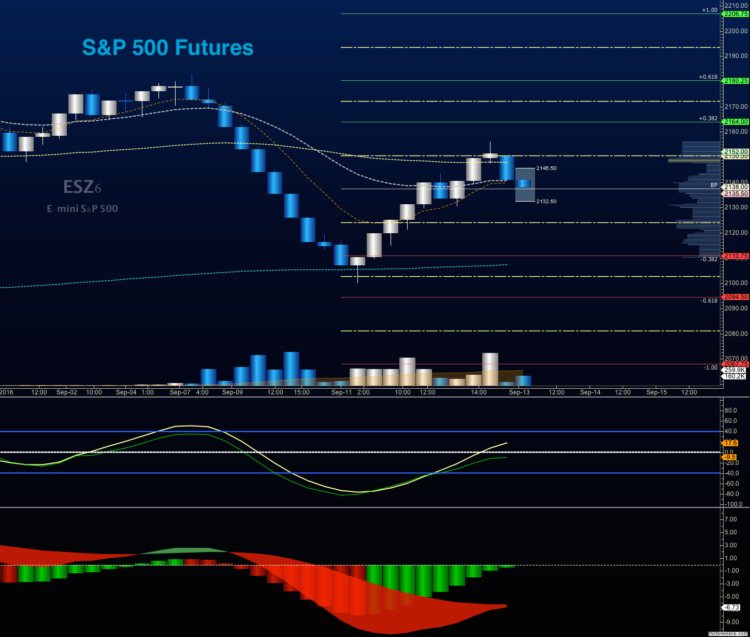

S&P 500 Market Overview and Trading Outlook for September 13, 2016 –

The monster bounce yesterday lead to a failure at resistance overnight. I am looking for higher lows to set in on the S&P 500 (INDEXSP:.INX), and generally a timid trading day as the stock market digests that movement. A positive retest of resistance will give the go-ahead to buyers in this environment – that number is currently 2150.75 on S&P 500 futures trading. That said, the key price support level today is 2120.5, and a break here will give sellers a shot at running the chart lower. Another key level of congestion to watch in this mess is 2130.75, where it seems that buyers and sellers are battling for dominance. Momentum has shifted, but still retains its bearish slant.

See today’s economic calendar with a rundown of releases.

RANGE OF TODAY’S MOTION

S&P 500 Futures Trading Outlook For September 13

Upside trades on S&P 500 futures – Favorable setups sit on the positive retest of 2135, or a positive retest of the bounce off 2121.5 with upward momentum. I use the 30min to 1hr chart for the breach and retest mechanic. Targets from 2121.5 are 2124.75, 2129.75, 2132.5, 2135, 2141.75, 2143.75 and 2147.25. As always, additional targets will be in the Members only portion of the morning blog.

Downside trades on S&P 500 futures – Favorable setups sit below the failed retest of 2129.5, or at the failed retest of 2132 with negative divergence. Retracement into lower levels from 2132 give us the targets 2129.5, 2126.5, 2122.25, 2117.75, 2114.5, and 2110.75. As always, additional targets will be in the Members only portion of the morning blog, and in the live trading room.

Nasdaq Futures

The NQ_F rebounded with the other broad indices in sharp fashion, but this morning continues to battle at higher lows to maintain support.

Upside trades on Nasdaq futures – Favorable setups sit on the positive retest of 4742.5, or a positive retest of 4727.75 with positive momentum. I use the 30min to 1hr chart for the breach and retest mechanic. Targets from 4742.5 are 4745, 4752.25, 4757.75, 4760.75, 4764.5, 4769.25, and 4773.75. As always, additional targets will be in the Members only portion of the morning blog, and in the live trading room.

Downside trades on Nasdaq futures – Favorable setups sit below the failed retest of 4726, or at the failed retest of 4744 with negative divergence. Retracement into lower levels from 4744 are 4741.75, 4737.75, 4735.5, 4729.75, 4725, 4725.25, 4721.75, and 4717.75. See the blog for additional targets.

Crude Oil

The API report is released after the close today. After bouncing with the rest of the markets, oil has also begun a fade into support, which sits near 45.04, with 44.74 below that. Resistance sits near 45.89, but could stretch into 46.47, if buyers can gain any footing.

Trading ranges for crude oil should hold between 44.04 and 46.59 today.

Upside trades on crude oil futures can be staged on the positive retest of 45.36, or at a positive retest off 45.04 with positive momentum. I often use the 30min to 1hr chart for the breach and retest mechanic. Targets from 45.04 are 45.14, 45.26, 45.47, 45.57, 45.89, 46.13, and 46.36. See the blog for more details on the chart action.

Downside trades on crude oil futures can be staged on the failed retest of 45.04, or at the failed retest of 45.69 with negative divergence. Targets from 45.69 are 45.54, 45.38, 45.22, 45.04, 44.86, 44.62, 44.48 and 44.24. Additional targets will be in the Members only portion of the morning blog, and in the live trading room.

If you’re interested in the live trading room, it is now primarily stock market futures content, though we do track heavily traded stocks and their likely daily trajectories as well – we begin at 9am with a morning report and likely chart movements along with trade setups for the day.

As long as the trader keeps himself aware of support and resistance levels, risk can be very adequately managed to play in either direction as bottom picking remains a behavior pattern that is developing with value buyers and speculative traders.

Twitter: @AnneMarieTrades

The author trades stock market futures every day and may have a position in mentioned securities at the time of publication. Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.