Stock Market Futures Considerations For November 7, 2017

The S&P 500 (INDEXSP:.INX) and Nasdaq (INDEXNASDAQ:.IXIC) are trading mixed in Tuesday morning trade. Markets are looking a bit toppy short-term, but as long as higher lows are made, the trend is up. Key trading levels and futures market commentary can be found below.

Check out today’s economic calendar with a full rundown of releases.

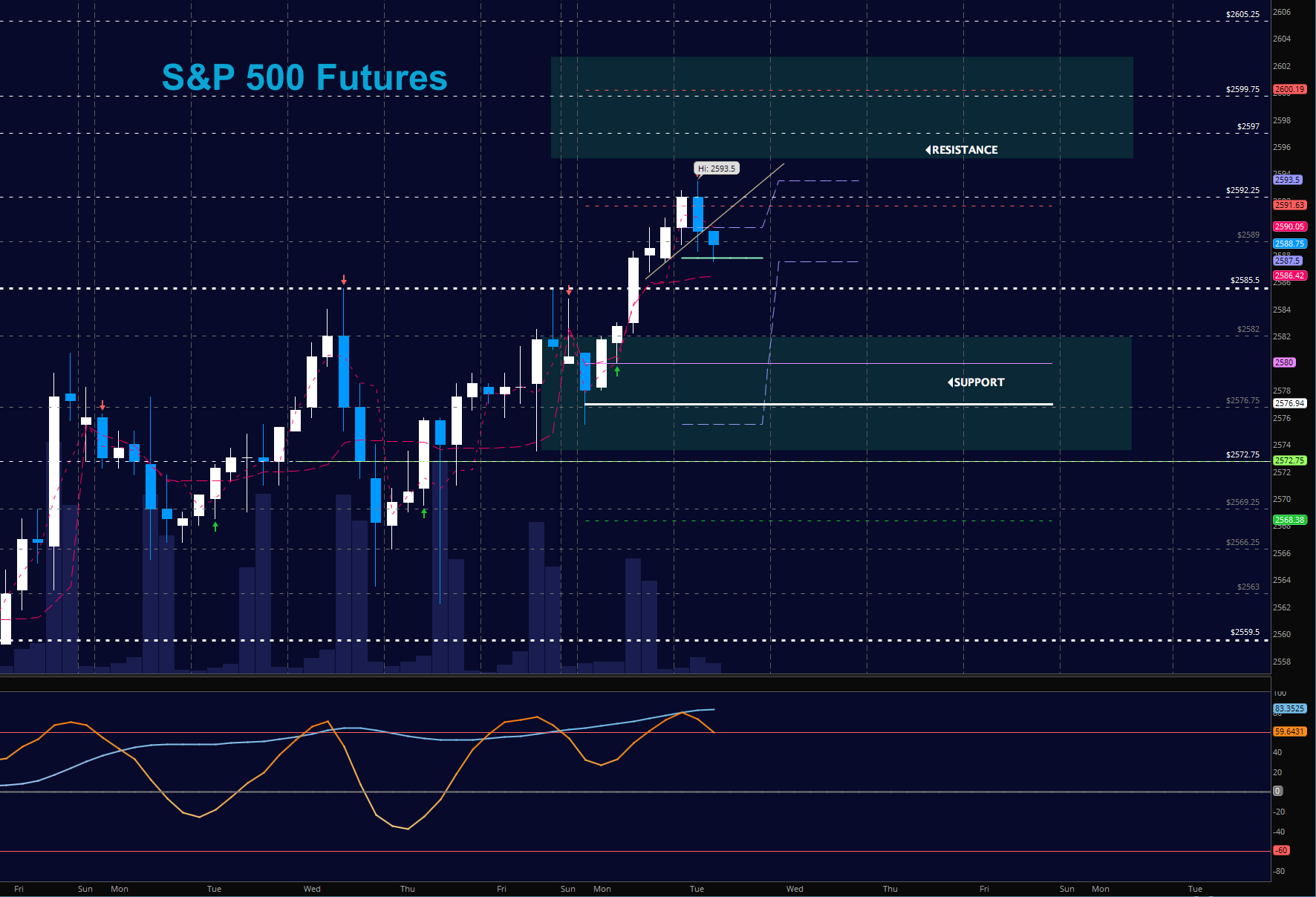

S&P 500 Futures

NEW HIGHS and subsequent HIGHER LOWS form the backdrop of today’s motion, as yesterday. Markets remain bullish with the greatest opportunities lying at the tests of support for long entries. Watch support regions to hold in the climb forward, but after this expansion, look for the potential of lower highs to prevail. The bullets below represent the likely shift of trading momentum at the positive or failed retests at the levels noted.

- Buying pressure intraday will likely strengthen above a positive retest of 2590.25

- Selling pressure intraday will likely strengthen with a failed retest of 2584.5

- Resistance sits near 2585.75 to 2593.75, with 2597.75 and 2600.5 above that.

