Stock Market Futures Considerations July 6, 2017

The S&P 500 futures are headed lower this morning. Initial support near 2416 is in play. For more trading levels to watch across the S&P 500, Nasdaq, and crude oil, read on…

Check out today’s economic calendar with a full rundown of releases. And note that the charts below are from our premium service and shared exclusively with See It Market readers.

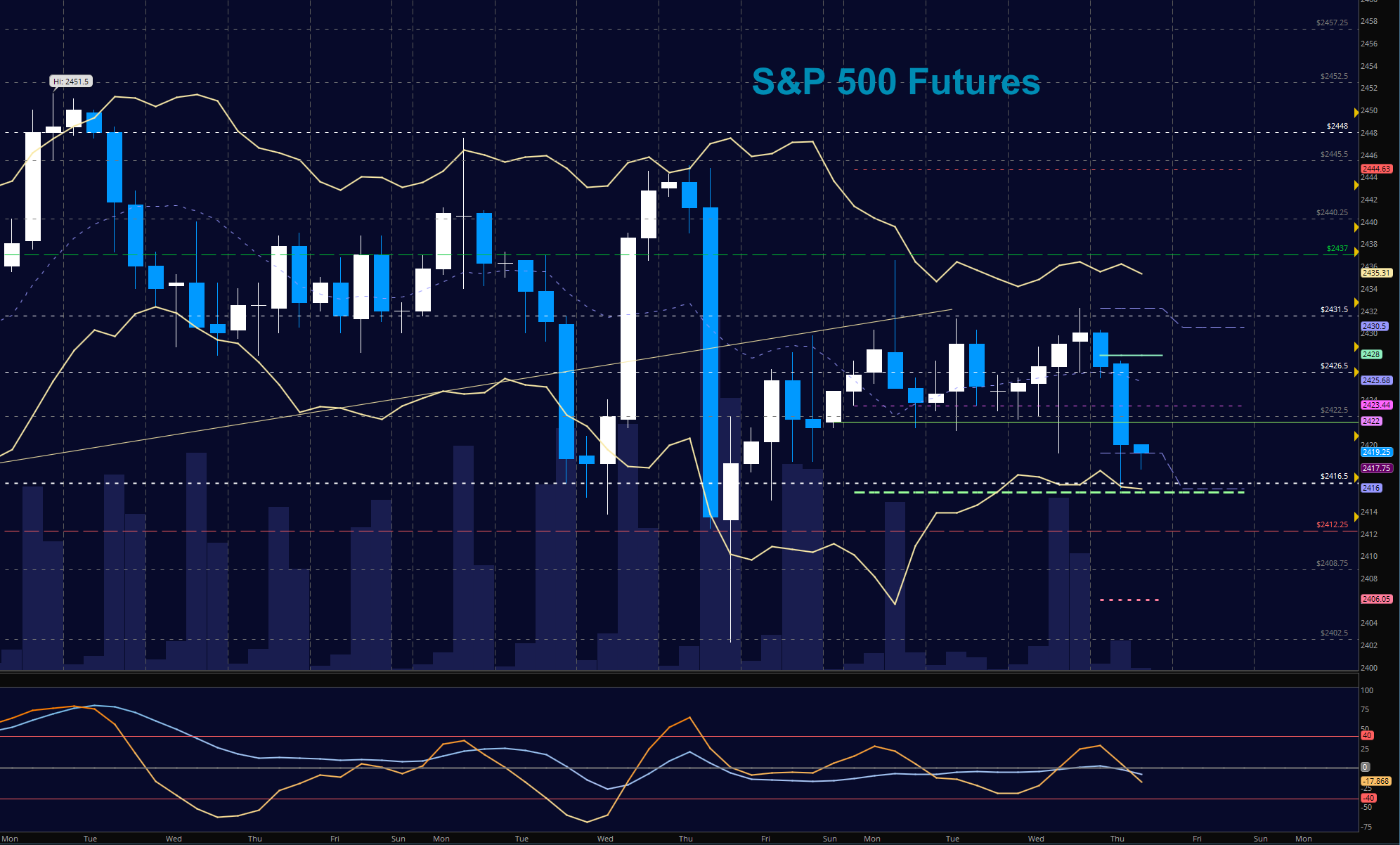

S&P 500 Futures (ES)

A bounce into congestion regions near 2428 was the order of yesterday. Deeper support near 2416 is now in play. Resistance still sits near 2437 as Thursday sets up as another range bound space, albeit wider. Momentum is neutral across time frames and generally still flat, so we’ll need to watch these edges for changes in motion. NFP is on Friday. The bullets below represent the likely shift of trading momentum at the positive or failed retests at the levels noted.

- Buying pressure intraday will likely strengthen above a positive retest of 2432 (careful again here with resistance)

- Selling pressure intraday will likely strengthen with a failed retest of 2416

- Resistance sits near 2436.5 to 2439, with 2445.5 and 2448.5 above that.

