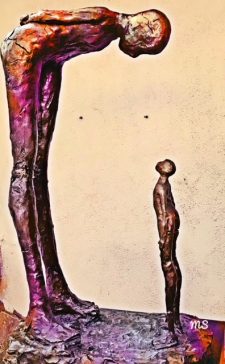

We see a perfect illustration of today’s stock market action in the sculpture if we think of the “adult” as the Dow Jones Industrials (INDEXDJX:.DJI) and the “child” as the Russell 2000 (INDEXRUSSELL:RUT).

In the overall metaphor of the Modern Family, the Russell’s are granddad.

Nevertheless, those of us who have aging grandparents know 2 things;

– They tend to shrink.

– The roles of parent/child often reverse.

The Dow Industrials made another new all-time high today. It was the only index that did so.

NASDAQ (NASDAQ:QQQ), which we speculated could be in the midst of putting in a double top, failed to follow the Dow’s lead.

The Russell 2000 managed to bounce after the last 2 days of carnage.

The Russell 2000 managed to bounce after the last 2 days of carnage.

But was that enough to satisfy the bulls?

Not really. The rally did not do enough for IWM to change phase or put in a legitimate reversal bottoming pattern.

Note the sculpture in the photo to the right was created by artist Lorri Acott.

What about Transportation IYT?

Better that this sector ETF managed to clear back over the 50 DMA and back into a Bullish phase.

However, it needs a second day above the 50 DMA to confirm. Furthermore, it could not clear above the fast moving average which is also declining in slope.

Then add to the mix that the rates soared today along with the dollar.

Naturally, that combo hit emerging markets and many commodities.

Except of course for crude oil. That continued to rise in price.

So now we have higher rates, a stronger dollar, expensive gas and 2 key indicators-IYT and IWM with questionable futures.

Add insult to injury, after making new highs, the Dow closed nearer to the intraday low than high. And on good volume.

That could turn out to be a bonafide topping pattern.

If so, our “adult” in trying to cajole the small caps to rise, will have bent over enough to cause serious back problems.

Here are the key levels to watch on ETFs:

S&P 500 (SPY) 291.00 pivotal. A move under should bring out more selling.

Russell 2000 (IWM) 164.07 was the low on July 30th. If can get back over 166 area, that would help the bulls.

Dow (DIA) 267.60 is pivotal support.

Nasdaq (QQQ) We won’t know if this is a double top unless this breaks down under 181.

Regional Banks (KRE) Looks like we got that blow off bottom with double the average volume. Makes sense with the higher rates. If good, Monday’s low 58.28 should hold.

Semiconductors (SMH) Could not clear 108 and now with the 50 DMA at 106.50, this could be in a make or break situation.

Transportation (IYT) Unconfirmed bullish phase -but if this cannot find buyers to take it back over 205.35, trouble-today’s high 205.25

Biotechnology (IBB) 120 is pivotal.

Retail (XRT) 50.00 is resistance.

Note that you can get daily trading ideas and market insights over on Market Gauge. Thanks for reading.

Twitter: @marketminute

The authors may have a position in the mentioned securities at the time of publication. Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.