- Support holds between 2582 and 2576.75, with 2572.25 and 2568.5 below that.

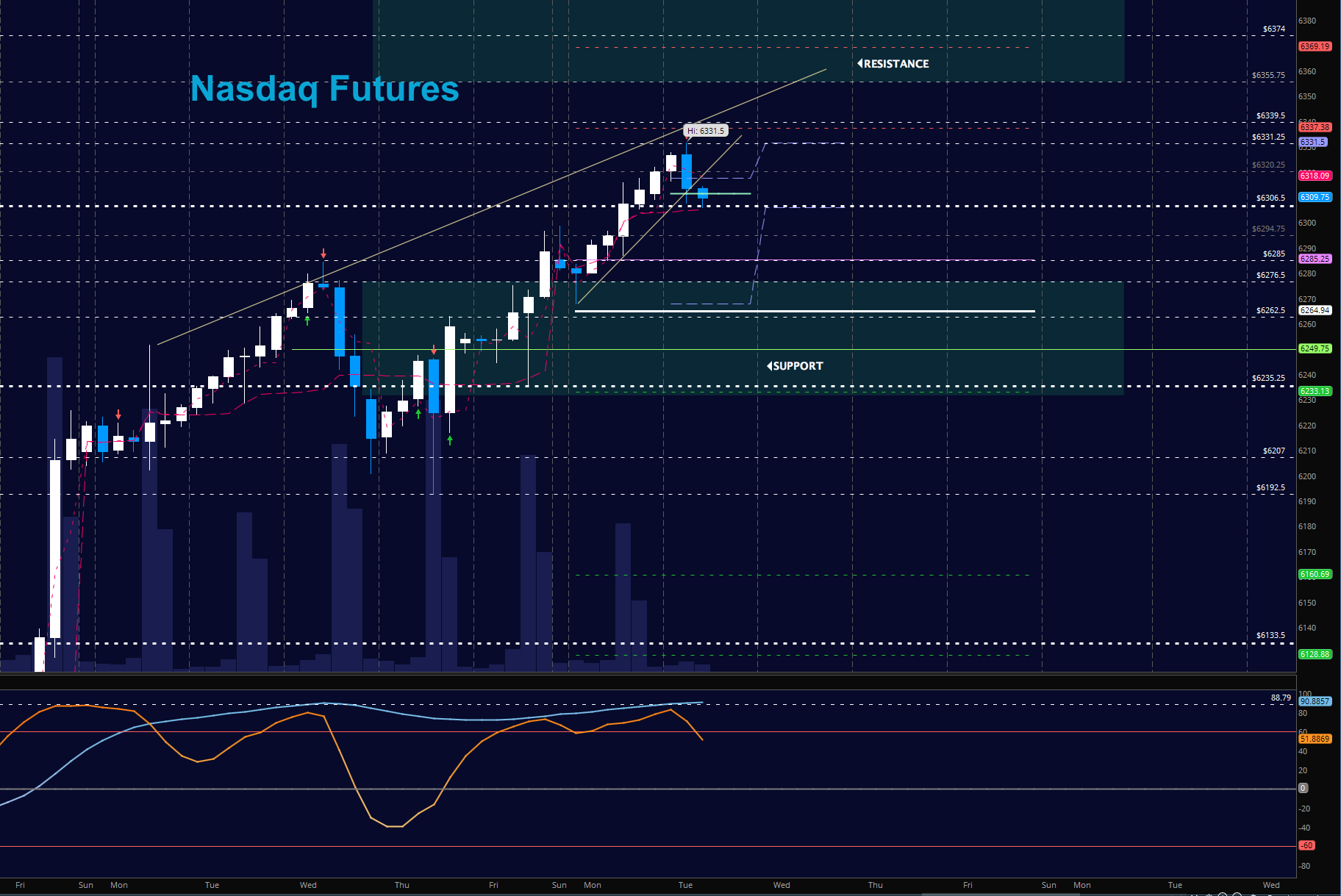

NASDAQ Futures

The NQ held HIGHER LOWS once more and tested NEW HIGHS overnight in a repeat of yesterday’s motion. As long as we hold 6304.75, buyers will continue to hold strong and bullish patterns continue. The bullets below represent the likely shift of intraday trading momentum at the positive or failed tests at the levels noted.

- Buying pressure intraday will likely strengthen with a positive retest of 6326.75

- Selling pressure intraday will likely strengthen with a failed retest of 6304.5

- Resistance sits near 6314.75 to 6321.5 with 6331.5 and 6355.75 above that.

- Support holds between 6307.5 and 6294.5, with 6240.75 and 6236.5 below that.

