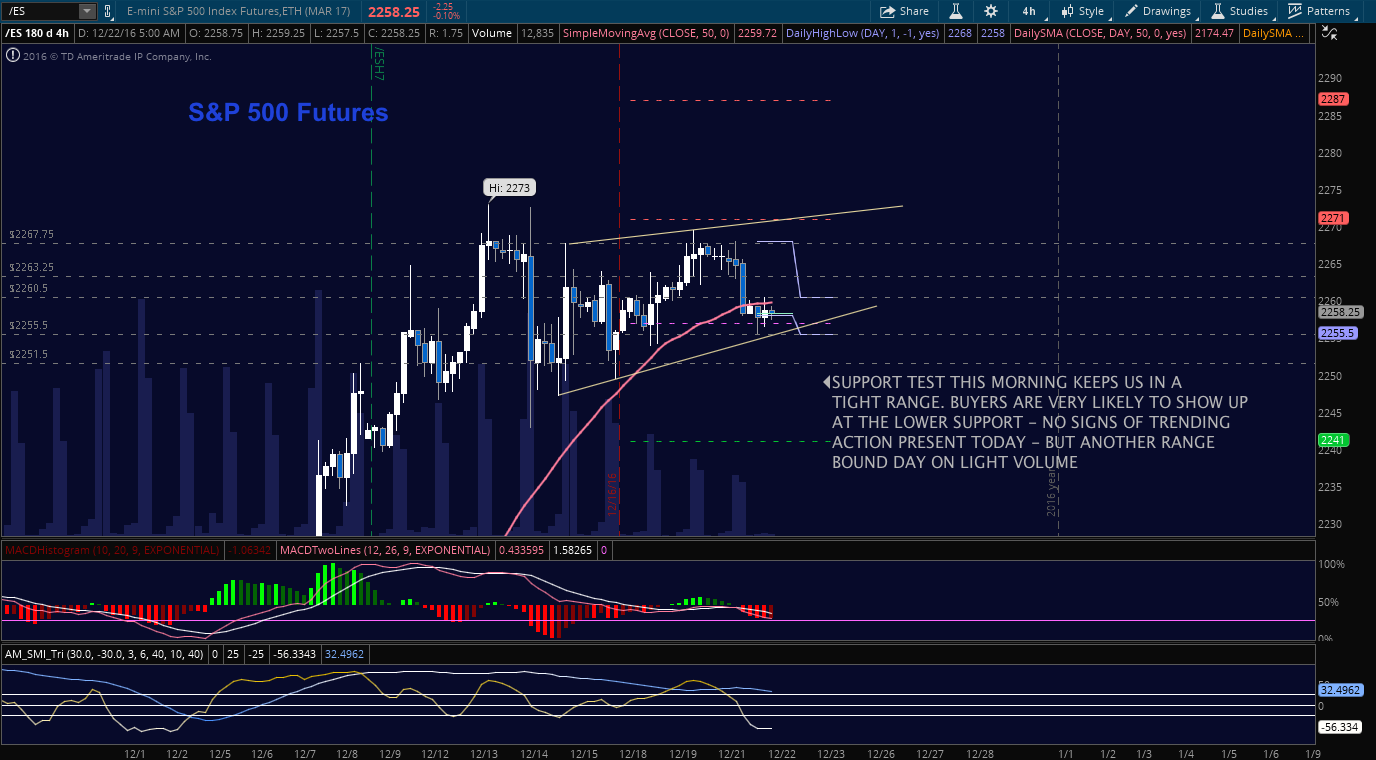

Stock Market Outlook for December 22, 2016 – Quiet price action and light volume continues to keep the S&P 500 (INDEXSP:.INX) and broader market indices range bound into the Christmas weekend. A test of price support near 2259 I anticipated yesterday is here and we have moved back and forth around the region. However, traders aren’t showing much conviction. Stock market momentum suggests the bounce off support levels into the range of trading we have seen over the last week.

The lines in the sand for buyers to hold will be 2255-2259. Charts will be weighted to the buyers as long if we recapture and hold 2260.5 test. Price resistance for traders remains 2267-2269, but could breach to test 2272.50, especially if we see buyers catch their footing (doubtful, but worth consideration at least)

See today’s economic calendar with a rundown of releases.

TODAY’S RANGE OF MOTION

E-mini S&P 500 Futures Trading Chart For December 22

Upside trades – Two options for entry

Positive retest of continuation level – 2260.5 (careful here – a retest is required)

Positive retest of support level – 2259

Opening targets ranges – 2263.5, 2267.5, 2269.25, 2271.25, 2272.75, 2275.50, 2278.25 and 2282.50

Downside trades – Two options for entry

Failed retest of resistance level – 2260 (needs retest confirmation)

Failed retest of support level – 2255.25 (also needs confirmation due to price forms)

Opening target ranges – 2257, 2255.75, 2251.5, 2249.50, 2246.50, 2242.75, 2238.75, 2234.75, 2231.50, 2227.75, 2224.25, and 2224.25

Nasdaq Futures

The NQ_F range has tightened but our support level near 4936 holds steady at this time. The tight box of trading has 4936 as support and 4966 as resistance. Breaches or price action that hold in either direction is a bit unlikely, but buyers are still in control of support levels. Secondary support is 4944. Resistance now holds near 4957 to 4966.

Upside trades – Two options

Positive retest of continuation level – 4952.50 (needs confirmation)

Positive retest of support level – 4937.50 (also needs confirmation)

Opening target ranges – 4944.25, 4947, 4952.25, 4957.75, 4965.50, 4972.25, 4979.75, and 4988.75

Downside trades – Two options

Failed retest of resistance level – 4952 (careful here – negative divergence needs to be present)

Failed retest of support level – 4936

Opening target ranges – 4947.5, 4944.75, 4937.25, 4931.50, 4925.75, 4920.75, 4914.25, 4907.50, 4902.75, 4898.75, 4883.75, 4876.25, 4872.25, 4863.75, 4859.75, 4854.75, and 4847.50

WTI Crude Oil

WTI crude faded after the EIA reported a mixed bag yesterday. The region near 53.56-53.64 is resistance, shifted lower from yesterday. Trending formations have not strengthened and we are testing lower support that I mentioned yesterday at 52.22. Below 52.22, we see 51.59 and then 50.87. Bullish formations are fading in the chart for now, but we hold in a range overall – between 50.65 and 53.65.

Upside trades – Two options

Positive retest of continuation level – 52.65

Positive retest of support level – 52.12

Opening target ranges – 52.3, 52.54, 52.87, 53.23, 53.41, 53.6, 53.86, 54.04, 54.21, 54.5, 54.97, and 55.4

Downside trades – Two options

Failed retest of resistance level – 52.6

Failed retest of support level – 51.92

Opening target ranges – 52.32, 52.09, 51.85, 51.57, 51.32, 51.08, 50.27, 50.13, 49.87, 49.6, 49.27, 49.05, and 48.92

If you’re interested in the live trading room, it is now primarily stock market futures content, though we do track heavily traded stocks and their likely daily trajectories as well – we begin at 9am with a morning report and likely chart movements along with trade setups for the day.

As long as the trader keeps himself aware of support and resistance levels, risk can be very adequately managed to play in either direction as bottom picking remains a behavior pattern that is developing with value buyers and speculative traders.

Twitter: @AnneMarieTrades

The author trades stock market futures every day and may have a position in mentioned securities at the time of publication. Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.