First, it’s hard to get too negative when capital expenditures for companies building out AI infrastructure are running near $400 billion annualized, growing roughly 50% Y/Y.

These are not small numbers and they’ve already influenced economic activity across sectors. And with no signs of slowing over the next 12 to 18 months, this momentum remains a powerful force for US GDP.

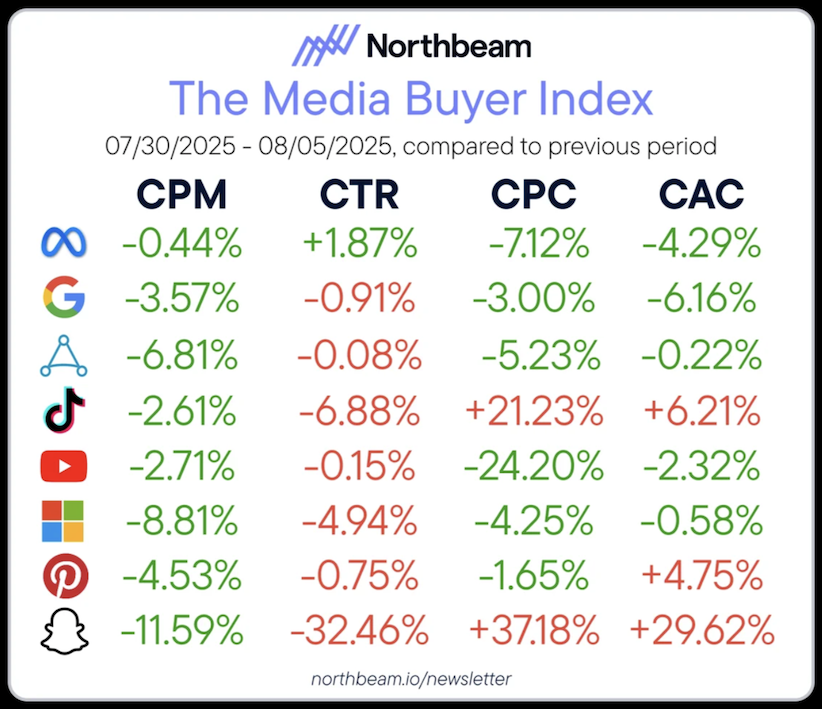

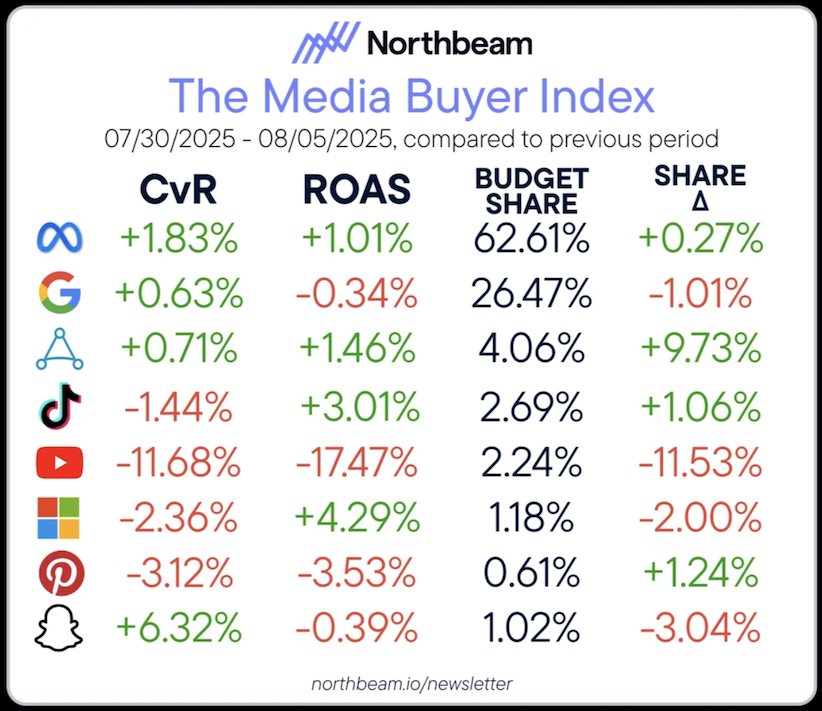

Why track real-time data? Because it shows what earnings will confirm. Meta had a blowout quarter driven by AI-powered targeting, better engagement, better conversion, better ROAS. Snap, on the other hand, struggled. Same macro, same advertisers (kinda), different outcomes.