- Support holds between 2419 and 2416.25, with 2409.5 and 2402.5 below that.

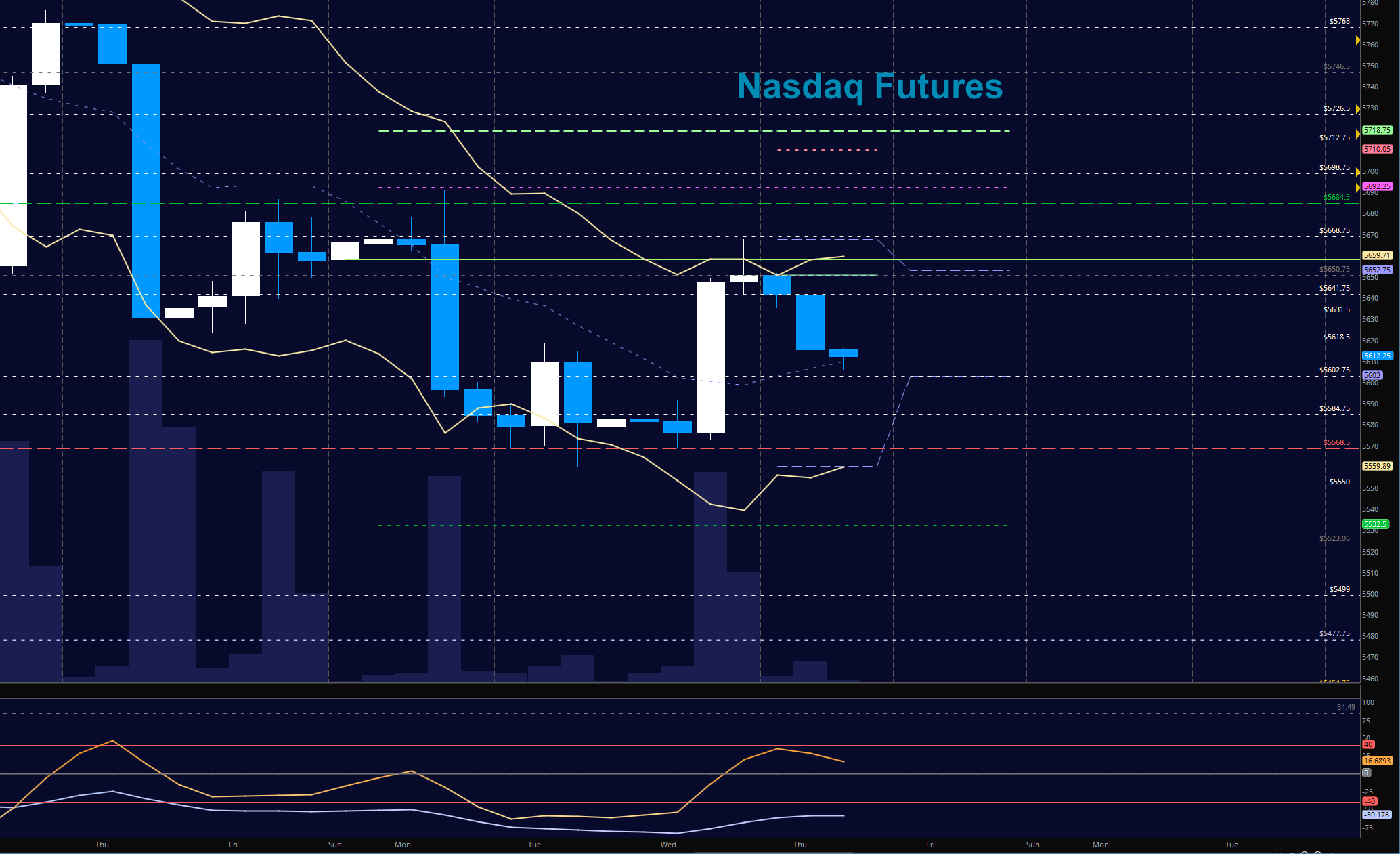

NASDAQ Futures (NQ)

Of the indices we watch, this one held the biggest bounce off the fade from Monday, but overnight the fade began and is continuing under a negative backdrop. Support levels are now 5602ish, but I still have eyes on the mark near 5454 – a breakaway event with a gap just above. The bullets below represent the likely shift of intraday trading momentum at the positive or failed tests at the levels noted.

- Buying pressure intraday will likely strengthen with a positive retest of 5618.5

- Selling pressure intraday will likely strengthen with a failed retest of 5600.5

- Resistance sits near 5622.75 to 5648.5, with 5667.25 and 5684.5 above that.

- Support holds between 5602.5 and 5568.75, with 5550.5 and 5477.75 below that.

