THE BIG PICTURE

The VIX Volatility Index (INDEXCBOE:VIX) finally saw a move outside the comfort zone of most investors to close out in the mid 15’s last week. This saw the S&P 500 (INDEXSP:.INX) and Nasdaq (INDEXNASDAQ:.IXIC) pull back, along with the leading Dow Jones.

On the tech side of the ledger, FANG/FAMMG stocks pulled back off the highs before making a recovery to close out the week (and likely to open this week). Blue Apron earnings, associated with Amazon (NASDAQ:AMZN) not coming in as hoped in week 32. Disney (NYSE:DIS) also made a splash in announcing that its pulling out of Netflix (NASDAQ:NFLX) on all its content and starting their own service.

AND Permabear posts are starting to heat up.

By the charts, open gaps remain above on the Russell 2000 future (TF), Dow Jones futures (YM), S&P 500 futures (ES) and Nasdaq futures (NQ). These are likely to be filled before any deeper move becomes a realization.

Surely if the indices will not be able to hold at their perspective 50 period averages, the 200ma, lower level MML levels and open gaps become viable levels to watch for support. The TF which mentioned last week can be the market leader in direction of trend has played out so far to be pulling the other markets with it.

As always be ready for both directions.

Key events in the market this week are earnings (WMT, HD, BABA, AMD, TGT) FOMC minutes and Philly Fed.

THE BOTTOM LINE

Technical Momentum probability remains in an UPTREND with caution on the RTY as it’s momentum has turned down.

Watch for more earnings this week as we also have the FOMC minutes released. Price action to regain traction will need to lift above the 10ema. The 50ma continues to be resistance above and support below. Complete loss of the 50 will seek the 200ma and open gaps below. Upside momentum remains just as strong and prevailing heads may prevail and realize North Korean conflict is nothing more. Nothing wrong with being cautious but big picture remains intact upside as the we wait for the RTY/TF momentum to rejoin the trend.

I will notify through social media and my daily outlook; posted 30 minutes prior to the US open of any updates throughout the week.