AI is a scale game, and Snap just isn’t there. Nearly 1B MAUs, but still subscale financially. That’s why we continue to view them as a potential takeout target. Great product.

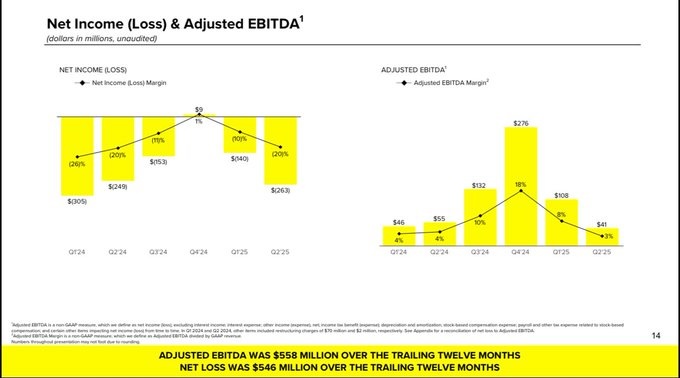

Here’s the financials for Snap. No bueno. Likely why they just issued $500m of debt here as I write this.

Now numbers that looked good. Zillow put up strong numbers in a housing market that’s been anything but strong, 15% Y/Y growth in a flat real estate environment. No surprise the stock had been running into the print. They now have 64,000 multifamily properties on the platform, with rentals growing over 36% Y/Y, and management expects that to accelerate next quarter. Site engagement remains massive: 2.6B quarterly visits and 243M monthly uniques.

They’re also layering in new tools, from CRM (FollowUpBoss) to AI-enabled solutions. With a deep data moat and a focus on profit growth, Zillow is starting to separate itself from the pack.

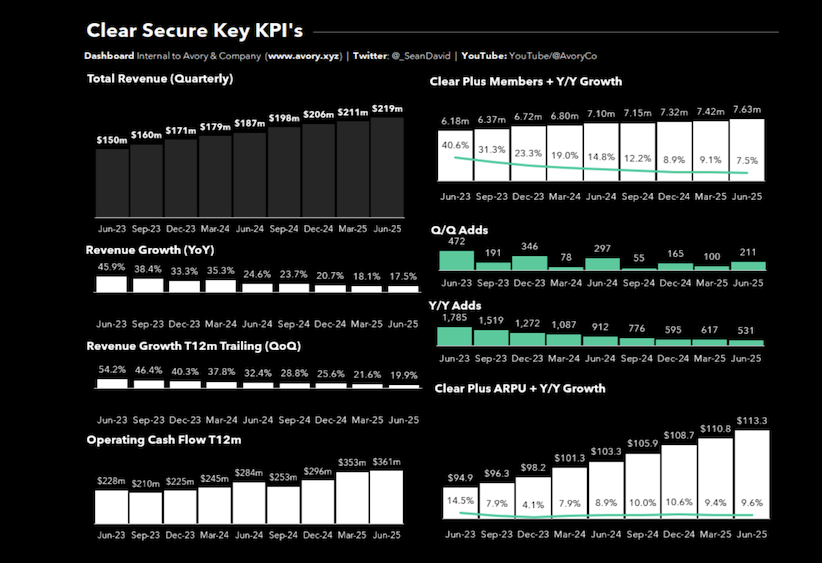

Another core holding for us is Clear Secure, our investment in the future of identity. As AI tools proliferate, the challenge of verifying real humans will only grow. Deepfakes, fake accounts, and synthetic IDs are all on the rise and Clear is positioned right at the center of that problem.

Their core airport business continues to expand, but they also posted a record quarter for non-airport deals through ClearOne. Margins remain strong, with $361M in trailing 12-month operating cash flow. Revenue is growing in the mid-teens, and they now have 7.63M Clear Plus members.

Our thesis is playing out: they’re raising prices, increasing throughput, and expanding beyond airports, all while partnering with programs like TSA PreCheck. Lots to like here.

Last but not least, Joby Aviation is acquiring Blade Air Mobility, a major move in the eVTOL space.

We just talked about this on the podcast last week: Joby is a leader in the category, but one of the most important long-term moats won’t be the aircraft it’ll be the network infrastructure.

Blade already has that in place through its helicopter operations, giving Joby a strategic foothold not just in manufacturing, but in owning the customer network. This deal positions them to control both the platform and the distribution, a powerful combo in any emerging transportation model.

Twitter: @_SeanDavid

The author and/or his firm have positions in the mentioned companies and underlying securities at the time of publication. Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.