Stock Market Futures Considerations For May 3, 2017

We have an FOMC meeting release today at 2pm with Janet Yellen attempting to be as transparent as any Fed chair has been in some time. So I am not quite sure that the S&P 500 (INDEXSP:.INX) and broader financial markets will find any surprises here.

This does not change the potential for knee jerk action that quietly settles into congestion once more. Especially as the markets gear up for the run off election with Macron and LePen in France over the weekend. If she loses, we will likely explode upside over the 2400 level (but that is still several days away, to be sure). Check out today’s economic calendar with a full rundown of releases. And note that the charts below are from our premium service at The Trading Book and are shared exclusively with See It Market readers.

S&P 500 Futures (ES)

Our range continues to tighten which presents a further coiling and a likelihood of a sharp move in coming days. Sellers are camped between 2389 and 2391 with support levels back near 2381. Momentum is drifting lower, but is bullish overall. Price action is very congested, bringing targets in much closer. The bullets below represent the likely shift of trading momentum at the positive or failed tests at the levels noted.

- Buying pressure intraday will likely strengthen above a positive retest of 2389.5 (bull flag in progress)

- Selling pressure intraday will likely strengthen with a failed retest of 2380.5

- Resistance sits near 2389.5 to 2392.25, with 2394.5 and 2397 above that

- Support holds between 2380.5 and 2378, with 2375.25 and 2369.5 below that

NASDAQ Futures

The completed Fibonacci retracement of the ABCD at 5638.5 yesterday held and the expected test of support at 5619.5 was achieved. A bounce is now in progress to test prior support that will act as resistance at 5628.5. Under the current momentum, pullbacks will continue to find buying support at the first pass, but we could also see a test of the target zone once more at 5638.5. Momentum is mixed, but still favors buyers at value areas of support. The bullets below represent the likely shift of trading momentum at the positive or failed tests at the levels noted.

- Buying pressure intraday will likely strengthen with a positive retest of 5638.5 (careful here as it is a pattern completion or could be a double top)

- Selling pressure intraday will likely strengthen with a failed retest of 5619.25

- Resistance sits near 5638.5 to 5644.25, with 5650.5 and 5662.25 above that

- Support holds between 5619.25 and 5607.25, with 5597.75 and 5592.5 below that

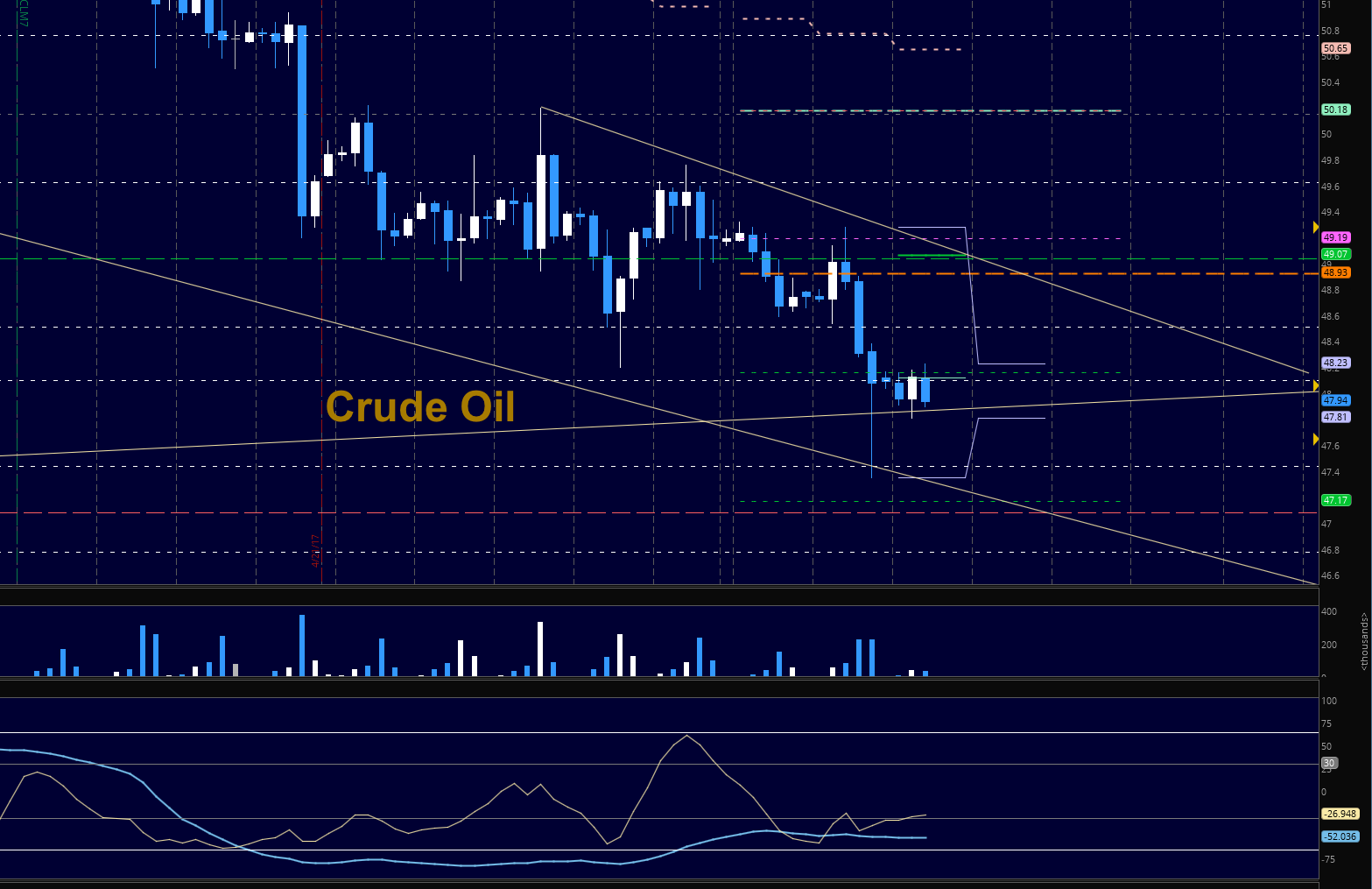

Crude Oil –WTI

Downside pressure continues as a shift out of long positions in hedge funds and managers reaches highest levels seen in months. The EIA report is at 10:30am today. This chart does show that bounces are likely to sell. Early morning sellers have drawn the line near 48.2 and the test of lower levels seems very likely. The bullets below represent the likely shift of trading momentum at the positive or failed tests at the levels noted.

- Buying pressure intraday will likely strengthen with a positive retest of 48.62

- Selling pressure intraday will strengthen with a failed retest of 47.78

- Resistance sits near 48.62 to 49.04, with 49.62 and 50.15 above that.

- Support holds between 47.78 and 47.44, with 47.08 and 46.78 below that.

Our live trading room is now primarily stock market futures content, though we do track heavily traded stocks and their likely daily trajectories as well – we begin at 9am with a morning report and likely chart movements along with trade setups for the day.

As long as the trader keeps himself aware of support and resistance levels, risk can be very adequately managed to play in either direction as bottom picking remains a behavior pattern that is developing with value buyers and speculative traders.

Twitter: @AnneMarieTrades

The author trades stock market futures every day and may have a position in mentioned securities at the time of publication. Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.