S&P 500 Futures Trading Considerations

Contract rolls and election votes abroad shifted prices down but with a swift gap. The S&P 500 (INDEXSP:.INX) will likely find buyers at support. See key levels below.

Check out today’s economic calendar with a full rundown of releases. And note that the charts below are from our premium service at The Trading Book and are shared exclusively with See It Market readers.

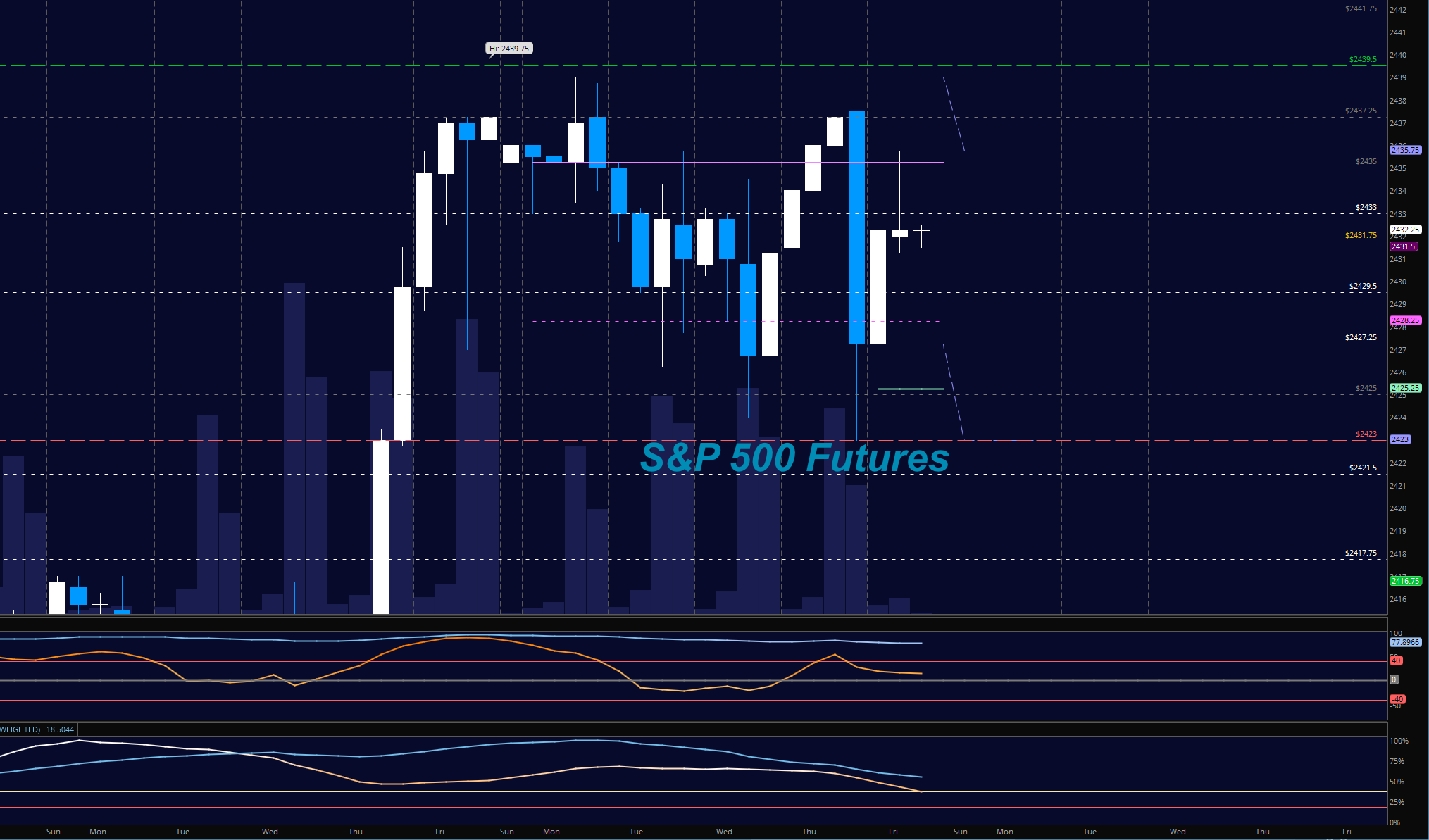

S&P 500 Futures (ES)

We are now at a congestion zone near 2431.5 with no resolution to sideways action in sight. The key for buyers looking for a breakout will be whether the chart can breach and hold 2435.5. Long trades at any pullbacks are still the best bet. Value areas near 2426 still hold. Use caution trading short on the lows of the candles -instead, look for topping formations to take resistance short into support. Longs are likely to hold at deeper support. The bullets below represent the likely shift of trading momentum at the positive or failed retests at the levels noted.

