Stock Market Outlook for January 3, 2017 –

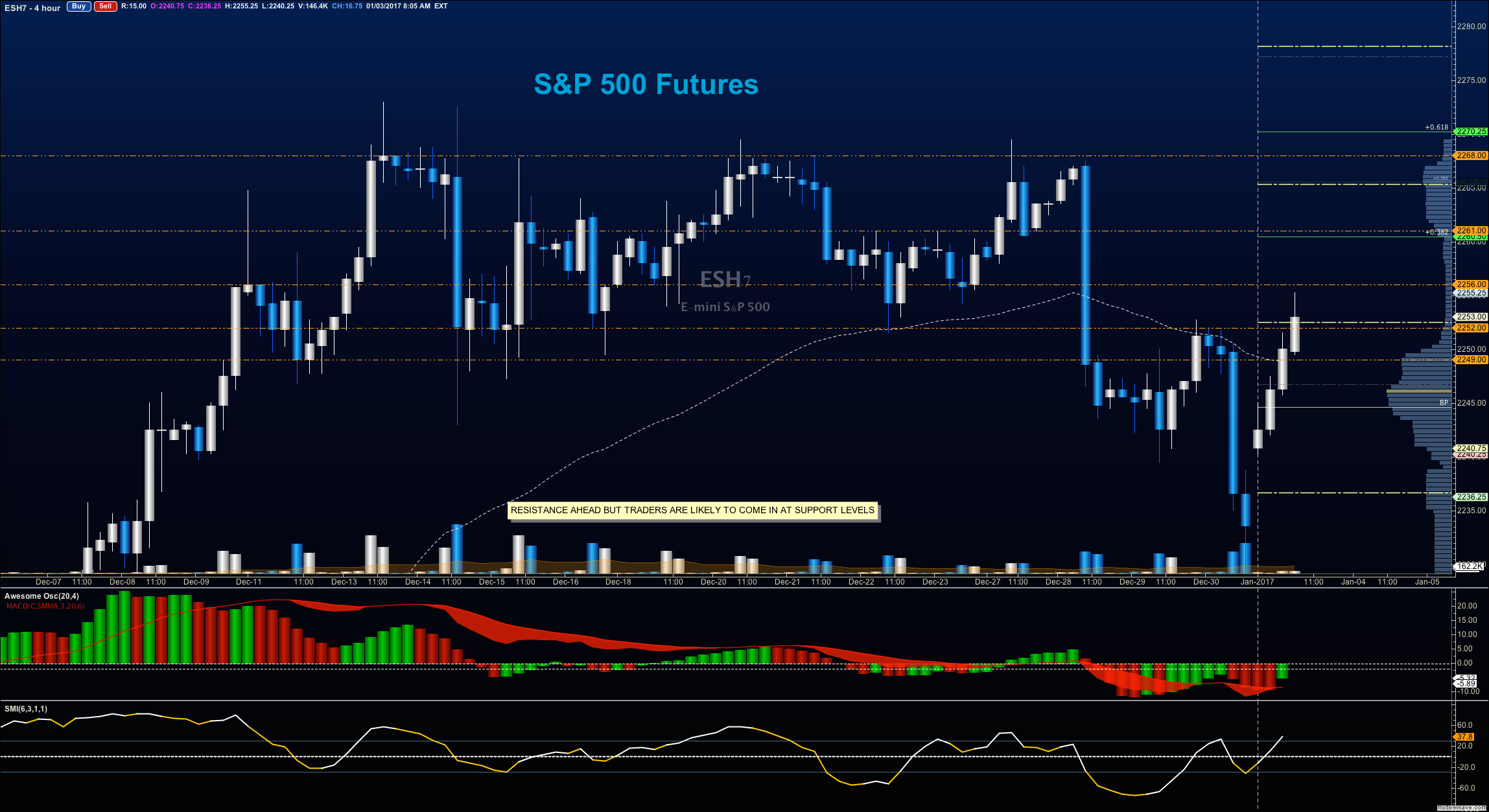

2017 trading begins on a positive note after a bit of a selloff for the S&P 500 (INDEXSP:.INX) on Friday. Sellers held primary power as expected from Thursday’s post. As bullish news catches hold, we can estimate that deep pullbacks will find buyers, but lower highs should arrive on the horizon.

