The stock market rose last week, with the S&P 500 (SPX) up 42 points to 2707, or 1.6%.

The Fed kept interest rates unchanged and noted flexibility in managing its balance sheet, which was taken by the market as bullish.

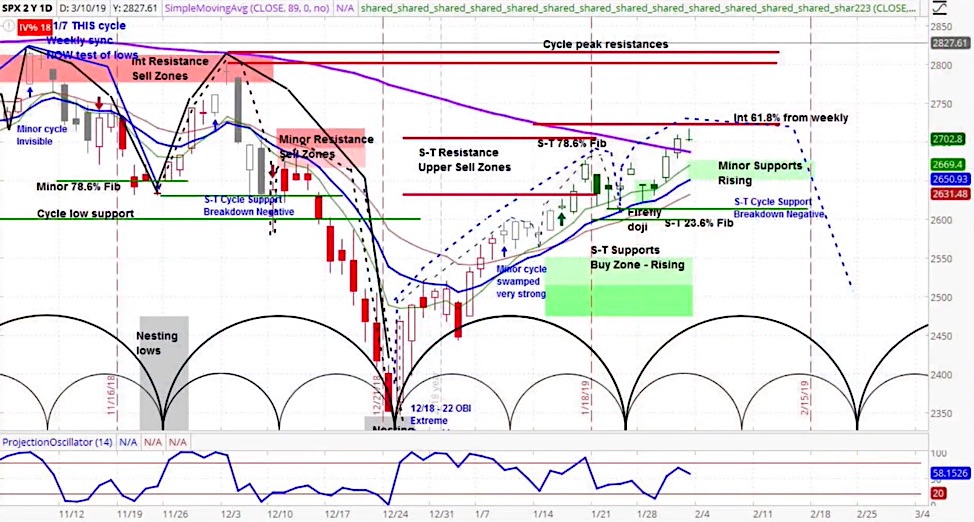

Our projection this week is for stocks to decline into the support zone between 2650-2675.

Looking forward, our approach to technical analysis uses market cycles to project price action. As expected, the S&P 500 tested the 2723 resistance, which is the 61.8% Fibonacci from the weekly chart.

We see the market moving down this week, testing the rising support zone between 2650-2675.

However, outside of some crazy news coming out, current positive momentum should keep downside corrections mild.

S&P 500 (SPX) Daily Chart

After some choppy action the next few weeks, we expect intermediate corrective forces to take over on the downside again, raising the risk of sharper declines into late March.

S&P 500 Market Cycle Outlook Video (week of February 4, 2019)

As the stocks continued their push higher last week, the S&P 500 finished with the strongest January since 1987. This was reasonable, given that it came after the weakest December since 1931, as I pointed out in the latest Market Week show.

Last week’s most important event was the Federal reserve meeting, during which it decided to keep interest rates unchanged. While that was expected, Chair Jerome Powell also said that he flexible with respect to whether to continue tightening the Fed’s balance sheet.

Despite strong US growth, Powell noted that, “Over the past few months we have seen some cross-currents and conflicting signals about the outlook.” He went on to identify issues such as slowing global growth, Brexit, the federal shutdown, and trade negotiations.

He is of course correct that growth is slowing globally. Last week, Germany, China, and the UK printed macroeconomic data that confirmed slowing economies. Nonetheless, the US outperformed expectations with respect to job creation, new home sales, and PMI.

With earnings season in full throttle, the US picture appears mixed. While the majority of firms continue to exceed expectations, 33 companies in the S&P 500 have revised earnings guidance lower, compared to only 9 who have revised up, according to FactSet.

For more from Slim, or to learn about cycle analysis, check out the askSlim Market Week show every Friday on our YouTube channel.

Twitter: @askslim

Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.