- Buying pressure intraday will likely strengthen above a positive retest of 2436.

- Selling pressure intraday will likely strengthen with a failed retest of 2425.

- Resistance sits near 2436 to 2439.75, with 2441.5 and 2447.75 above that.

- Support holds between 2424.75 and 2421.5, with 2418.25 and 2413.75 below that.

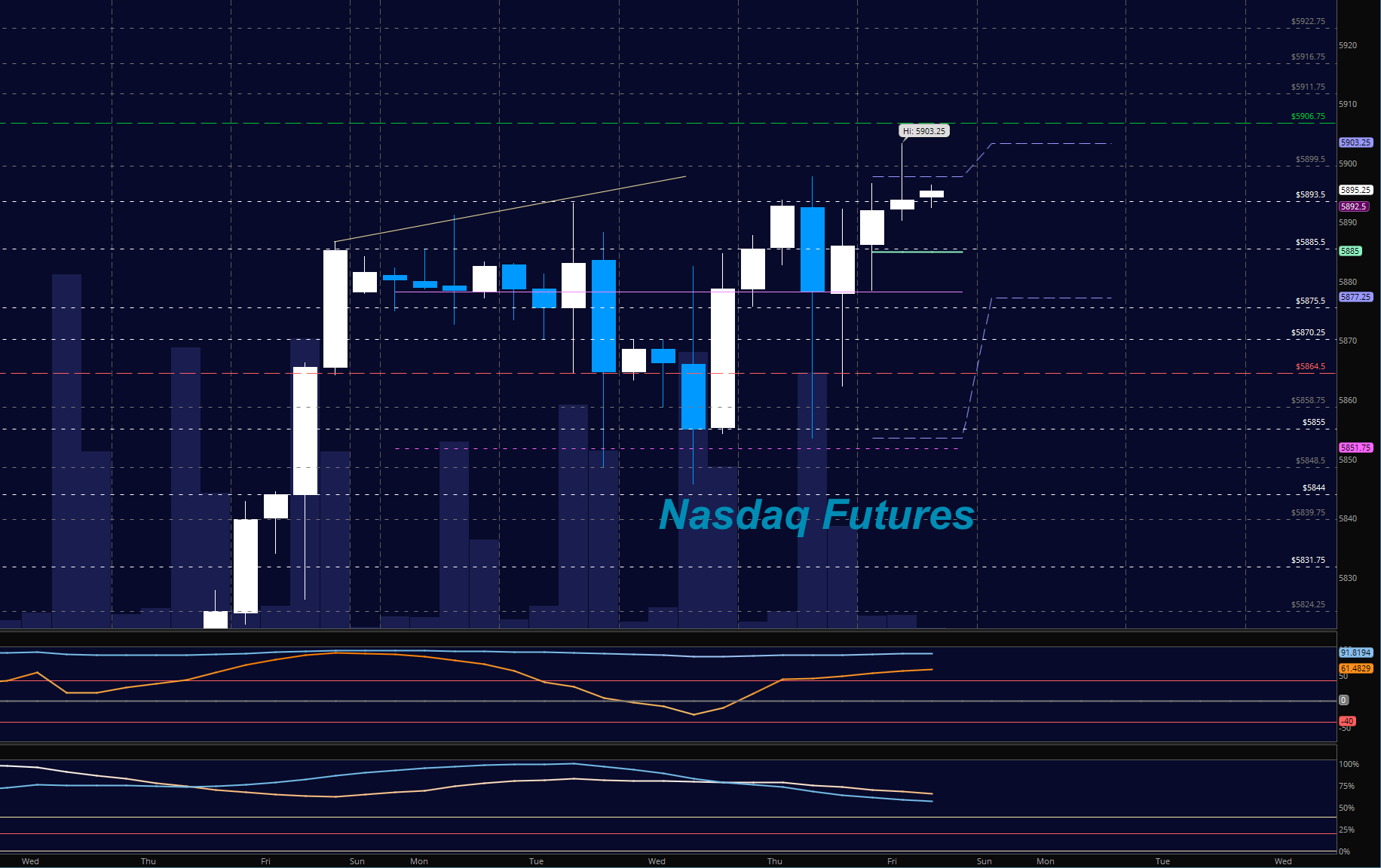

NASDAQ Futures (NQ)

A new high under negative divergence appeared again, suggesting that breakout trades long remain suspect for continuation. Pullbacks will still create buying opportunities, and higher lows are still expected as we test levels about. Buyers now hold 5862.25 as support. The bullets below represent the likely shift of intraday trading momentum at the positive or failed tests at the levels noted.

- Buying pressure intraday will likely strengthen with a positive retest of 5893.50.

- Selling pressure intraday will likely strengthen with a failed retest of 5855.

- Resistance sits near 5893.5 to 5895.75, with 5906.75 and 5916.75 above that.

