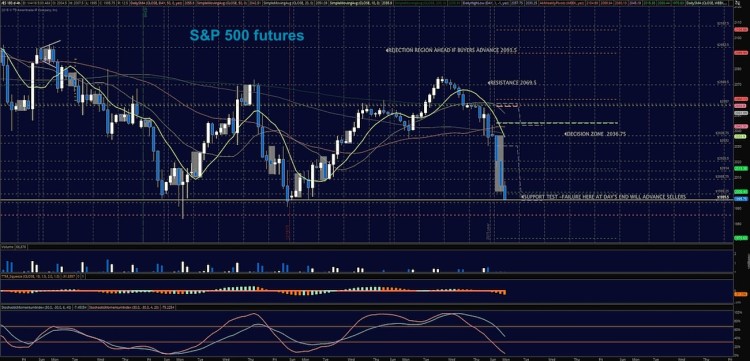

The Morning Report: S&P 500 Futures Breach Important Support Levels

The markets are down for the third day breaking through important support and holding below 1995. Traders moved in to test and breach yesterday’s resistance in the S&P 500 futures near 2014 only to see that level reject again.

1995 was important for buyers as we can see by the sharp drop down below this level. Momentum is negative across timeframes – we are now looking at significant range expansion. The war to hold support at 1975 rages at this time of writing.

Intraday resistance sits near 1997.25. Intraday support for S&P 500 futures sits at 1968.5. Breaks of either support or resistance must be confirmed on tighter time frames (30min/1hr) for trending trades on the day to hold. Buyers are trapped so bounces should be sold. We have bearish momentum formations.

Shorter time frame momentum indicators are negative, and lower than Tuesday. Longer cycles are upward trending and moving into negative territory steeply.

See today’s economic calendar with a rundown of releases.

RANGE OF TUESDAY’S MOTION

Crude Oil Futures (CL_F)

EIA report ahead. Crude Oil finally lost support after a battle to hold support failed. As I mentioned yesterday, if we lost the 35.7 area we would certainly see new lows – and this is our current direction – the low seen on WTI is 34.53. Chances are that the failed bounces will bring us into this region. Support ranges between 34.17 and 33.55. Buyers will create bounce events at these levels but they are likely not to hold as we head lower. Momentum is increasingly bearish across time frames, and traders seem willing to trade the ranges waiting for volume to punch the move in either direction.

Moving averages, though still clearly negative on longer time frames, and momentum is securely negative and very expanded – another reversion to the mean bounce might be ahead, but just like the last one, bounces are sure to remain as temporary. The chart is trending short but near a possible support level. Intraday trade setup suggests a long off 34.67 (counter trend) into 35.15, 35.37, 35.65, and perhaps 36.1 – even more if the buyers take over on volume at the breach of the level – see the blog for levels above that region. Below a 34.9 failed retest or a rejection of the 36.1 area sends us to 35.65, 35.15, 34.8, 34.65, 34.17, and 33.55 ultimately as the next support space – Momentum on longer time frames is negative but lifting.

E-mini S&P 500 Futures (ES_F)

Below is a new chart with active S&P 500 futures price support and resistance trading levels. Click to enlarge.

Upside motion has the best setup on the breach of and positive retest of 1982.5 – or a bounce off 1970.5 (as long as momentum shows this as likely to hold). S&P 500 futures targets near 1985.5, 1989.75, 1995.5 and 2000.75 seem likely if the bounce holds – but all bounces should run into resistance. Watch 1991 for sellers to try to reverse the trend of the bounce. Long trades are counter trending at this writing but pullbacks into higher lows may reverse the intraday trend.

Downside motion opens below the failed retest of 1975.5 or at the failure to hold 1991 bounce. Retracement into lower levels from 1991 gives us the targets at 1989.25, 1985, 1982.5, 1980.25, 1978.75, 1975.75 and perhaps 1970.75.

Short action intraday is trending currently unless we have a bounce and positive retest of 1985.75 with momentum shifts.

As long as the traders keep themselves aware of support and resistance levels, risk can be very adequately managed to play in either direction as bottom picking remains a behavior pattern that is developing with value buyers and speculative traders.

Twitter: @AnneMarieTrades

The author trades futures every day and may have a position in mentioned securities at the time of publication. Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.