The lines in the sand for buyers to hold will be the range between 2257 and 2254 on S&P 500 futures. So far, though, we sit below that. Below the area noted, sellers are in primary control for now. Resistance sits near 2261 to 2264.75 with 2267.75 above that.

See today’s economic calendar with a rundown of releases.

TODAY’S RANGE OF MOTION

E-mini S&P 500 Futures Trading Chart For January 3

Upside trades – Two options for entry

Positive retest of continuation level – 2261.5 (careful here – a retest is required)

Positive retest of support level – 2252.25

Opening targets ranges – 2254.75, 2256.75, 2260.75, 2263.75, 2267.5, 2269.25, 2271.25, 2272.75, 2275.50, 2278.25 and 2282.50

Downside trades – Two options for entry

Failed retest of resistance level – 2260.5

Failed retest of support level – 2251

Opening target ranges – 2256.75, 2252.75, 2249.75, 2246.50, 2242.75, 2239, 2235, 2231.50, 2227.75, 2224.25, and 2221.75

Nasdaq Futures

The NQ_F also sits at a bounce zone after the move lower yesterday. Momentum is now mixed, but as long as buyers can hold the support at 4920-4924, we should see a test of 4941. Sellers are in control as long as prices hold below 4940

Upside trades – Two options

Positive retest of continuation level – 4906.25 (needs confirmation)

Positive retest of support level – 4876.75 (also needs confirmation)

Opening target ranges – 4885.25, 4891.75, 4897, 4905, 4912.75, 4917.75, 4924.5, 4930.50, 4936.75, 4940.75, 4947.75, 4952.75, 4959, 4962.25, 4966.75, 4973.25, 4978.5, 4988.25, 4994, 4997, and 5002.25

Downside trades – Two options

Failed retest of resistance level – 4924.25

Failed retest of support level – 4905.5

Opening target ranges – 4917.75, 4912.25, 4908.50, 4905.25, 4897, 4891.75, 4885.25, 4879.75, 4871.75, 4861.75, 4857.5, and 4851.75,

Crude Oil –WTI

OPEC cuts are confirmed in place and that is driving price up this morning. The chart remains bullish but we are sitting near key resistance at 55.24 to 55.34 with a gap into 56.5 showing on the weekly chart (likely a contract roll event).

Buyers are trying to hold a breakout event at 54.90. Pullbacks ought to find buyers – new resistance sits near 56.05 to 56.5.

Upside trades – Two options

Positive retest of continuation level – 54.9 (needs bullish momentum)

Positive retest of support level – 54.22

Opening target ranges – 53.37, 53.64, 53.8, 53.94, 54.04, 54.35, 54.5, 54.77, 54.9, 55.24, 55.34, 55.7, 56.05, and 56.5

Downside trades – Two options

Failed retest of resistance level -54.82

Failed retest of support level– 54.51 (watch support near 54.22)

Opening target ranges – 54.52, 54.34, 54.08, 53.87, 53.7, 53.52, 53.37, 53.2, 53.03, 52.81, 52.64, 52.32, 52.09, and 51.85

If you’re interested in watching these trades go live, join us in the live trading room from 9am to 11:30am each trading day.

Visit TheTradingBook for more information.

If you’re interested in the live trading room, it is now primarily stock market futures content, though we do track heavily traded stocks and their likely daily trajectories as well – we begin at 9am with a morning report and likely chart movements along with trade setups for the day.

As long as the trader keeps himself aware of support and resistance levels, risk can be very adequately managed to play in either direction as bottom picking remains a behavior pattern that is developing with value buyers and speculative traders.

Twitter: @AnneMarieTrades

The author trades stock market futures every day and may have a position in mentioned securities at the time of publication. Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.