The popular averages moved higher for the second week in a row with the Dow and S&P 500 gaining more than 2.00%.

Most of the gains occurred post-election day as some of the uncertainty surrounding the mid-term elections has been removed.

The markets are now looking forward to a strong seasonal three-month period that historically follows the elections and could result in rallies off the recent lows.

According to Ned Davis Research, over the past 65 years November, December and January have been the best three-month period for stocks. Nevertheless, the combination of rising interest rates, including the potential for a ninth increase in the fed funds level in December, ongoing trade and tariff tensions, concerns over the prospects for a global recession and a deceleration of corporate profits in 2019 argues that the stock market remains susceptible to large price swings.

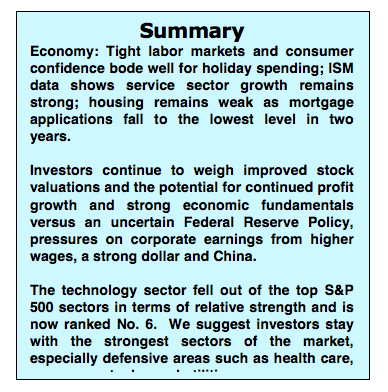

As widely anticipated, the Fed kept interest rates unchanged. The tight labor market and the recent Producer Price Index Report that showed stronger-than-expected inflation pressures are likely to cause the Fed to raise rates next month.

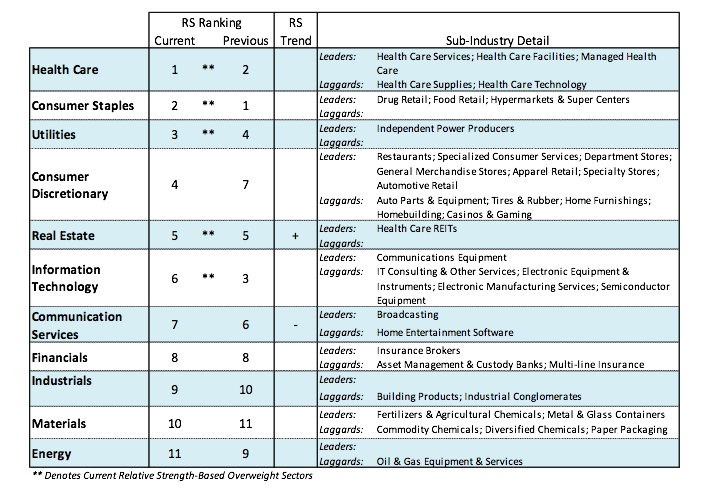

The bottom line is that the risks that precipitated the weakness in October have yet to be fully unwound. As a result, we recommend investors focus on defensive sectors including health care, consumer staples and utilities.

The technical indicators for the stock market continue to flash a yellow light. Notwithstanding the post-election strength exhibited by the popular averages, most of the indicators of market breadth continue to deteriorate. This has been the case for much of 2018 and until such time that the broad market assumes a leadership role, the probability of a sustained upside move is questionable. Historically, after mid-term elections, there tends to be a leadership shift from defensive and large-cap issues to cyclical and small-caps.

Currently, defensive issues remain the top performers in terms of relative strength and small-caps underperformed in the late October early November rally and were basically unchanged last week lagging significantly the move in the S&P 500 Index. Additionally, despite the big rally by the Dow Industrials on the Wednesday following the election, upside volume versus downside volume measured less than 3-to-1. To be comfortable that the October decline has run its course, we would need to see one or two sessions where upside volume exceeds downside volume by a ratio of 10-to-1 or more.

Twitter: @WillieDelwiche

Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.