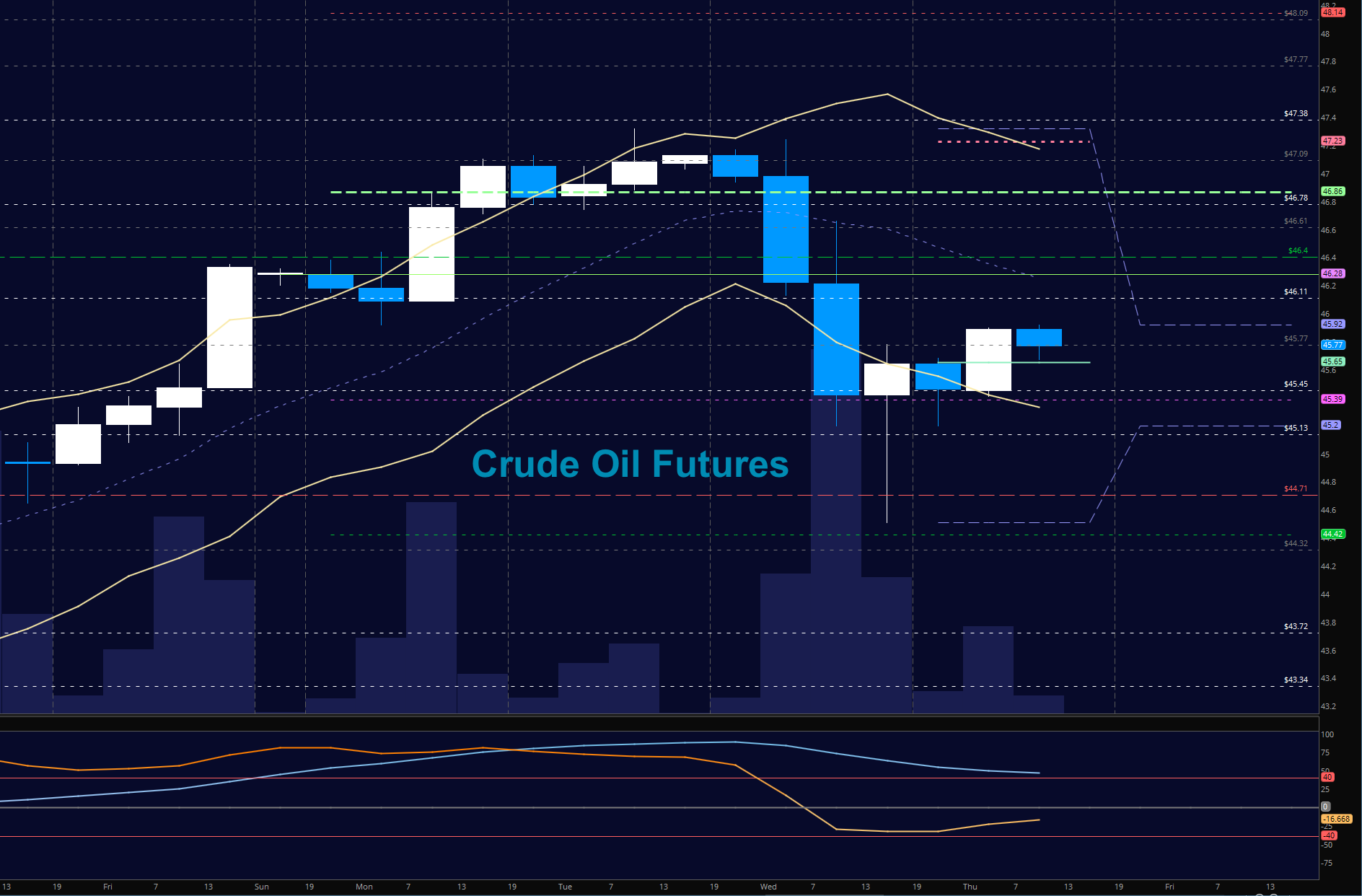

WTI Crude Oil

A deep fade into 44.7 found buyers ready to participate en masse. Today, traders are battling against 45.77 with a likely test of 46.11 ahead. API reported last evening and EIA is due this morning. Momentum is mixed. The bullets below represent the likely shift of trading momentum at the positive or failed tests at the levels noted.

- Buying pressure intraday will likely strengthen with a positive retest of 46.34

- Selling pressure intraday will strengthen with a failed retest of 45.2

- Resistance sits near 46.24 to 46.86, with 47.14 and 47.4 above that.

- Support holds between 45.22 to 44.87, with 44.56 and 44.12 below that.

If you’re interested in the live trading room, it is now primarily stock market futures content, though we do track heavily traded stocks and their likely daily trajectories as well – we begin at 9am with a morning report and likely chart movements along with trade setups for the day.

As long as the trader keeps himself aware of support and resistance levels, risk can be very adequately managed to play in either direction as bottom picking remains a behavior pattern that is developing with value buyers and speculative traders.

Twitter: @AnneMarieTrades

The author trades stock market futures every day and may have a position in mentioned securities at the time of publication. Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.