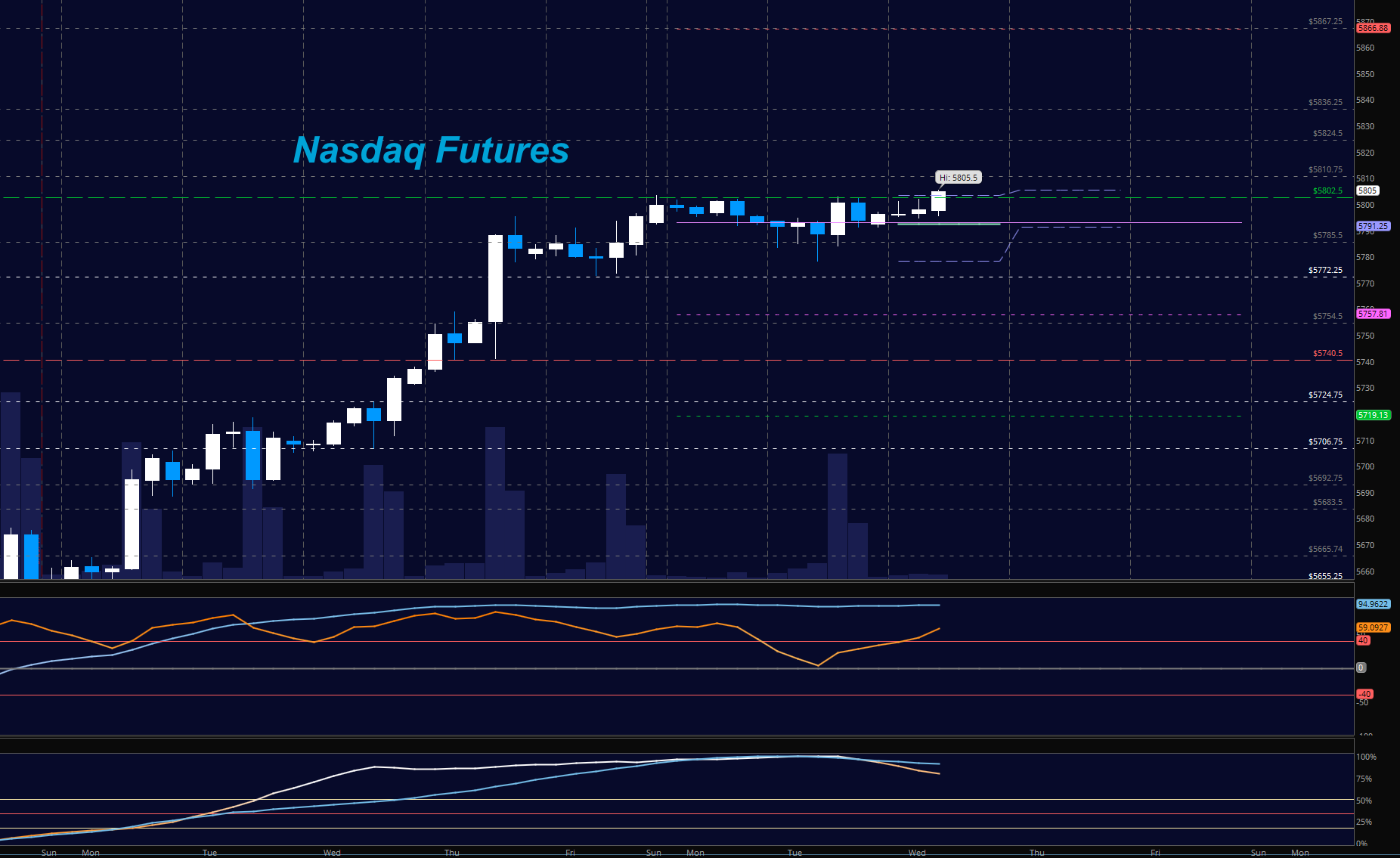

NASDAQ Futures (NQ)

This chart has breached higher in the premarket session as traders chase returns in technology. The key to watch will be the higher lows and the potential loss of tested support. Too much buying interest exists for this chart to collapse without a fight but both volume and momentum have weakened slightly, so buying the breakouts still remains suspect. The bullets below represent the likely shift of trading momentum at the positive or failed tests at the levels noted.

- Buying pressure intraday will likely strengthen with a positive retest of 5802.5

- Selling pressure intraday will likely strengthen with a failed retest of 5772.25

- Resistance sits near 5802.5 to 5810.25, with 5817.25 and 5826.75 above that

- Support holds between 5778.25 and 5772.5, with 5757.75 and 5740.5 below that

Crude Oil –WTI

Crude continues to drift lower under the news of glut prevailing as OPEC tightens and others increase supply. Today’s API and tomorrow’s EIA should provide catalysts for motion as we are still in the midst of key weekly and monthly congestion levels. Our long trade at the support of 49.03 yesterday into lower highs near 49.8 presented a lower high – a key signal to me that price action would not hold under the momentum levels present. Support levels to watch are now at 48.62 and 48.02. The bullets below represent the likely shift of trading momentum at the positive or failed tests at the levels noted.

- Buying pressure intraday will likely strengthen with a positive retest of 50.09

- Selling pressure intraday will strengthen with a failed retest of 48.02

- Resistance sits near 49.8 to 50.6, with 51.23 and 51.87 above that

- Support holds between 48.6 and 48.2, with 48.02 and 47.78 below that.

Our live trading room is now primarily stock market futures content, though we do track heavily traded stocks and their likely daily trajectories as well – we begin at 9am with a morning report and likely chart movements along with trade setups for the day.

As long as the trader keeps himself aware of support and resistance levels, risk can be very adequately managed to play in either direction as bottom picking remains a behavior pattern that is developing with value buyers and speculative traders.

Twitter: @AnneMarieTrades

The author trades stock market futures every day and may have a position in mentioned securities at the time of publication. Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.