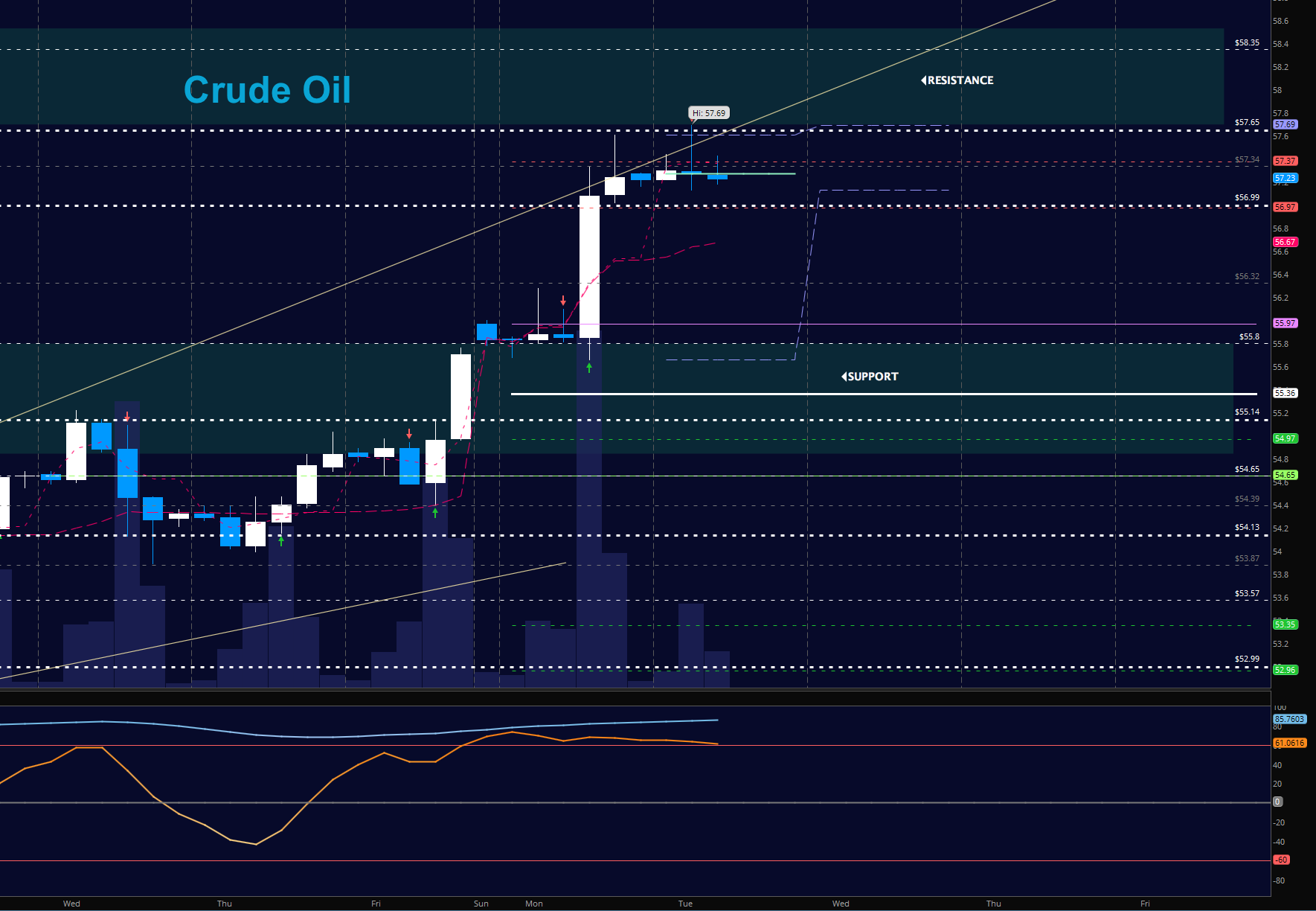

WTI Crude Oil

API report today and EIA in the morning. Oil holds bullish formations and sideways overnight but holding steady. Momentum is bullish allowing pullbacks into support to be key buy zones still. The bullets below represent the likely shift of trading momentum at the positive or failed tests at the levels noted.

- Buying pressure intraday will likely strengthen with a positive retest of 57.39

- Selling pressure intraday will strengthen with a failed retest of 56.98

- Resistance sits near 57.65 to 58.27, with 58.75 and 59.15 above that.

- Support holds between 56.67 to 56.34, with 55.97 and 55.56 below that.

If you’re interested in the live trading room, it is now primarily stock market futures content, though we do track heavily traded stocks and their likely daily trajectories as well – we begin at 9am with a morning report and likely chart movements along with trade setups for the day.

As long as the trader keeps himself aware of support and resistance levels, risk can be very adequately managed to play in either direction as bottom picking remains a behavior pattern that is developing with value buyers and speculative traders.

Twitter: @AnneMarieTrades

The author trades stock market futures every day and may have a position in mentioned securities at the time of publication. Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.