- Support holds between 5853.25 and 5846.75, with 5839.5 and 5831.25 below that.

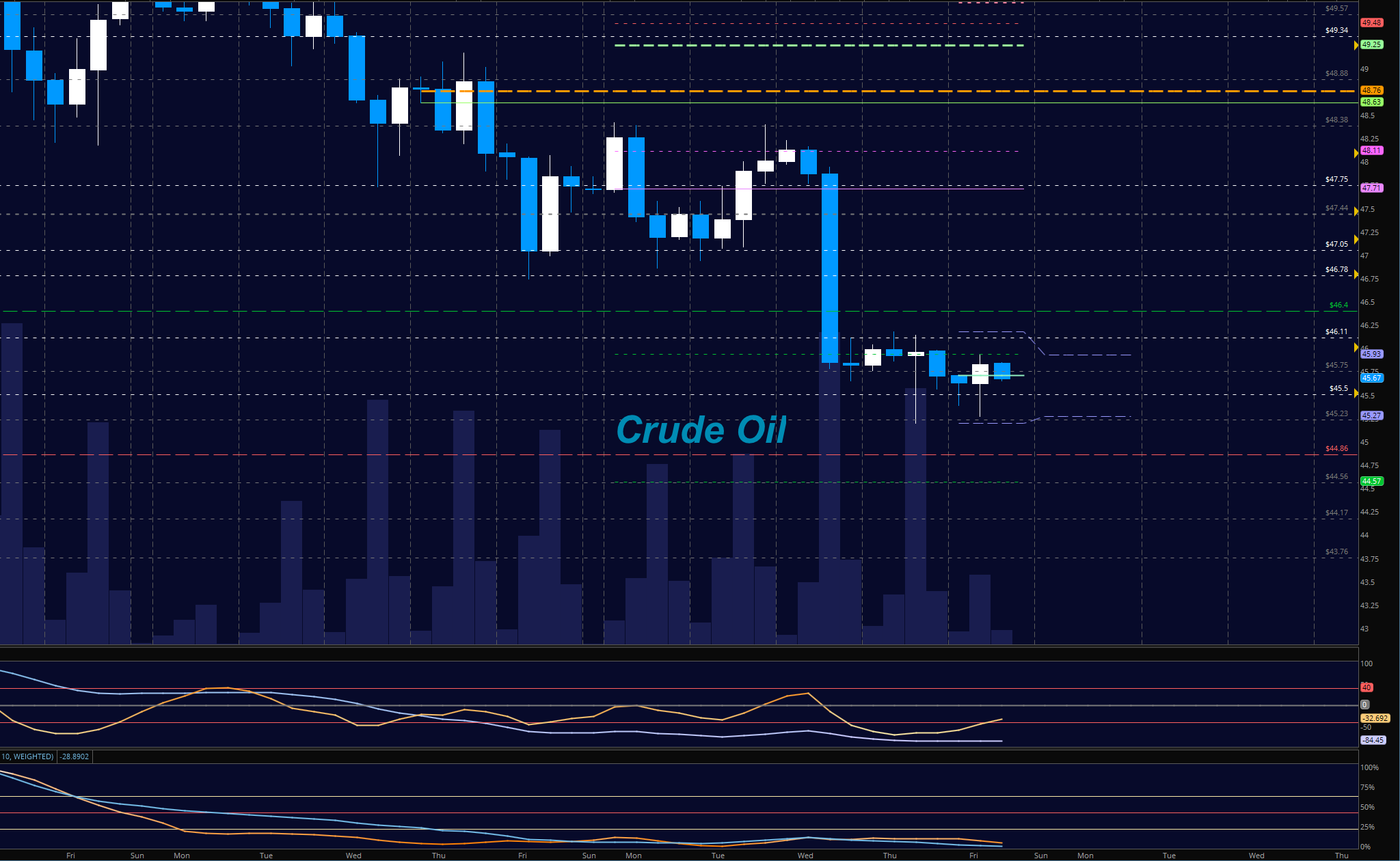

WTI Crude Oil

Bearish action continues as prices try to stabilize near 45.5. Bounces continue to be regions to sell, but even if we fade deeper, I suspect we attempt another bounce. Support seems to hold for now near 45.2 and below is 44.86. The bullets below represent the likely shift of trading momentum at the positive or failed tests at the levels noted.

- Buying pressure intraday will likely strengthen with a positive retest of 46.25.

- Selling pressure intraday will strengthen with a failed retest of 45.20.

- Resistance sits near 46.4 to 46.78, with 47.05 and 47.4 above that.

- Support holds between 45.23 and 45.05, with 44.86 and 44.56 below that.

Twitter: @AnneMarieTrades

The author trades stock market futures every day and may have a position in mentioned securities at the time of publication. Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.