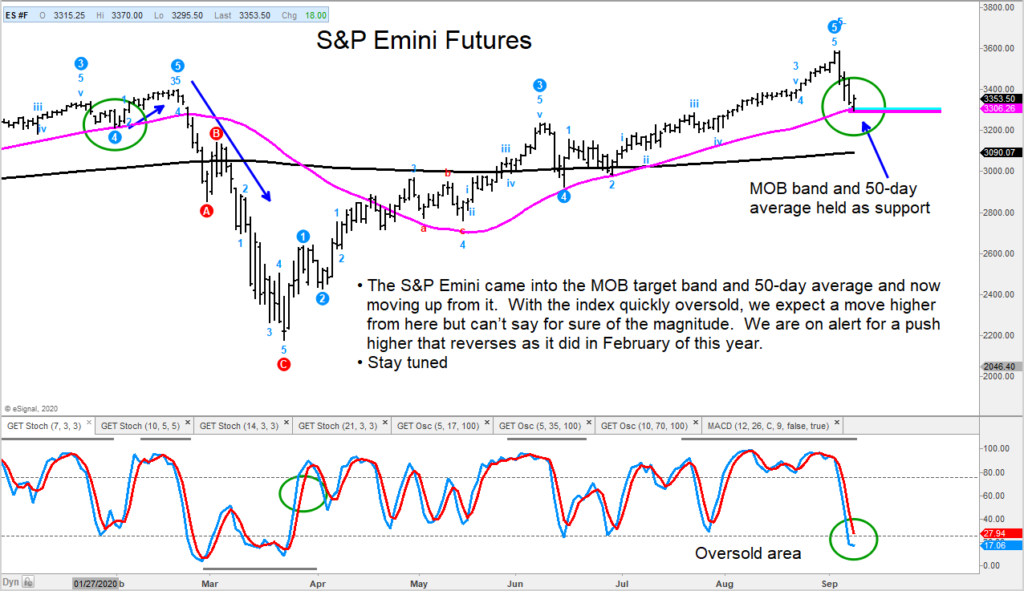

S&P 500 e-mini futures Chart

The S&P 500 e-mini futures selloff saw the broad stock market futures index decline into a MOB target band and are now reversing higher.

Also supportive to the index is the 50 day moving average.

While I don’t know the magnitude of the advance, I do think short-term traders can take advantage of this deep oversold condition.

The fact that we have a reversal higher from a MOB target band and the 50-day moving average is important (again, short-term – i.e. days).

I am concerned we could see a rally that eventually fails as it did in February of this year.

The author may have a position in mentioned securities at the time of publication. Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.