Jerome Powell’s remarks provided the spark that ignited the markets and after one day on the Hill, he has another today with more commentary that could take traders once again into new territory higher.

This is coming on the calendar today as he speaks on Capitol Hill.

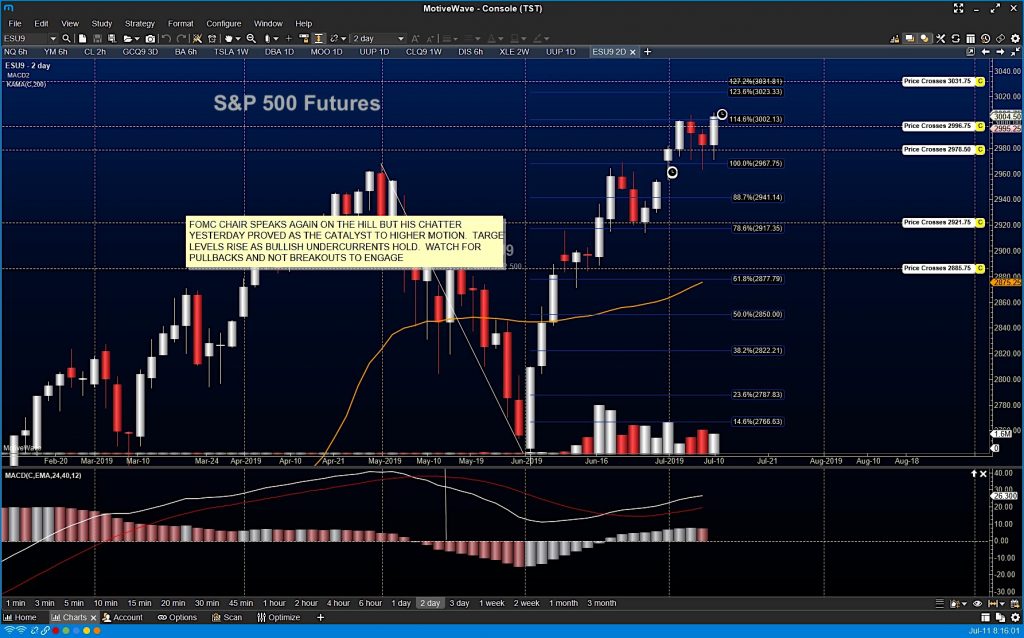

Bullish undercurrents continue and dips continue to be bought. FOMC days tend to be choppy as lots of swift trading takes advantage of the moves.

Getting through overhead resistance near 3006 is still key. Jobs numbers were weaker than expected but fades into support that hold are expected.

S&P 500 Futures Trading Chart

Gold broke its range resistance at 1412 to hold higher and now sits at the breakout level near 1422 as the dollar faded into this event with the Fed speak over the next two days on the Hill.

THE BIG PICTURE – Daily momentum is positive to neutral and bouncing off daily support levels noted but with resistance nearby.

INTRADAY RECAP – Neutral to positive but broadly rangebound as traders move in to test resistance above after bouncing off support below. Selling ES near failed test of 2986 with stops a bit wider if getting stopped out is a concern- or buying near 2997.5 – with wider stops also. In crosscurrent trends, watch your size. Whipsaw is likely between these two levels. Holding 2978.5 is now the critical zone to hold through the noise.

NEUTRAL TO POSITIVE SLANT – CROSS CURRENTS PRESENT – BOUNCE ACTION TODAY VERY IMPORTANT- WAIT FOR DIPS TO ENGAGE

Twitter: @AnneMarieTrades

The author trades stock market futures every day and may have a position in mentioned securities at the time of publication. Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.