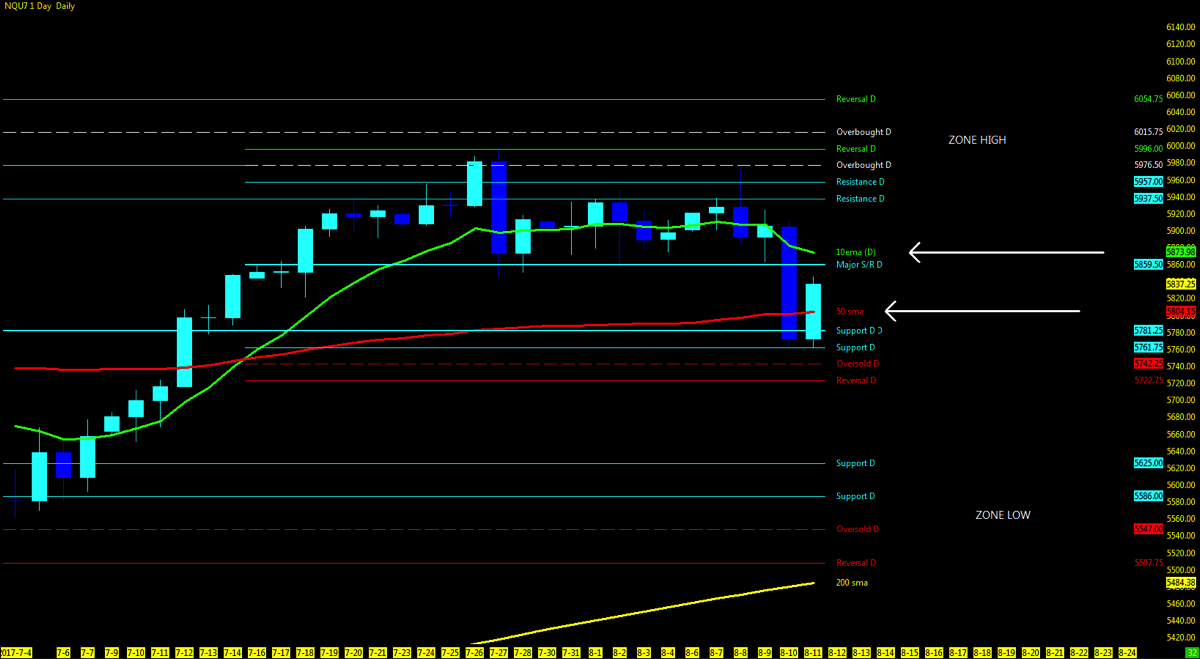

NQ – Nasdaq Futures

Technical Momentum: UPTREND Pullback

Using the Murray Math Level (MML) charts on higher time frames can be a useful market internal tool as price action moves amongst fractal levels from hourly to daily charts. Confluence of levels may be levels of support/resistance or opportunities for a breakout move.

Multiple MML Overlay (DAILY )

- Lowest Open Gap: 4017

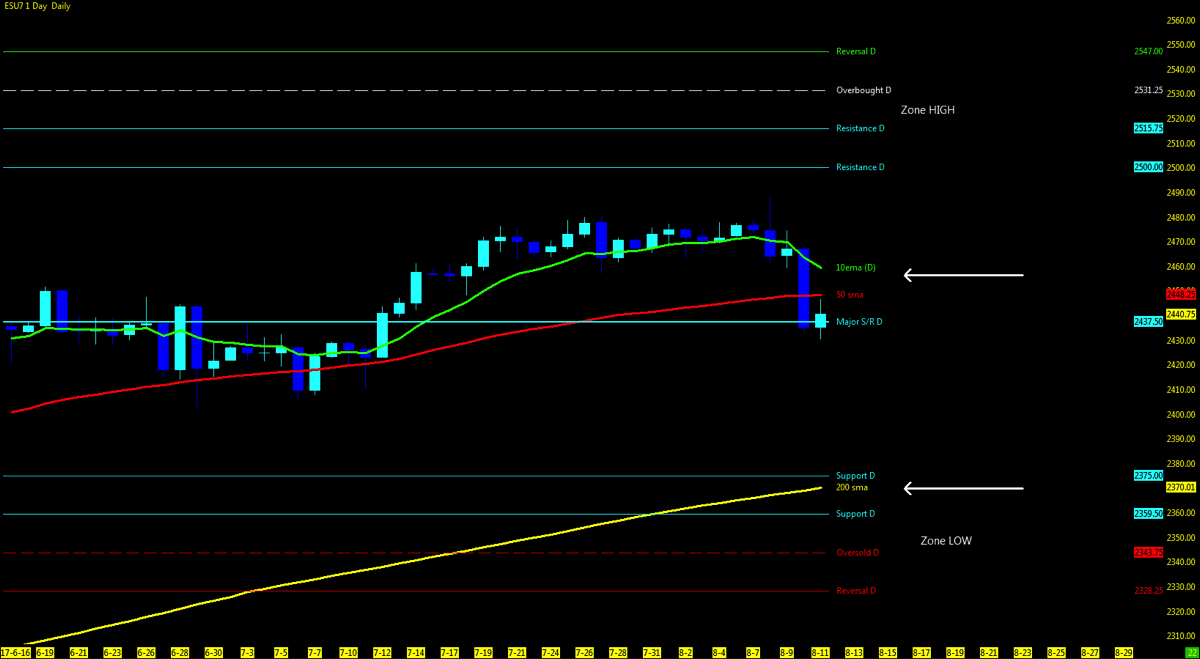

ES – S&P Futures

Technical Momentum: UPTREND Pullback

Multiple MML Overlay (DAILY )

- Lowest Open Gap: NONE

Thanks for reading and remember to always use a stop at/around key technical trend levels.

Twitter: @TradingFibz

The author trades futures intraday and may have a position in the mentioned securities at the time of publication. Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.