This week is known as the week the Fed will either raise interest rates for the first time in nine years, or they won’t. I’ve long been in the camp that interest rates aren’t going anywhere this year. Does a 25 basis point move even matter in the whole scope of things? I would say probably not, but it does give everyone something to talk about all day.

Now what does matter is this week in September historically has been rather bullish for stocks (i.e. the S&P 500). I find this somewhat surprising, given how September is one of the worst months historically.

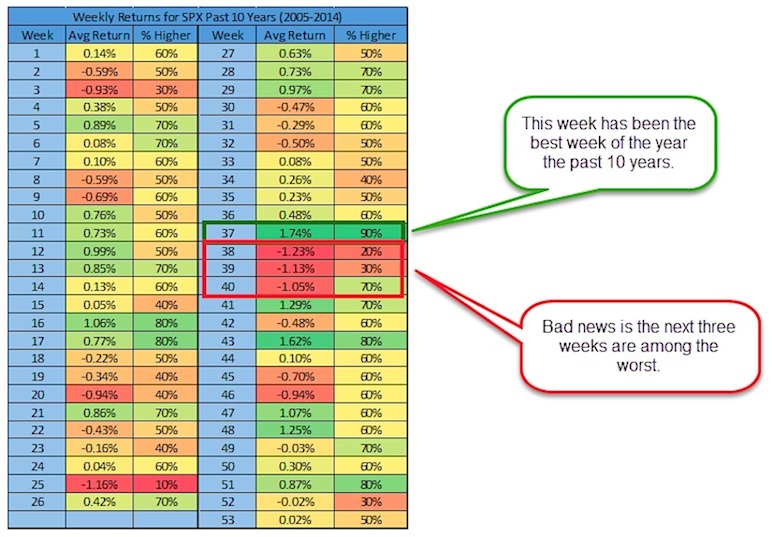

Turns out, this week is the 37th full week of the year. Going back 10 years, this week has been up nine times and has the highest average return.

Of course, the next three weeks are among the worst!

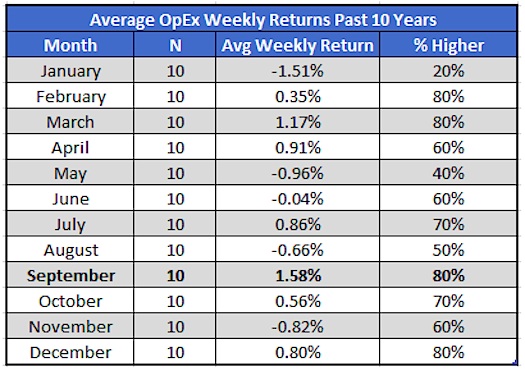

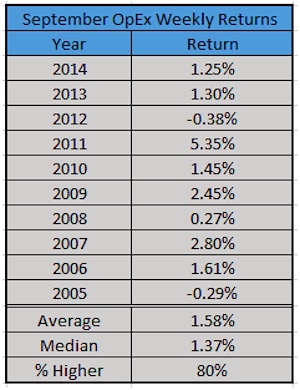

It doesn’t end there, as this week is also options expiration. Looking at September OpEx the past 10 years, this is again the strongest week.

Looking at September OpEx, it has been higher eight of the past nine years.

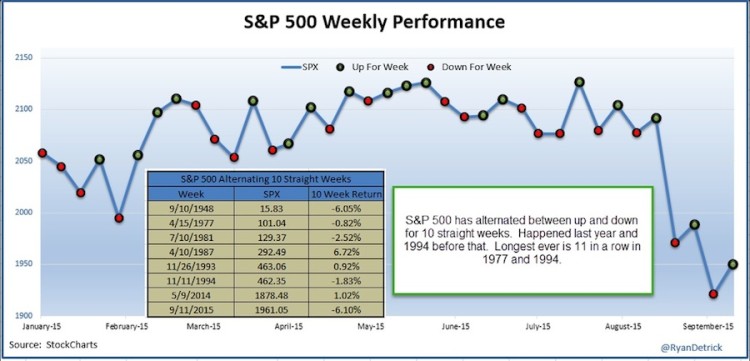

Now, here’s one reason why this week could be lower. The S&P 500 has alternated between higher and lower for 10 straight weeks. This has only happened eight times ever and it has made it to a record 11 only twice. Given last week things were very green, if the chop continues, it bodes well for some red this week.

So will seasonality take over and the bulls continue to lead, or will the alternating streak win out?

Thanks for reading.

Twitter: @RyanDetrick

Read more from Ryan on his tumblr.

Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.